Business

Petrol landing cost climbs to ₦186 as oil hits $64

Landing cost of imported Premium Motor Spirit (PMS) popularly known as petrol has risen to N186.33 per litre.

The sharp increase is occasioned by the rising price of crude oil at the international market, currently at $64 per barrel.

Already, the Federal Government has hinted of possible increase in the pump price of petrol at the filling stations saying there is no provision for fuel subsidy in the budget,

But the labour has kicked against any fresh increase in petrol price, which they note that Nigerians cannot absorb in view of the biting economic crunch.

The Minister of Labour and Employment said a decision on the petrol price would be taken a meeting between the FG and state governors on Thursday.

The landing cost of petrol rose to N180 per litre on February 5 from N158 .53 per litre on January 7.

Crude oil price accounts for a large chunk of the final cost of petrol, and the deregulation of petrol price by the Federal Government last year means that the pump price of the product will reflect changes in the international oil market.

The pricing template of the Petroleum Products Pricing Regulatory Agency showed that the landing cost of petrol rose to N186.33 per litre on February 16.

The latest rise also indicates that the pump price of the product would be N209.33 per litre.

The Nigerian National Petroleum Corporation, which has been the sole importer of petrol into the country in recent years, is still being relied upon by marketers for the supply of the product despite the deregulation of the downstream petroleum sector.

Oil marketers said recently that they were ready to resume importation of petrol if the foreign exchange was made available to them at a competitive rate.

“The discussion we should be having today is how best to maximise the benefits of the removal of price controls and subsidies while minimising the adverse effects of this action on our citizens,” Chairman, Major Oil Marketers Association of Nigeria, Mr Adetunji Oyebanji, said at a virtual press briefing.

The international oil benchmark, Brent crude, closed at $ 63.96 per barrel on February 16, up from $59.34 per barrel on February 5.

Brent crude, against which Nigeria’s oil is priced, rose by to $64.58 per barrel as of 6.08pm Nigerian time on Monday.

Other cost elements that make up the landing cost are freight (N10. 29), lightering expenses (N4.57), insurance cost (N0.25 ), Nigerian Ports Authority charge (N2.38), Nigerian Maritime Administration and Safety Agency charge (N0.23), jetty throughput charge (N1.61 ), storage charge (N2.58), and financing (N1.33).

The freight cost rose to $35.41 per MT (N10.29 per litre) last Wednesday from $30.04 per MT ( N8.74 per litre ) on February 5 .

The pump price is the sum of the landing cost, wholesale margin and the distribution margins. The wholesale margin is N4.03 while the distribution margins comprise transporters allowance ( N3 . 89 ), retailer ( N6 . 19 ), bridging fund ( N7 . 51 ), marine transport average (N 0 .15 ) , and admin charge (N1 . 23 ).

Apart from the changes in global crude oil prices , the exchange rate of naira to the dollar also affects the cost of imported petrol .

The cost of petrol would be higher if the 410/ $ 1 rate at which the naira closed on Monday at the Investors’ and Exporters’ Foreign Exchange Window was used. The naira closed at 480 / $ 1 at the parallel market.

Auto

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

Carloha Nigeria has officially unveiled the Chery Himla pickup in Nigeria, marking the brand’s entry into the country’s highly competitive pickup segment with a bold focus on productivity, durability and business efficiency.

The launch, held at Orange Island, Lekki, Lagos on February 19, 2026, positions the Himla not merely as a utility vehicle but as a high-performance mobile business asset tailored for commerce, agriculture, logistics, security operations and regional trade.

Speaking at the event, Managing Director of Carloha Nigeria, Mr. Sola Adigun, described the unveiling as a significant milestone for the company and Nigerian entrepreneurs.

“Today’s launch represents a key milestone, with Himla engineered to enhance efficiency and productivity for security outfits, farmers, logistics operators, entrepreneurs and others,” he said.

Built for Bigger Load, Fewer Tripsĺ

At the heart of the Himla’s appeal is its class-leading 1,276-litre cargo bed (1,530 mm × 1,620 mm × 515 mm), designed to accommodate standard industrial pallets and enable what the company describes as “one-trip loading.”

Its optimised chassis and suspension design minimise wheel arch intrusions, creating a flatter and more practical loading surface.

Integrated side and rear steps simplify loading and unloading, helping businesses improve turnaround time in demanding work environments.

READ ALSO:

- Suspected Bandits Use IED to Blow Up Cement Trailer in Zamfara

- How Nigerian Ex-Naval Officer Allegedly Tricked Into Russia’s Army via Fake Job Offer

- MURIC Demands Suspension of Olubi School Principal, VPs Over Alleged Religious Discrimination

Built on a high-strength ladder frame with reinforced rear-spring suspension, the Himla offers a rated payload exceeding 1,000 kg while maintaining stability under heavy loads.

It also boasts a 3-ton towing capacity, positioning it as a strong contender for hauling equipment, refrigerated containers and other heavy-duty applications across logistics, construction and agriculture.

Engineered for Nigerian Terrain

Designed with Nigeria’s diverse road conditions in mind, the Himla features advanced 4×4 capability and 265 mm ground clearance to tackle rough job sites and rural terrain with confidence.

Carloha says the pickup is engineered for durability in high temperatures and humid environments, incorporating wear-resistant and anti-corrosion materials, galvanised steel components and high-strength body panels. Multiple heavy-duty anchoring points ensure cargo stability even on uneven surfaces.

The vehicle is available in ICE variants and comes equipped with premium leather seats, a 15.6-inch central touchscreen, a 9.2-inch digital dashboard display and enhanced rear-seat comfort. Higher-end models feature advanced driver assistance systems.

Real-World Test Drive

Motoring journalists, customers and automobile enthusiasts at the launch event had the opportunity to test-drive the Himla across simulated terrains.

The demonstration highlighted its 4×4 capability, hill approach and descent angles, towing strength, load stability, water-wading ability, in-cabin quietness and overall ride comfort.

General Manager, Marketing at Carloha Nigeria, Mr. Felix Mahan, described the Himla as a cornerstone of Chery’s global pickup strategy.

He said the model combines “class-leading cargo capacity, hardcore load capability, advanced technology and climate-adapted engineering” to serve Nigerian entrepreneurs as a reliable business partner.

Backed by a class-leading six-year warranty, the Himla enters the Nigerian market with a strong value proposition.

With its unveiling, Carloha is betting that Nigeria’s evolving economy will increasingly demand pickups that do more than transport goods — vehicles designed to power productivity, cut operational costs and drive enterprise growth.

Carloha shakes up pickup market with launch of heavy-duty Chery Himla

Business

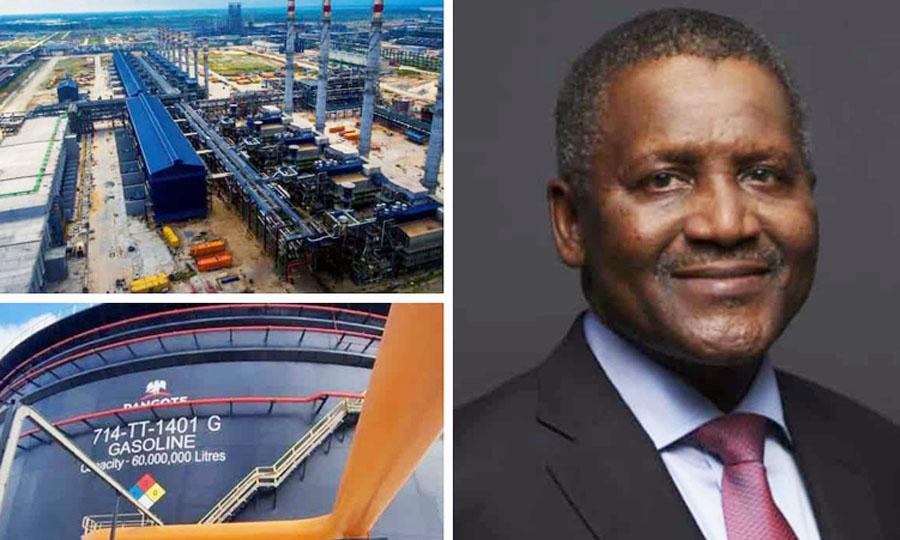

Dangote Refinery Signs Off‑Take Deal to Deliver 65m Litres of Petrol Across Nigeria

Dangote Refinery Signs Off‑Take Deal to Deliver 65m Litres of Petrol Across Nigeria

Dangote Petroleum Refinery & Petrochemicals has confirmed that it will supply between 60 million and 65 million litres of Premium Motor Spirit (PMS) — commonly known as petrol — daily to meet Nigeria’s national fuel demand, effectively positioning the country for sustained fuel self‑sufficiency and ending decades of reliance on imported petrol. The facility will also export up to 20 million litres of surplus petrol daily under a structured off‑take arrangement with major marketers.

The announcement was made by Aliko Dangote, President of the Dangote Group, during a press engagement in Lagos, where he said the refinery had concluded a structured distribution agreement with key local oil marketing firms to ensure stable nationwide supply and curtail fuel scarcity and speculation.

“We have agreed a framework to supply up to 65 million litres daily for the domestic market. Any surplus, estimated at between 15 million and 20 million litres, will be exported,” Mr. Dangote said, affirming confidence in the refinery’s production capacity and downstream rollout strategy.

Output Exceeds Domestic Consumption

Nigeria’s average daily petrol consumption currently ranges between 50 million and 60 million litres, meaning the Dangote Refinery now produces more petrol than the country needs for local use. Industry watchers say this marks a decisive break from decades of fuel import dependence, which historically exposed the nation to foreign exchange pressures, supply disruptions, and periodic scarcity.

READ ALSO:

- Sheikh Gumi Warns Against Airstrikes on Bandits, Backs Forest Security Service

- FG Denies ₦10 Billion Ransom Payment, Affirms Pupils Freed Through Security Operations

- Lookman Assist Powers Atletico to 7–4 Aggregate Win Over Brugge

Structured Off‑Take and Nationwide Distribution

Under a distribution framework approved by the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), petrol from the Dangote Refinery will be channelled through a network of major marketers to ensure broad and consistent coverage across the country. Participating companies include:

- MRS Oil Nigeria Plc

- Nigerian National Petroleum Company Limited Retail (NNPC Retail)

- 11 Plc (formerly Mobil Oil Nigeria)

- **TotalEnergies Marketing Nigeria Plc

- Rainoil Limited

- Ardova Plc

- Northwest Petroleum & Gas Company Limited

- Bovas & Company Limited

- AA Rano Nigeria Limited

- AYM Shafa Limited

- Conoil Plc

- Masters Energy

The structured model is designed to eliminate supply bottlenecks, curb speculative hoarding, and stabilise retail prices nationwide.

Economic Impact and Fuel Security

Energy analysts describe the development as a structural reform in Nigeria’s fuel supply chain. For decades, Africa’s largest crude oil producer depended heavily on imported refined products, draining valuable foreign exchange reserves and exposing the economy to global price shocks and logistical bottlenecks.

With local refining now exceeding national demand, Nigeria is poised to conserve billions of dollars annually previously spent on petrol imports. Analysts say this would ease pressure on the naira, strengthen external reserves, and improve the country’s trade balance stability. There is also optimism that Nigeria could become a regional supplier of refined products, potentially exporting petrol to neighbouring countries, boosting revenue and supporting economic growth.

Refinery Performance and Government Support

During a recent facility visit, Bayo Ojulari, Group Chief Executive Officer of NNPC Limited, described the Dangote Refinery as a transformative national asset capable of reshaping Nigeria’s energy security architecture and accelerating industrial growth. He noted that the refinery had surpassed expectations, performing above its design capacity of 650,000 barrels per day, with live production reaching 661,000 barrels per day on recent measurement — a performance indicator that underscores the plant’s operational efficiency and reliability.

Ojulari said, “This plant was designed for 650,000 barrels per day. None of us thought it would even touch 550,000. What we saw live today was 661,000. These are live parameters, not reports or photographs.”

Broader Industrial and Economic Benefits

Experts say the refinery’s success will have ripple effects across Nigeria’s industrial landscape. With reliable access to refined products, manufacturing and transportation sectors are expected to benefit from improved logistics and reduced production costs. Additionally, the refinery’s integrated petrochemical complex — one of the largest in the world — is projected to stimulate growth in downstream industries, create jobs, and attract foreign and local investment.

The government has repeatedly lauded the operationalisation of the Dangote Refinery as a key milestone in Nigeria’s economic diversification strategy. It aligns with national objectives to boost energy independence, reduce import bills, strengthen local capacity, and stimulate private-sector‑led growth.

Dangote Refinery Signs Off‑Take Deal to Deliver 65m Litres of Petrol Across Nigeria

Business

Zinox, TD Africa Partner to Expand Nigeria’s Tech Distribution Footprint Across Africa

Zinox, TD Africa Partner to Expand Nigeria’s Tech Distribution Footprint Across Africa

Zinox Technologies and TD Africa have formalised a strategic partnership to strengthen Africa’s technology ecosystem, expand access to locally manufactured technology, and accelerate digital inclusion across the continent.

The partnership was unveiled at a press conference attended by industry stakeholders, technology partners and journalists. It is aimed at scaling the reach of Nigerian-made technology products across Africa while promoting technological self-reliance, local innovation, and indigenous manufacturing.

Under the agreement, Zinox Technologies, widely regarded as Sub-Saharan Africa’s leading indigenous technology manufacturer, will leverage TD Africa’s extensive distribution network covering 43 African countries. TD Africa is Africa’s largest technology distributor and a major channel partner to global brands such as HP, Microsoft, Dell and Cisco, giving Zinox products access to a vast continental market.

Speaking at the event, Coordinating Managing Director of TD Africa, Chioma Chimere, described the collaboration as a defining milestone for the continent’s technology industry. She said the partnership represents a moment where African innovation meets African distribution strength, noting that Zinox’s products are designed specifically to solve local challenges and reflect African realities.

READ ALSO:

- ABC Transport reaffirms commitment to safety as Driver Training Academy graduates 137

- EFCC Arraigns Former NRC MD Fidet Okhiria Over $385,000, ₦165m Fraud

- Peter Obi Survives Shooting in Edo as Armed Men Target ADC Leaders (VIDEO)

Executive Director and Head of Human Resources at Zinox Technologies, Chioma Nwoke, said the partnership aligns with Zinox’s founding vision of building dependable technology standards in Africa. According to her, the collaboration goes beyond commercial interests and extends to digital education, enterprise development, job creation, and nation-building, while reinforcing the message that African technology can compete globally.

Providing further insight into the company’s innovation journey, Head of Research and Development at Zinox, Moses Edoh, highlighted the firm’s track record in developing solutions tailored to African needs. He noted that Zinox was the first company to introduce hybrid inverters in Nigeria, adding that its products are engineered around local power challenges, climate conditions and affordability concerns.

Zinox’s expanding product portfolio includes smart boards, personal computers, tablets, desktops, monitors, and point-of-sale systems. Through its iPower brand, the company manufactures hybrid inverters, solar panels, lithium and tubular batteries, MPPT solar charge controllers, and solar street lights. Its iTEC division produces generators, while its consumer electronics line features AI-powered QLED smart televisions, microwave ovens, and rechargeable fans.

Partners and channel stakeholders at the event attested to the durability, reliability and cost-effectiveness of Zinox products, urging greater awareness and patronage of locally manufactured technology as a credible alternative to imported brands.

With TD Africa’s distribution capacity now supporting Zinox’s product range, customers and partners across the continent are expected to benefit from flexible ownership and access models such as Just Own It (JOI), Technology as a Service (TaaS) and Product as a Service (PaS). These models are designed to reduce upfront costs and improve technology adoption among businesses, institutions and consumers.

The partnership also coincides with renewed recognition of Zinox Group Founder and Chairman, Leo Stan Ekeh, who recently marked his 70th birthday. President Bola Tinubu described Ekeh as one of Nigeria’s pioneering innovators in the information technology sector, recalling the landmark 2001 launch of Zinox’s indigenous computer products.

Ekeh currently presides over Zinox Group, which comprises Zinox Technologies, Task Systems, TD Africa, TD Mobile and Konga, among other subsidiaries that operate across manufacturing, distribution and e-commerce.

Industry observers say the Zinox–TD Africa alliance represents a significant step toward scaling indigenous manufacturing, reducing Africa’s dependence on imported technology, and positioning Nigerian technology brands as competitive players across the continent, in line with Africa’s fast-growing digital transformation agenda.

Zinox, TD Africa Partner to Expand Nigeria’s Tech Distribution Footprint Across Africa

-

News1 day ago

News1 day agoBREAKING: IGP Kayode Egbetokun Steps Down as Tinubu Names Tunji Disu as New Police Chief

-

Entertainment18 hours ago

Entertainment18 hours agoNollywood Actor Okemesi Confirmed Dead After Brief Illness

-

metro9 hours ago

metro9 hours agoFrank Mba, Senior DIGs to Exit Police Service After Disu’s Appointment

-

News1 day ago

News1 day agoMother of Three Dies by Suicide After Fiance’s Family Rejects Marriage in Ijebu-Ode

-

News8 hours ago

News8 hours agoBREAKING: Tinubu Decorates Tunji Disu as Acting Inspector‑General of Police

-

International3 days ago

International3 days agoUS Adds 19 More Nigerians to ‘Worst of the Worst’ Deportation List

-

metro6 hours ago

metro6 hours agoAfrican Virologists Elected to Lead World Society for Virology

-

News2 days ago

News2 days agoU.S. Congress Submits Report to Trump on Alleged Christian Persecution in Nigeria

You must be logged in to post a comment Login