News

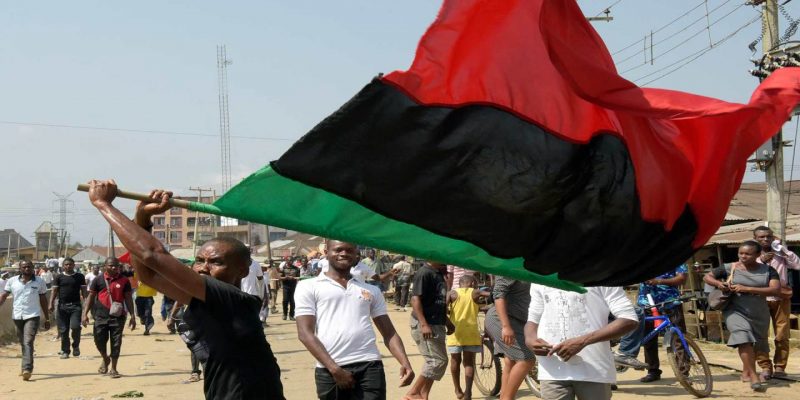

NFIU uncovers IPOB cells in UK, US, others

NFIU uncovers IPOB cells in UK, US, others

The Nigerian Financial Intelligence Unit uncovered 27 cells affiliated with the Indigenous Peoples of Biafra in 22 countries worldwide, including the United States of America and the United Kingdom of Great Britain and Northern Ireland.

The NFIU reports that the Ucenited States and the United Kingdom have the highest concentrations of IPOB cells, with seven and six cells in each country.

A newsletter revealed that IPOB, bandits, and other extremist organizations used global crowdfunding and sports betting sites to support terrorist activities in Nigeria.

In 2017, the Federal Government made the decision to ban IPOB and label them as a terrorist organisation. The government is currently trying its leader, Nnmadi Kanu, on terrorism charges.

In a recent document titled “Counter Terrorism Financial Newsletter,” the NFIU has identified 54 individuals from around the world who are allegedly connected to the activities of IPOB.

According to the document, it has been confirmed that the diaspora affiliates of the IPOB group have established a presence in over 22 countries worldwide. Upon closer examination, it was discovered that there were 27 entities scattered around the world that were registered under the group’s name. Interestingly, the United States and the United Kingdom had the most registrations, with seven and six entities registered, respectively.

READ ALSO:

- JUST IN: Dangote, Otedola meet Sanwo-Olu as Dangote Foundation flags off rice distribution

- Why Borno doesn’t witness attacks on schools, mass abduction of student again – Gov Zulum

- 3 Ondo Amotekun officers dismissed for misconduct, 7 suspects paraded

“The analysis further indicates that the group has several bank accounts in different countries where funds are being received from various contributors with the narrations ‘Monthly Dues, Services and for ESN’, among others, then later disbursed for various operations.

“It was confirmed that one of the major sources of revenue for the group is crowdfunding by several individuals abroad, mostly Nigerians.

“It was observed that over $160,000 was disbursed to Transmission, Media, and Broadcasting companies in Bulgaria, South Africa, and the United Kingdom. The analysis profiled the leader of the group, his addresses, and mobile numbers abroad with other 53 individuals associated with the dissident group. The report was forwarded to Law Enforcement for further investigation.”

The NFIU has disclosed that a betting platform, known as ‘XC’, reported a Suspicious Transaction Report on a 24-year-old Nigerian customer from North-Central, Nigeria.

“This 24-year-old from Nigeria’s North-Central region received over N350,000 in his betting wallet, believed to be ransom money from a kidnapping,” the NFIU said.

In a separate incident, the financial intelligence unit uncovered a terrorist who was trying to avoid detection. The report highlighted that the person made organised cash withdrawals from various ATMs and bought plane tickets to volatile regions, using credit cards.

The NFIU clarified that whenever the person went over their withdrawal limit, they would find different ways to travel.

“The terrorist then attempted suspicious transfers exceeding €1,000 to a local charity with potential links to terrorism. These transactions, along with others for luxury goods and escort services, raised red flags,” the newsletter stated.

The NFIU has called on law enforcement agencies to thoroughly investigate transactions involving individuals connected to known terrorists or financiers. They have also highlighted the need to look into unauthorised tax collection or forced donations in areas prone to terrorism, as well as the role of Bureau de Change operators in facilitating transfers within suspected networks.

The unit is urging security agencies to focus on various areas of concern. These include monitoring multiple cash deposits in bank accounts, scrutinising Point of Sale operators who receive large deposits followed by cash withdrawals, tracking money transfers from Nigeria to high-risk countries, investigating individuals who are recruited to open multiple bank accounts, and monitoring financial transfers to charities that may be linked to terrorism.

NFIU uncovers IPOB cells in UK, US, others

News

Osogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

Osogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

The 5th anniversary celebration of Osogbo Sons and Daughters drew prominent indigenes, political office holders, traditional leaders and stakeholders to a colourful gathering focused on the development of Osogbo, the Osun State capital.

Members of the Osogbo United Youth Forum were also in attendance at the event, which featured the presentation of meritorious awards to distinguished sons and daughters of the town in recognition of their contributions to community growth.

Among the award recipients were the member representing Osogbo Federal Constituency in the House of Representatives, Alhaji Moruf Adewale Gangari; the Secretary to the Osun State Government, Alhaji Teslim Igbalaye; and the member representing Osogbo in the Osun State House of Assembly. Others honoured included the Chief Executive Officer of Mars Filling Station, Alhaji Eniafelamon, the Head Baale of Osogbo, as well as several other eminent indigenes.

The awards, according to the organisers, were aimed at appreciating individuals who have demonstrated dedication and service toward the advancement of Osogbo.

The Osun State Governor, Ademola Adeleke, who was represented at the event by the Commissioner for Information, Kolapo Alimi, used the occasion to stress the importance of collective support for the administration ahead of the August 8 governorship election.

READ ALSO:

- Check Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

- Troops Arrest Suspected Gunrunner, Recover Six Machine Guns in Taraba Operation

- Argungu Festival 2026 Highlights Peace, Stability, Economic Growth — Tinubu

In his address, the commissioner noted that Osogbo and Ile-Ife are strategically positioned in ongoing political discussions concerning succession politics toward 2030. He stated that the town which records the highest number of votes in the forthcoming election could stand a stronger chance of producing the governor’s successor in 2030.

He also highlighted developmental projects executed by the present administration in Osogbo and urged residents to remain united in order to attract more dividends of democracy to the town.

Speaking earlier, the Secretary to the State Government, Alhaji Teslim Igbalaye, outlined several initiatives he said he had facilitated for Osogbo through his office. According to him, over 100 indigenes of Osogbo have secured employment opportunities since the inception of the current administration.

He added that arrangements were at an advanced stage for more Osogbo indigenes to occupy principal officer positions across tertiary institutions in the state. Igbalaye promised to provide the leadership of Osogbo Sons and Daughters with the names and phone numbers of beneficiaries to ensure transparency and verification.

He also pledged to donate a bus to the association, following a request by its President, Saheed Akinyemi.

The programme further provided an avenue for elected representatives from Osogbo to present their scorecards before the audience, promoting accountability and engagement with constituents.

In his closing remarks, the President of Osogbo Sons and Daughters commended dignitaries and participants for their presence and reiterated the organisation’s commitment to the continued progress and unity of Osogbo.

Osogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

News

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

The pan‑Yoruba socio-political group Afenifere has warned that escalating terrorist attacks in states bordering the South-West are heightening fears of a full-scale incursion into Yorubaland, calling on governors to urgently implement robust security measures and push for the take-off of state police.

In a statement by its National Publicity Secretary, Jare Ajayi, Afenifere expressed deep concern over repeated attacks in Kwara, Kogi, and Niger states, as well as kidnappings in Ondo, Ekiti, and Oyo states. The group cited the recent Woro and Nuku attacks in Kwara State, where nearly 200 people were reportedly killed and several others abducted, as a warning of the growing threat.

“This is a very disturbing development as cases of abduction seem to be on the increase in Yorubaland. Terror acts are no longer confined to rural areas; even cities like Ibadan have witnessed incidents,” the statement read. Afenifere highlighted the broad-daylight abduction of a schoolgirl in Ibadan’s Challenge area as a chilling example of the insecurity affecting urban centres.

Ajayi urged governors of the six South-West states — Oyo, Ogun, Osun, Ekiti, Ondo, and Lagos — as well as neighbouring states including Kwara, Kogi, Edo, and Delta, to implement practical security arrangements that will allow residents to “sleep with their two eyes closed.”

READ ALSO:

- CAF Confirms 2027 AFCON Dates, Reveals Host Cities, Stadiums Across East Africa

- Ronaldo Returns From Absence to Score in Al‑Nassr’s 2‑0 Win Over Al‑Fateh

- One Dead as Hausa, Benue Communities Clash at Port Harcourt Market

The group recalled that during a November 24, 2025, meeting in Ibadan, the South-West governors had agreed to strengthen regional security through measures such as the South-West Security Fund and the creation of monitoring centres to track potential terrorist activity. Afenifere noted that recent steps, such as Ogun State’s inauguration of CCTV monitoring centres, are commendable but insufficient.

Ajayi stressed that the persistence of banditry and terrorism is not due to a lack of intelligence, but rather the failure to effectively utilize available information. He insisted that state police should take off immediately, while communities must be empowered to develop local security arrangements, including support for the Amotekun Corps and other regional security initiatives.

“It is high time governors in Yorubaland went beyond sermonisation and swung into decisive actions that will make the region truly secure,” Ajayi said.

Afenifere’s warning comes amid growing concerns over security across southern Nigeria, where the spread of banditry, kidnappings, and terrorist attacks is increasingly threatening both rural and urban communities. The group’s call reinforces longstanding advocacy for state-level policing as a critical measure to combat rising insecurity.

Afenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

News

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

The Secretary-General of the United Nations, António Guterres, has described Africa’s continued exclusion from permanent membership of the UN Security Council as “indefensible”, calling for urgent reforms to reflect today’s global realities.

Guterres made the remarks while addressing world leaders, stressing that Africa—home to more than 1.4 billion people and a major focus of the Council’s peace and security agenda—remains without a single permanent seat in the UN’s most powerful decision-making body.

According to him, the current structure of the Security Council no longer reflects geopolitical realities of the 21st century and undermines the credibility and legitimacy of the United Nations.

“Africa is dramatically under-represented. This is not only unfair, it is indefensible,” Guterres said.

READ ALSO:

- Tragedy on Enugu–Port Harcourt Highway as 11 Die in Road Accident

- Kwara Govt, Security Agencies Analyse Terrorists’ Video to Identify Kidnap Victims

- 26 Killed as Bandits Attack Niger Communities, Burn Police Station, Homes

He noted that while Africa accounts for a significant proportion of issues discussed by the Council—including peacekeeping operations, sanctions, and conflict resolution—it remains excluded from permanent decision-making power, including the veto.

The UN chief reiterated his support for long-standing African demands for at least two permanent seats and additional non-permanent seats on the Council, in line with the African Union’s Common African Position on UN reform.

Guterres also warned that failure to reform the Security Council risks eroding trust in multilateral institutions at a time when global cooperation is most needed to address conflicts, climate change, terrorism, and humanitarian crises.

Calls for reform of the Security Council have intensified in recent years, with African leaders, alongside countries from Latin America and Asia, arguing that the current structure—largely unchanged since 1945—reflects post-World War II power dynamics rather than present-day global realities.

Despite widespread agreement on the need for reform, progress has been slow due to disagreements among UN member states, particularly the five permanent members who hold veto power.

UN Chief Calls Africa’s Security Council Exclusion Unfair, Outdated

-

Education10 hours ago

Education10 hours agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

metro3 days ago

metro3 days agoLagos Police Launch Manhunt for Suspect in Brutal Ajah Murder

-

News3 days ago

News3 days agoAso Rock Goes Solar as Tinubu Orders National Grid Disconnection

-

metro1 day ago

metro1 day agoBoko Haram Terrorists Release Video of 176 Abducted Kwara Residents

-

metro1 day ago

metro1 day agoWoman Arrested Over Murder of Nigerian E-Hailing Driver in South Africa

-

Sports3 days ago

Sports3 days agoLookman Shines as Atlético Madrid Hammer Barcelona 4-0

-

metro2 days ago

metro2 days agoCourt Orders DIA to Produce Cleric Accused of Coup Plot by February 18

-

News12 hours ago

News12 hours agoAfenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland