Business

New naira: CBN, EFCC to track large withdrawals

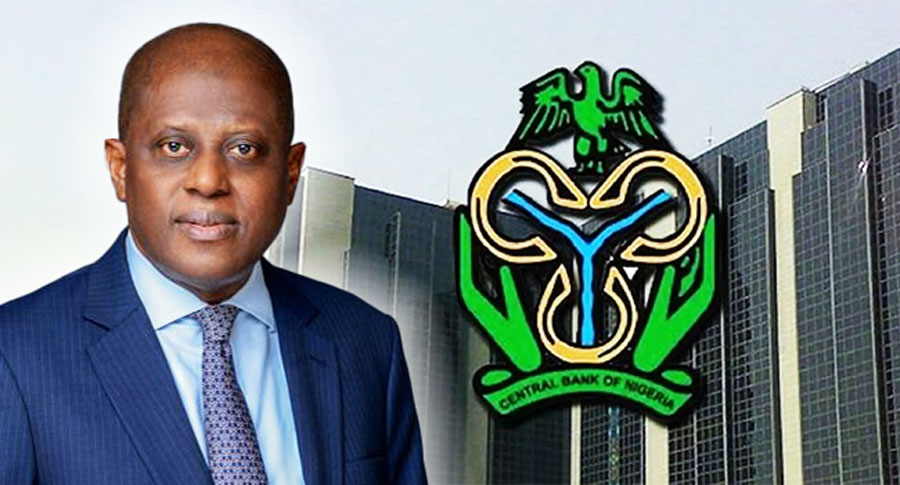

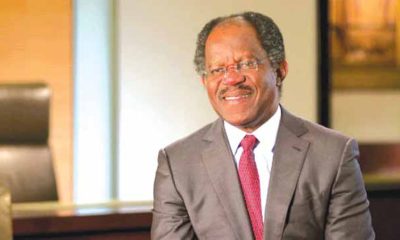

The Governor of the Central Bank of Nigeria, Godwin Emefiele has said that it would work with law enforcement agencies like the Economic and Financial Crimes Commission and the Independent Corrupt Practices and Other Related Offences Commission, to complicate and track large withdrawals.

He said this while briefing the press after the launch the new Naira banknotes in Abuja on Wednesday.

At the briefing, Emefiele said that the amount of money that can be withdrawn from the counter would be reduced drastically, adding that bulk withdrawals would require several procedures and security checks to track use.

He said this would ensure a steady transition into a cashless economy.

“There is no economy imbued with the thinking that it has to be a cash economy; the world has moved from predominantly cash to a cashless economy. And I think Nigeria and the Central Bank of Nigeria are prepared to move towards a cashless economy. And that is why following the redesign and issuance of this note, we will insist that cashless will be nationwide.

“We will restrict the volume of cash that people can withdraw over the counter. If you need to draw large volumes of cash, you will fill out uncountable forms; we will take your data, whether it’s your BVN or NIN so that our law enforcement agencies like EFCC and ICPC can follow you and be sure that you are taking that money for a good purpose.”

READ ALSO:

- Wife Stabbed Hubby To Death For Making Move For Sex

- Spain defeats Costa Rica 7-0 as they kick off World Cup campaign

- Ikirun mayhem: How deceased was killed, Eyewitness narrates

He also noted that this move alongside the redesigned notes would ensure that the apex bank has ample control over the amount of money in circulation.

The CBN Governor further argued that the new move is not targeted at anyone while noting that the past attempts to redesign the naira notes were resisted.

According to him, “The Central Bank of Nigeria, by law, has the mandate to reissue and redesign currency for the country, and for Nigerian people, every five to eight years. And I want to hope that after the event of today, the Central Bank of Nigeria can take it as part of its programmes to see that the currencies are designed or reissued every five to eight years.

“It is mainly because the central bank should be able to control the size of currency in circulation fully. That is the actual mandate of the Central Bank of Nigeria because it has implications for monetary policy management in the country.

“There is no need for anybody to think this program is targeted at anyone. Like you heard the President, he said, this discussion to redesign and reissue currency started early in the year.”

The President, Major General Muhammadu Buhari (retd.), said the naira notes are long overdue for a change as the current tender has been in circulation for nearly 20 years.

This was as he said the newly redesigned notes have unique security features that make them difficult to counterfeit.

Buhari said this when he launched the new Naira banknotes at the council chamber of the State House, Abuja, shortly before the kick-off of this week’s Federal Executive Council meeting.

READ ALSO:

- INEC Moves To Check Illicit Flow of Campaign Funds

- Ex-AG-F Idris returned $900,000 cash, witness tells court

- We’ve recovered $1bn looted funds since 2015 —FG

According to a statement signed by Buhari’s Special Adviser on Media and Publicity, Femi Adesina, Buhari also expressed delight that the redesigned currencies were locally produced by the Nigerian Security Printing and Minting PLC.

Speaking at the launch of the new banknotes, the President noted that international best practice requires central banks and national authorities to issue new or redesigned currency notes every five to eight years.

He lamented that it is almost 20 years since the last major redesign of the country’s local currency was done.

‘‘This implies that the Naira is long overdue to wear a new look.

“A cycle of banknote redesign is generally aimed at achieving specific objectives, including but not limited to: improving the security of banknotes, mitigating counterfeiting, preserving the collective national heritage, controlling currency in circulation, and reducing the overall cost of currency management,” he said.

He added that “the new Naira banknotes have been fortified with security features that make them difficult to counterfeit.’’

Explaining why he approved the redesign, the President said there is an urgent need to control the amount of currency in circulation.

Punch

Railway

Lagos Rail Mass Transit part of FG free train ride – NRC

Lagos Rail Mass Transit part of FG free train ride – NRC

The Nigerian Railway Corporation (NRC) has disclosed that the Lagos Rail Mass Transit (LRMT) trains are included in the Federal Government’s free train ride initiative for the Christmas and New Year celebrations.

The LRMT, which currently includes the Phase 1 Blue Line Rail and the Phase 1 of the Red Line Rail, operates under the Lagos Metropolitan Area Transport Authority (LAMATA).

This announcement was made by Ben Iloanusi, the Acting Managing Director of the NRC, during an interview on NTA News TV on Friday, following the launch of the initiative earlier that day.

While Iloanusi stated that Phase 1 of both the Blue Line and Red Line Rail projects are part of the program, LAMATA has yet to confirm this inclusion.

READ ALSO:

- Nigeria denies alleged plot to destabilise Niger Republic

- Navy arrests 19 Nigerians attempting to reach Europe by hiding on ship

- Troops arrest four Ambazonian rebels in Taraba

Iloanusi outlined the other routes benefiting from the scheme, which include the Lagos-Ibadan Train Service, Kaduna-Abuja Train Service, Warri-Itakpe Train Service, Port Harcourt-Aba Train Service, and the Bola Ahmed Tinubu Mass Transit in Lagos. Notably, little was previously known about the Bola Ahmed Tinubu Mass Transit service until this disclosure.

“Let me mention the routes where this free train service is happening. We have the Lagos-Ibadan Train Service, we have the Kaduna-Abuja Train Service, we have the Warri-Itakpe Train Service, we have the Lagos Rail Mass Transit trains, we have the Port Harcourt-Aba Train Service, and we have what we call the Bola Ahmed Tinubu Mass Transit, which is also in Lagos,” he stated.

Iloanusi provided operational updates, stating that passengers nationwide can access free tickets online or, for those unable to do so, at train stations where they will be profiled and validated.

He noted that passengers using NRC-managed services (excluding the Lagos Rail Mass Transit) should reserve tickets via the official website, www.nrc.gov.ng, with a valid ID required. He also advised travelers to plan, arrive on time, and bring valid identification.

Lagos Rail Mass Transit part of FG free train ride – NRC

Business

NNPC denies claim of Port Harcourt refinery shutdown

NNPC denies claim of Port Harcourt refinery shutdown

The Nigerian National Petroleum Company Limited (NNPCL) has denied claims in media reports that the newly refurbished Port Harcourt refinery has shut down.

The national oil company denied the claim in a press release issued by its Chief Corporate Communications Officer, Olufemi Soneye, on Saturday.

Soneye said the claim was false and urged Nigerians to disregard it. He stressed that the Port-Harcourt Refinery is fully operational.

READ ALSO:

- Like Ibadan, stampede claim 10 lives for Abuja Catholic church, 17 in Anambra

- Marketers react after NNPCL slashes petrol price to N899 per litre

- Electricity: We installed 184,507 meters, issued 50 licences in Q3, says FG

The statement read, “The attention of the Nigerian National Petroleum Company Limited (NNPC Ltd.) has been drawn to reports in a section of the media alleging that the Old Port Harcourt Refinery which was re-streamed two months ago has been shut down.

“We wish to clarify that such reports are totally false as the refinery is fully operational as verified a few days ago by former Group Managing Directors of NNPC.”

He noted that preparation for the day’s loading operation is currently ongoing, and added that claims of the shutdown are “figments of the imagination of those who want to create artificial scarcity and rip-off Nigerians.”

NNPC denies claim of Port Harcourt refinery shutdown

Business

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

The Central Bank of Nigeria (CBN) has granted Bureau de Change (BDC) operators temporary permission to purchase up to $25,000 weekly in foreign exchange (FX) from the Nigerian Foreign Exchange Market (NFEM).

This move, detailed in a circular dated December 19, 2024, is designed to meet seasonal retail demand for FX during the holiday period.

The circular was signed by T.G. Allu, on behalf of the Acting Director of the Trade and Exchange Department.

The arrangement will be in effect from December 19, 2024, to January 30, 2025.

Under the directive, BDCs may purchase FX from a single Authorized Dealer of their choice, provided they fully fund their accounts before accessing the market.

Transactions to occur at the prevailing NFEM rate

The transactions will occur at the prevailing NFEM rate, and BDCs are required to adhere to a maximum 1% spread when pricing FX for retail end-users.

READ ALSO:

- Badenoch’s negative portrayal of Nigeria Police unfair-PCRC

- Bitcoin price crashes to $95,000 as market continues to react to Federal rate cuts

- Bauchi high court dismisses blasphemy, cybercrime charges against Rhoda Jatau

All transactions conducted under this scheme must be reported to the CBN’s Trade and Exchange Department.

The circular read in part:

“In order to meet expected seasonal demand for foreign exchange, the CBN is allowing a temporary access for all existing BDCs to the NFEM for the purchase of FX from Authorised Dealers, subject to a weekly cap of USD 25,000.00 (Twenty-five thousand dollars only).

This window will be open between December 19, 2024 to January 30, 2025.

“BDC operators can purchase FX under this arrangement from only one Authorized Dealer of their choice and will be required to fully fund their account before accessing the market at the prevailing NFEM rate. All transactions with BDCs should be reported to the Trade and Exchange department, and a maximum spread of 1% is allowed on the pricing offered by BDCs to retail end-users.”

The CBN assured the general public that PTA (Personal Travel Allowance) and BTA (Business Travel Allowance) remain available through banks for legitimate travel and business needs.”

These transactions are to be conducted at “market-determined exchange rates” within the NFEM framework.

This initiative reflects the CBN’s strategy to stabilize the FX market and manage seasonal surges in demand.

CBN permits BDCs to buy up to $25,000 FX weekly from NFEM

-

Railway1 day ago

Railway1 day agoLagos Rail Mass Transit part of FG free train ride – NRC

-

metro2 days ago

metro2 days agoCourt stops customs from seizing imported rice in open market

-

metro6 hours ago

metro6 hours agoWhy we displayed ‘Jesus Christ is not God’ banner at Lekki mosque -Imam

-

metro2 days ago

metro2 days agoIbadan stampede: Tinubu orders probe as death toll hits 40

-

metro1 day ago

metro1 day agoIbadan stampede: Ooni reacts after arrest of ex-wife

-

metro2 days ago

metro2 days agoAfe Babalola: Court grants Dele Farotimi bail, barred from media interviews

-

metro1 day ago

metro1 day agoNIMC warns against extortion, reaffirms free NIN enrollment

-

News2 days ago

News2 days agoAdebayo Ogunlesi, 2 other Nigerians make Forbes 50 wealthiest Black Americans list 2024