Business

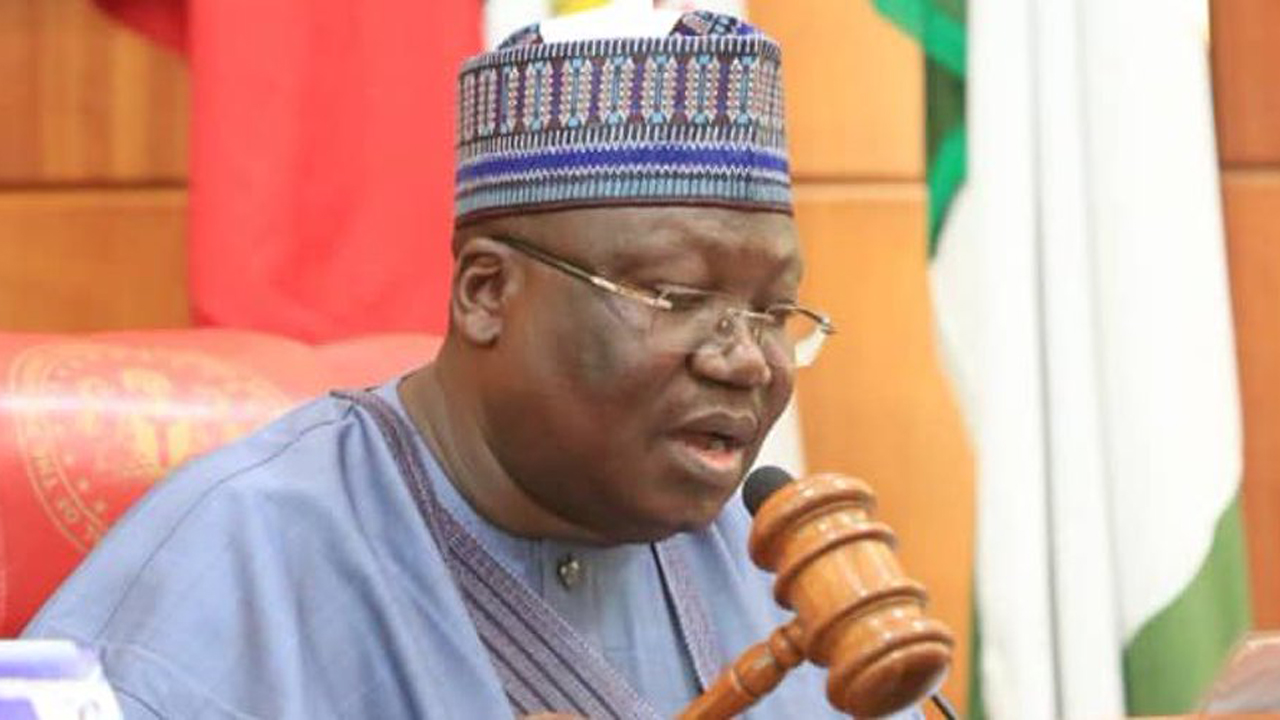

Senate cautions CBN over cash withdrawal limits

The Senate on Wednesday asked the Central Bank of Nigeria (CBN) to exercise restraint on its latest policy on cash withdrawals.

Aviation

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air grounds plane after runway incident, 83 passengers on board

Dana Air says it has grounded its airplane that skidded off the Lagos airport runway on Tuesday.

The affected aircraft, a McDonald Douglas (MD-83) with registration 5N-BKI, had 83 passengers on board, it added.

Spokesman for the airline, Mr Kingsley Ezenwa, however, said all the 83 passengers and crew onboard the flight disembarked safely without injuries.

He said in a statement that the airline decided to ground the plane to allow for proper investigation into what caused the accident.

The statement read in part, “Dana Air regrets to inform the public of a runway incursion involving one of our aircraft, registration number 5N BKI, which was flying from Abuja to Lagos today, 23/04/24.

“We are relieved to confirm that all 83 passengers and crew onboard the flight disembarked safely without injuries or scare as the crew handled the situation with utmost professionalism.

“We have also updated the Accident Investigation Bureau, AIB, and Nigerian Civil Aviation Authority (NCAA) on the incident, and the aircraft involved has been grounded by our maintenance team for further investigation.

“We wish to thank the airport authorities, our crew for their very swift response in ensuring the safe disembarkation of all passengers following the incident, and our sincere apologies and appreciation to the passengers on the affected flight for their patience and understanding.”

Aviation

Just in: Panic as Dana Air plane skids off Lagos airport runway

Just in: Panic as Dana Air plane skids off Lagos airport runway

Tragedy was averted on Tuesday as a Dana Air plane skidded off the Lagos airport runway.

Although it was not immediately clear why the pilot lost control, causing the plane skid off the runway, Newstrends learnt that the incident led to the diversion of other flights to the international wing of the Murtala Muhammed Airport, Lagos.

In a post by X user, BelemaMhart — who boarded another airline — it was stated that there were no casualties.

Business

FG revokes N32bn metering contract, vows to sell five DisCos

FG revokes N32bn metering contract, vows to sell five DisCos

President Bola Tinubu has ordered the revocation of a N32 billion ($200m) metering contract awarded by the Federal Government since 2021 for non-performance.

Minister of Power Adebayo Adelabu disclosed this and hinted of plans to sell off five electricity Distribution Companies (DisCos) over persistent blackout.

Adelabu spoke on Monday while hosting members of the Senate Committee on Power in his Abuja office.

The minister said the Federal Government had mobilised a company named Messr Zigglass with $200 million (N32 billion) to supply three million meters, but that the firm had failed to deliver.

“If you held N32 billion for these years, where is the interest?” he asked.

According to him, President Tinubu has directed that the contract be revoked.

The government, he said, would bridge the current eight million metering gap in the next four to five years.

The minister also said the funding would be coming from a seed capital of N100 billion and N75 billion.

He added that the Nigerian Sovereign Investment Authority (NSIA) would come to the aid of the ministry with the funds.

The sale of the five DisCos to reputable technical power operators, he said, would be completed within three months.

He told the committee that tough decisions on the DisCos had become necessary because the entire Nigerian Electricity Supply Industry (NESI) failed due to the poor performance of the distribution companies.

The minister said the ministry would prevail on the Nigerian Electricity Regulatory Commission (NERC) to revoke underperforming licences and change the management boards of the DisCos if necessary.

Adelabu said, “On distribution, very soon you will see that tough decisions will be taken on the DisCos. They are the last lap of the sector. If they don’t perform, the entire sector is not performing.

“The entire ministry is not performing. We have put pressure on NERC, which is their regulator to make sure they raise the bar on regulation activities.

“If they have to withdraw licences for non-performance, why not? If they have to change the board of management, why not?

“And all the DisCos that are still under AMCON and banks; within the next three months, they must be sold to technical power operators with good reputations in utility management.

“We can no longer afford AMCON to run our DisCos. We can no longer afford the banks to run our DisCos. This is a technical industry and it must be run by technical experts.”

He listed those affected as Abuja Electricity Distribution Company (AEDC) under the management of the United Bank of Africa (UBA), Benin Electricity Distribution Company (BEDC), Kaduna Electricity Distribution Company and Kano Electricity Distribution Company managed by Fidelity Bank; Ibadan Electricity Distribution Company (IEDC) is under the AMCON management.

Investors hold 60 per cent of shares in the DisCos. The Federal Government holds the remaining 40 per cent.

Blackout has persisted in most states with DisCos blaming low allocation from the national grid as well as gas shortage to generating companies (GenCos) as the causes.

The minister said that the energy distribution assets are technical and should be managed by experts.

According to him, the Ibadan DisCo is too large for one company to manage.

Responding to the decision to resell the DisCos, a member of the committee, Senator Isah Jibrin, alleged that some of the operators have stripped the assets of the DisCos they took over in 2013.

He insisted that the operators of any revoked DisCo must be compelled to fix the assets as they were prior to handover.

Adelabu blamed issues in the industry on uncompleted projects and appealed to the committee to approve funds for the completion of over 120 projects across the country.

-

Education3 days ago

Education3 days agoWhy we charge N42m fees for primary school pupils — Charterhouse Lagos

-

Business6 days ago

Business6 days agoGovt paying N600bn for fuel subsidy monthly — Rainoil CEO

-

News5 days ago

News5 days agoUpdated: More trouble for Yahaya Bello as Immigration places him on watch list

-

Auto3 days ago

Auto3 days agoWe expect massive roll-outs of Nigeria-made cars by December 2024 – Minister

-

News7 days ago

News7 days agoJubilation as FG begins disbursement of N200bn palliative loans

-

News7 days ago

News7 days agoKano anti-corruption agency slams fresh charges against Ganduje

-

News7 days ago

News7 days agoIMF predicts 3.3% growth for Nigeria’s economy in 2024

-

metro6 days ago

metro6 days agoEdo court sentences three to death by hanging for kidnapping, murder