Business

Reps reject Customs N1.33tn revenue target for 2022

The House of Representatives Committee on Finance has rejected N1.33tn revenue target of the Nigeria Customs Service for 2022, saying it is too low.

The committee gave its verdict at its 2022 to 2024 Medium-Term Expenditure Framework/Fiscal Strategy Paper (MTEF/FSP) interactive session with Ministries, Departments and Agencies, said with new technologies deployed and the recent devaluation of the naira, Customs should be able to generate more revenue.

Leke Abejide (SDP-Kogi) said that with the recent devaluation of the naira, he expected that the proposal of the NCS should be N2 trillion or above.

He said the exchange rate for 2021 was N381 to a dollar and the targeted revenue generation was N1.6 trillion, adding that the service should factor in the devaluation of the naira and increase their target.

The lawmaker said the service would still surpass an upward review target, adding that the new Finance Act had empowered the service to generate more revenue from alcoholic beverages and tobacco as against 2021.

Ahmed Muhktar (APC-Kaduna State) said that customs should be able to generate more revenue following the ongoing deployment of technology in revenue collection.

He said that with the number of training and retraining lined up in the NCS budget, the service should be able to generate much more than N1.33 trillion.

According to him, the committee will not accept anything less than N3 trillion.

The Chairman of the committee, Mr James Faleke (APC-Lagos State), said at the beginning of every year, the Budget Office takes a critical look at expected revenue generation of the country.

He said that was done to know the required funds and make adequate preparation for borrowing, adding the amount of money to be borrowed would reduce if more revenue could be generated.

Faleke said, “We are saying no, that your gross revenue generation is low given all the available opportunities that you have; when you also look at your previous performance 2020 to 2021.

“For us as a committee on finance, we will not accept the N1.3 trillion, I am sure by the time our report comes out, you will be pleasantly happy.”

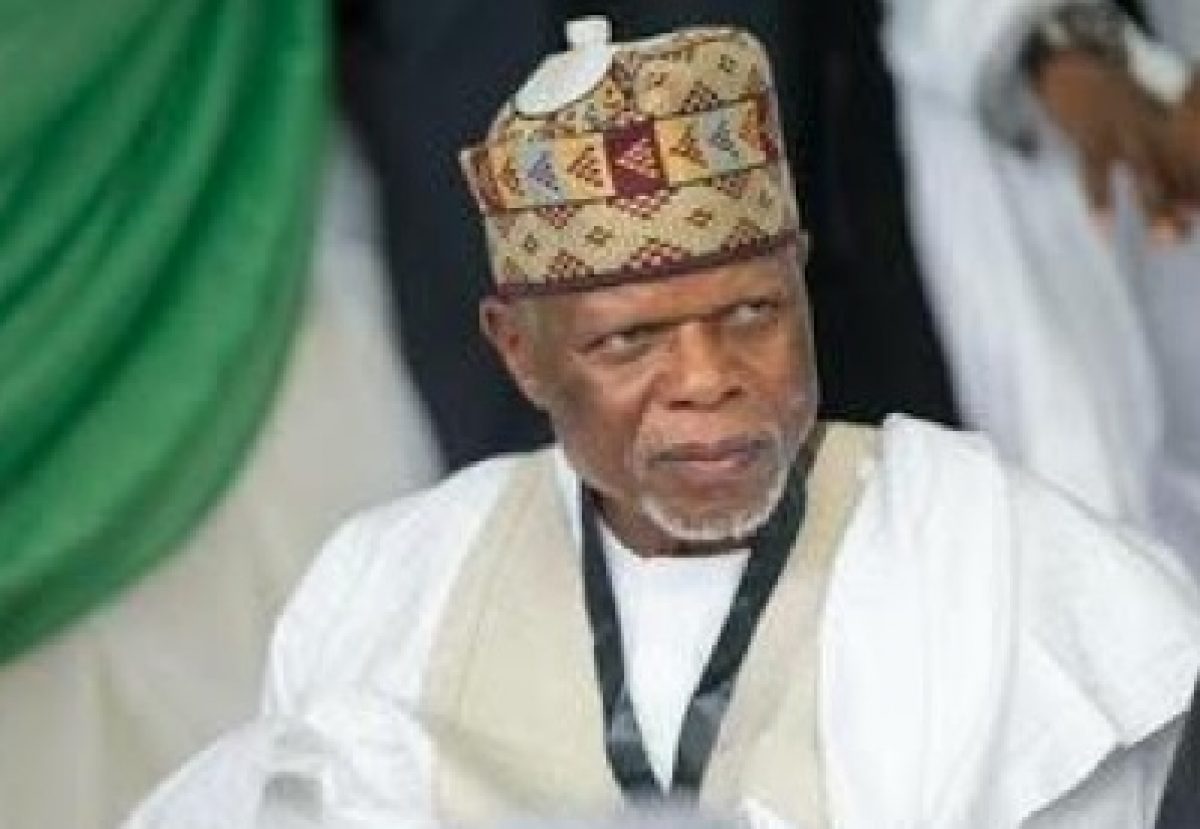

Comptroller-General of Customs, Col. Hameed Ali (rtd), had earlier told the committee that the service planned to generate N1.33 trillion in 2022.

Ali said the service came up with the figure after analysing the average revenue collection in the previous and was trying to be as realistic as possible.

“We are expecting in 2022, N1.33 trillion, that is what we are proposing; we are hoping that things will improve, importation do fluctuate and we do not have any constant measurement.

“So, we take the average of what we collected in the previous year and compute it and come up with a figure that is realisable.

“Whatever comes thereafter, it is our hope that we will surpass it by far but we are trying to be as realistic as we can in our proposal,’’ he said.

Ali, however, said should any extra money be generated, it would go straight into the federation account and that the service had no intention to defraud the government. (NAN)

Business

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

The CEO of Rainoil Limited, Gabriel Ogbechie, has claimed that the federal government resumed the payment of the controversial fuel subsidy following the devaluation of the Naira in the foreign exchange market.

Ogbechie made this statement on Tuesday during the Stanbic IBTC Energy and Infrastructure Breakfast Session held in Lagos.

He pointed out that with Nigeria’s daily fuel usage at 40 million liters and the foreign exchange rate at N1,300, the government’s subsidy per liter of fuel falls between N400 and N500, culminating in a monthly total of approximately N600 billion.

He said; “When Mr. President came in May last year, one of the things he said was that Subsidy is gone. And truly, the subsidy was gone, because immediately the price of fuel moved from 200 to 500 per liter. At that point truly, subsidy was gone.

“During that period, Dollar was exchanging for N460, but a few weeks later, the government devalued the exchange rate. And Dollar moved to about N750. At that point, subsidy was beginning to come back.

READ ALSO:

- North Central Support Group rejects Northern Elders, pledges allegiance to Asiwaju

- Gunmen kidnap 2 FRSC officers along Abakaliki-Enugu highway

- Driver killed, 16 passengers abducted on Abuja-Lokoja road

“The moment the two markets officially closed, officially the market went to about N1,300. At that point, that conversation was out of the window. Subsidy was fully back on petrol. If you want to know where petrol should be, just look at where diesel is. Diesel is about N1,300 and petrol is still selling for N600.

Furthermore, he said that NNPC being the only petrol importer in the country implies that there is an ongoing subsidy, as prices had to be fixed.

Earlier yesterday, the former governor of Kaduna State, Nasir El Rufai, said the federal government is spending more on petrol subsidy than before.

In addition, the Special Adviser to the President on Energy, Mrs. Olu Veŕheijen, said that the Federal Government reserves the right to pay fuel subsidy intermittently to cushion hardship in the country.

“The subsidy was removed on May 29. However, the government has the prerogative to maintain price stability to address social unrest. They reserve the right to intervene.

“If the government feels that it cannot continue to allow prices to fluctuate due to high inflation and exchange rates, the government reserves the right to intervene intermittently and that does not negate the fact that subsidy has been removed,” she said.

Govt paying N600bn for fuel subsidy monthly — Rainoil CEO

Business

Breaking: Dangote brings diesel price down to N1000/litre

Breaking: Dangote brings diesel price down to N1000/litre

Dangote Petroleum Refinery has announced a further reduction in the price of diesel.

When it commenced operation a few weeks ago, Dangote Petroleum Refinery pegged the price of diesel as N1,200.

While rolling out the products, the refinery supplied at a substantially reduced price of N1,200 per litre three weeks ago, representing over 30 percent reduction from the previous market price of about N1,600 per litre.

READ ALSO:

- Kano anti-corruption agency slams fresh charges against Ganduje

- Troops kill ISWAP Commanders, 30 other terrorists

- Ooni of Ife dismisses agitators of Yoruba nation

However, on Tuesday, a further reduction of N200 was noticed in the price, with the product now pegged at N1,000.

This significant reduction in the price of diesel, at Dangote Petroleum Refinery, is expected to positively affect all the spheres of the economy and ultimately reduce the high inflation rate in the country.

The President of Dangote Group, Aliko Dangote, had during the Eid-el-Fitr celebration said if the cost price of diesel comes down, the inflation rate will be substantially reduced.

Dangote spoke when he visited President Bola Tinubu in his residence in Lagos State to celebrate the end of the Ramadan fast with him.

Breaking: Dangote brings diesel price down to N1000/litre

Business

Naira records five-month highest gain, sells below N1000/$ at parallel market

Naira records five-month highest gain, sells below N1000/$ at parallel market

The naira continued its positive showing against the United States dollar on Monday, selling below N1000/$ in some segments of the parallel market.

Newstrends reports that the Federal Government, groups and some individuals have mounted a spirited campaign for those hoarding the dollars to push them out as naira continues to appreciate.

On Monday, the naira was offered in some parts of Lagos and Abuja between N995 and N1,050 per dollar in the parallel market. It was N1,230/$ on Friday.

The latest gain, being over five-month highs, came in the wake of the Iranian attack on Israel and a rise in the crude oil price.

Goldman Sachs, American investment bank economists, had earlier predicted that the naira’s bullish momentum on the foreign exchange market would likely cause it to trade for less than N1,000 per US dollar in the coming months.

According to a report by Nairametrics, the group claimed that the rally in Nigerian currency helped recover from large losses after two devaluations since last June by being bolstered by capital inflows and successive interest rate hikes.

In March, Goldman Sachs projected that the Naira would appreciate to N1,200 per dollar in 2024.

At the official foreign exchange market, the rate was put at N1,136/$ in contrast with N1,205/$ last Friday.

The top bank has implemented several policy initiatives in recent months to bring stability to the foreign exchange market.

The CBN increased interest rates to 24.75% at the most recent meeting of the Monetary Policy Committee (MPC), which helped it recover losses from the two devaluations that occurred since June of last year.

Further gains for the naira result from the CBN’s ongoing intervention, which involves selling foreign exchange to Bureau De Change operators at a revised rate.

The market anticipates higher inflows of US dollars from the sale of foreign currency bonds in the second quarter as disclosed by Finance Minister Wale Edun.

The Federal Government has just offered high-yield short-term debt products at a premium to entice overseas capital into the economy.

The Middle East’s geopolitical unrest and

Notwithstanding a drop in Nigeria’s production volume, crude oil prices have risen beyond $90.

Nigerian grades of oil are trading at a premium to the ICE Brent benchmark.

The Middle East’s geopolitical unrest and the anticipation of an Iranian government strike on Israel caused oil prices to soar.

-

metro7 days ago

metro7 days agoTroops arrest ISWAP commander involved in Army General, 3 soldiers’ killing in Borno

-

News7 days ago

News7 days agoBREAKING: Ex-Abia gov, Ogbonnaya Onu, is dead

-

Sports6 days ago

Sports6 days agoKane’s three children involved in car crash, hospitalised

-

metro5 days ago

metro5 days agoTroops neutralise 188 terrorists, rescue 133 hostages in assault operations

-

News5 days ago

News5 days agoFG gives update on where fleeing Binance executive is hiding

-

News7 days ago

News7 days agoEdo APC chairman visits Shaibu after impeachment

-

Entertainment5 days ago

Entertainment5 days agoTolani Baj expresses love for Bobrisky

-

Business5 days ago

Business5 days agoNaira continues gain, sold N1,150/$ at parallel market