Business

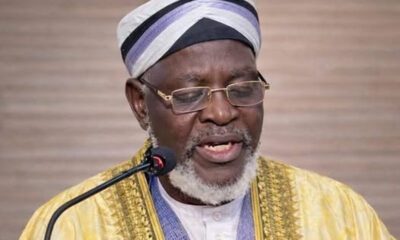

Paying for oil exports, others in naira will strengthen our currency, says Dogara

Paying for oil exports, others in naira will strengthen our currency, says Dogara

Former Speaker of the House of Representatives, Yakubu Dogara, has offered a number of suggestions on how to immediately strengthen the nation’s currency, the naira.

One of the measures, he said, was for the Federal Government to mandate those buying Nigeria’s crude oil to pay in naira and not United States dollar.

Similarly, he said all payments for exports should be made in the local currency, which he noted would reduce the desperation for the USD and continued fall in the naira’s value.

Dogara also asked the Federal Government to unlock “idle dollars” in private vaults to crash the foreign exchange (FX) rate.

Dogara spoke on Wednesday at the special edition of The Platform, an event powered by The Covenant Nation to facilitate national development.

Themed, ‘Democracy and the Free Market Economy’, the programme was held to mark Nigeria’s 25 years of unbroken democracy.

The naira had appreciated marginally to N1,480/$ at the parallel section of the FX market on June 10 — but fell to N1,483 at the official window on the same trading day.

Dogara said the naira was grossly undervalued, attributing this to an insatiable demand for dollars.

The former lawmaker said the forex issue is the primary problem currently affecting Nigeria’s economy.

He said both legitimate and shady transactions were being conducted in dollars, stressing that unless the appetite for dollars was curbed, the demand would always exceed the supply.

He said, “So many reasons have been adduced by pundits to be responsible for FX rate instability in Nigeria.

“I believe the naira is grossly undervalued. This is because the most productive nations are not necessarily the nations with the strongest currencies.

“I think the only infliction point we witnessed was due to the advent of the BVN, which crippled the ability of corrupt officials and other shady characters to keep their loot in anonymous bank accounts.

“Almost all ill-gotten money is stashed in USD in private vaults as the naira is too bulky to warehouse.

“Therefore, I am of the firm belief that our insatiable appetite for USD is what is killing the naira.

“Believe it or not, nearly all big-ticket deals and transactions, both legitimate and shady, are closed in USD in Nigeria.

“Just find out, there is no hefty bribe that is not paid for in USD. Some schools in Nigeria charge fees in foreign currencies, and even our most valued export is paid for in USD.

“So, to me, wittingly or unwittingly, the USD is our currency of choice and as long as we don’t kill our appetite for USD, the demand for USD will always outstrip its supplies.

“The challenge before the government is how to unlock and make the USD locked up in private vaults in Nigeria begin to chase the naira. That to me is the commonsensical solution.

“I believe we have enough dollars in this country that we can unlock to make our economy work and to crash the FX rate.”

Dogara urged the government to mandate the use of the naira for the payment of all Nigerian exports, including crude oil, to strengthen the local currency.

“To achieve this, the government must demand that all Nigerian exports, including crude oil exports, be paid for in naira, just as we don’t pay for any import into Nigeria from any country in naira. It is not too much to demand that,” he said.

Auto

Chanrai Storms Nigeria’s Gas Market, Unveils High-Capacity CNG, LNG Solutions to Power Energy Shift

Chanrai Storms Nigeria’s Gas Market, Unveils High-Capacity CNG, LNG Solutions to Power Energy Shift

By Rasheed Bisiriyu

Nigeria’s drive towards cleaner and more affordable transport fuel gathered fresh momentum on Friday as Chanrai Nigeria Limited formally entered the country’s gas distribution space, unveiling high-capacity CNG and LNG compression technologies in Lagos.

The company, a member of the globally diversified Kewalram Chanrai Group, announced a strategic partnership with India’s Tulip Compression to roll out advanced compressor packages and integrated “single window” CNG solutions aimed at accelerating the Federal Government’s Presidential CNG Initiative.

Chief Operating Officer of Chanrai Nigeria Limited, Anil Sahgal, described the Tulip CNG Compressor Packages as a “game-changer” for Nigeria’s evolving energy landscape.

“With our commitment to safety, efficiency and OEM-grade partnership, we’re empowering the nation to achieve its CNG ambitions while driving economic growth and environmental sustainability,” Sahgal said.

The move marks Chanrai’s expansion beyond its traditional business interests — which span automobiles, agro-products, healthcare and fast-moving consumer goods — into the fast-growing gas infrastructure segment, as fleet operators and industrial users increasingly seek alternatives to petrol and diesel.

Under the partnership, Chanrai Nigeria and Tulip Compression will deliver Compression Station on Single Window (CssW) solutions — integrating compressors, dispensers, storage and stainless-steel tubing under one brand — to simplify deployment and reduce installation timelines.

The compressor packages come in a wide capacity range, from 250 to 4,500 standard cubic metres per hour, making them suitable for small refuelling stations as well as large gas hubs.

A 1,400 SCMH gas engine-driven booster compressor is designed to refuel heavy-duty CNG trucks in about 20 minutes by drawing gas from tube trailers.

The systems are available in both electric motor-driven and gas engine-driven configurations, eliminating the need for large gas generators while ensuring energy efficiency and lower life-cycle costs.

According to the company, the equipment features dual-chamber leak-proof safety systems, advanced sealing technology to eliminate gas loss and global certifications including ATEX, CE, BIS and SGS standards.

The unveiling underscores the growing private sector response to government reforms encouraging gas adoption as a cost-effective and environmentally friendly alternative fuel.

With the compressor packages now available for immediate orders, Chanrai Nigeria said it would provide 24/7 after-sales support, operations and maintenance services, as well as remote asset monitoring solutions.

The development signals intensifying investment in CNG infrastructure as Nigeria seeks to deepen local gas utilisation, reduce fuel import dependence and cushion consumers from volatile petrol prices.

Entertainment

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

A team of leading Nigerian artistes and entertainment executives has paid a courtesy visit to the Managing Director of the Nigerian Railway Corporation (NRC), Kayode Opeifa, ahead of the 2026 Valentine Love Train experience.

The delegation included celebrated musician Sunny Neji, Managing Director of Ojez Entertainment Limited, Joseph Odobeatu, and veteran vocalist Yinka Davies.

The high-profile visit formed part of final preparations for the Valentine-themed train ride scheduled for Saturday, February 14, 2026, at the Mobolaji Johnson Train Station.

Dr. Opeifa received the artistes and commended the creative industry for choosing the national rail system as the venue for the annual Valentine event. He noted that the partnership reflects growing public confidence in the corporation’s safety standards, operational improvements, and renewed focus on customer experience.

READ ALSO:

- 2027 General Elections: INEC Announces February 20 for Presidential Poll

- EFCC Nabs Three in Borno Over Viral ₦500 Naira Mutilation Video

- Omokri Accuses El-Rufai of Rights Abuses During Kaduna Governorship

“The 2026 edition aims to deliver an unforgettable experience while deepening public engagement with the rail service,” Opeifa said, reaffirming the NRC’s commitment to providing secure and efficient transport for passengers during special events.

Organisers disclosed that this year’s edition will feature an expanded entertainment lineup, including performances and appearances by Charles Inojie, Yinka Davies, Sunny Neji, and Segun Arinze. Guests are expected to enjoy live music, comedy, a couple’s game show, fashion showcases, and special performances throughout the Lagos–Ibadan–Lagos train ride, culminating in a Valentine banquet ball.

The Valentine Love Train has in recent years become a fixture on the NRC’s festive calendar, attracting couples, families, and leisure seekers with its blend of travel, romance, and entertainment. The initiative also aligns with ongoing efforts by the corporation to promote rail transportation as a viable and enjoyable alternative for intercity travel.

With final logistics being fine-tuned, organisers say the 2026 edition promises to combine safety, comfort, and premium entertainment for participants.

NRC, Entertainers Finalise Plans for 2026 Valentine Train Ride

Auto

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

The 20th edition of the Lagos International Motor Fair and the 13th Africa Autoparts Expo is set to spotlight investment, technology transfer and industry collaboration as organisers intensify efforts to position Nigeria as a major automotive hub in West Africa.

The three-day event, which will also incorporate the Africa Motorcycle and Tricycle Expo, is scheduled to hold from March 17 to 19, 2026, at the Federal Palace Hotel in Lagos.

Organisers said the upcoming edition would focus strongly on accelerating the development of the country’s automotive sector by creating platforms that connect global manufacturers with local industry players.

“Nigeria has all it takes to become a global automotive industry giant,” the organisers stated, noting that the fair remains a strategic contribution toward driving growth despite prevailing industry challenges.

Chairman of the Organising Committee, Ifeanyichukwu Agwu, said the exhibitions had over the years evolved into a key platform for attracting investment into automobile spare parts and accessories manufacturing while strengthening aftermarket activities across the region.

“We have consistently used these events to attract investment into auto components manufacturing and to showcase the enormous capacity and potential of this critical sector of the economy,” he said.

READ ALSO:

- First Daughter of Murtala Muhammed Reflects on Life Without Father, Preserving His Legacy

- Anambra Police Arrest Motel Owner, Two Others Over Firearms, Drug Trafficking

- 2 Nigerians Killed While Fighting for Russian Army in Ukraine War

Agwu, who also serves as Managing Director of BKG Exhibitions Limited, disclosed that the 2026 edition would place emphasis on business-to-business engagement between original equipment manufacturers (OEMs) and auto parts dealers from Nigeria and neighbouring countries.

According to him, the goal is to foster partnerships capable of leading to the establishment of component manufacturing plants locally.

He added that the exhibition is expected to support government policies aimed at building a sustainable automotive industry by stimulating the emergence of companies involved in component production.

Calling for policy adjustments, Agwu urged the Federal Government to prioritise spare parts and components manufacturing over vehicle assembly, arguing that deeper technology transfer and innovation occur within the components segment.

“Spare parts manufacturing is where real technology transfer occurs. It involves precision engineering, planning and innovation—far beyond the coupling processes involved in assembly,” he said, while also advocating a review of the existing automotive policy to better support local production.

Despite the challenges associated with hosting large-scale industry events, Agwu reaffirmed the organisers’ commitment to sustaining the platform, warning that neglecting the automotive sector could have far-reaching consequences for the economy and employment.

The organisers said more than 100 original components manufacturers from countries including China, India, South Korea, South Africa, Singapore and Turkey, alongside major automobile distribution and manufacturing companies operating in Nigeria, are expected to participate.

In addition to product exhibitions, the event will feature seminars and technical workshops focusing on policy, investment opportunities, technology transfer and industry best practices, with each day structured to deliver value to exhibitors, investors, policymakers and other stakeholders.

Lagos Motor Fair, Autoparts Expo to begin March 17, targeting Investment, Industry Growth

-

Education23 hours ago

Education23 hours agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

News15 hours ago

News15 hours agoOsogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

-

metro2 days ago

metro2 days agoWoman Arrested Over Murder of Nigerian E-Hailing Driver in South Africa

-

metro2 days ago

metro2 days agoBoko Haram Terrorists Release Video of 176 Abducted Kwara Residents

-

News1 day ago

News1 day agoAfenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

-

metro3 days ago

metro3 days agoCourt Orders DIA to Produce Cleric Accused of Coup Plot by February 18

-

metro1 day ago

metro1 day agoUS Military Boosts Support for Nigeria’s Fight Against Insurgency With Ammunition, Troop

-

metro1 day ago

metro1 day agoArgungu Festival 2026 Highlights Peace, Stability, Economic Growth — Tinubu