Business

Subsidy removal: Fuel price hike imminent as crude oil price inches towards $100 per barrel

Subsidy removal: Fuel price hike imminent as crude oil price inches towards $100 per barrel

In the last three months since President Bola Tinubu announced the withdrawal of petroleum subsidy, Nigerians are still trying to grapple with the over 400 per cent increment while they continue to wait for the promised palliatives from the government.

But the increase in the price of crude oil in the international market could further increase the price of petroleum at the filling stations despite the promise by President Tinubu that PMS price will not increase further.

The crude oil price in the international market has risen to $94 per barrel, the highest in the past 10 months. Market observers believe that the price will cross the $100 mark as demand increases during winter.

In the last three months since President Bola Tinubu announced the withdrawal of petroleum subsidy, Nigerians are still trying to grapple with the over 400 per cent increment while they continue to wait for the promised palliatives from the government.

But the increase in the price of crude oil in the international market could further increase the price of petroleum at the filling stations despite the promise by President Tinubu that PMS price will not increase further.

The crude oil price in the international market has risen to $94 per barrel, the highest in the past 10 months. Market observers believe that the price will cross the $100 mark as demand increases during winter.

READ ALSO:

-

NIMC unveils self-service app for NIN enrollment, digital ID

-

Why Cardoso could wait until 2024 before taking over as new CBN boss

-

Niger signs official defense pact with Mali, Burkina Faso – warns ECOWAS

In the past, this increment would have generated excitement because it would mean more revenue for the Nigerian government; however, the increment in crude oil price means Nigerians may have to pay more for fuel.

Last month, President Tinubu had promised that price would be maintained by “addressing the inefficiencies within the midstream and downstream petroleum subsectors to maintain prices where they are without having to resort to a reversal of the administration’s policy in the petroleum industry.”

On Friday, the Group Chief Executive Officer of NNPC Limited, Mele Kyari had told some members of the House of Representatives that the NNPC Retail is moving to acquire significant market shares in the downstream sector so as to have control of the downstream market.

It would be recalled that NNPC Retail had in December acquired the retail outlets of Oando Limited.

The deal according to Kyari means that the NNPC Retail now has 30 per cent of the market and is able to regulate prices through the market share. He explained that other petroleum marketers would be forced to maintain prices because NNPC Retail won’t increase prices.

“Some weeks ago in Lagos, There was a small queue because one company increased their price by N7. As simple as this, everybody rushed to our filling stations and a queue developed. This is the security that the PIA guarantees.

“That Nigerians will have choices and they will not be exploited. We will be the market balancer. We will create stability in the market and Nigerians will not be exploited,” he said.

READ ALSO:

-

My first marriage introduced me to poverty – Iyabo Ojo

-

3 Nigerian boxers qualify for Paris 2024 Olympic games

-

Akpabio’s aide dismisses reports of imminent NASS leadership change

However, Nigerians are still concerned about the increment despite the assurance by the President and the oil chief, particularly with the deregulation of the sector.

An economist, Dr Babatunde Adeniran says an increment may be inevitable considering the factor of demand and supply which is playing out in the international market.

“Yes. It is inevitable because they (marketers) adjust prices depending on the market realities, i.e, forces of demand and supply,” Adeniran says while responding to a question on the chance of a price hike.

Alternatives energy sources

President Tinubu had in a national broadcast in August promised to invest N100 billion in Compressed Natural Gas (CNG) buses to mitigate the impact of subsidy removal.

“The Nigerian Government has put aside N100 billion to purchase 3,000 twenty-seater buses powered by Compressed Natural Gas for deployment in all the states in the next nine months,” President Buhari said.

Adeniran urged the government to provide assistance to the masses by subsidizing the CNG kits.

“One of the means to mitigate the effect is to source for an alternative source of energy. One such alternative is the CNG. It remains the best source since it is relatively cheaper and cleaner.

“But to assist, the government can subsidize the CNG kit. If the government is able to achieve that, more people will embrace this.

“Nigeria has the capacity to meet the demand; we currently flare a lot of gas. Instead of flaring the gas, we can channel it into CNG which would be more productive,” he said.

Subsidy removal: Fuel price hike imminent as crude oil price inches towards $100 per barrel

Business

Forex: FG to delist naira from P2P platforms

Forex: FG to delist naira from P2P platforms

The Federal Government is set to delist the naira from all Peer-to-Peer platforms to reduce the manipulation of the local currency value in the foreign exchange market.

Director General of the Securities and Exchange Commission, Emomotimi Agama, made this known on Monday at a virtual conference with blockchain stakeholders.

The goal of this resolution is to combat manipulation of the value of the local currency in the foreign exchange market.

In past months, the nation’s regulatory bodies have started looking into and closely examining cryptocurrency exchanges.

This is part of a number of regulations to be rolled out in the coming days.

He said, “That is one of the things that must be done to save this space. The delisting of the naira from the P2P platforms to avoid the level of manipulation that is currently happening.

“I want your cooperation in dealing with this as we roll out regulations in the coming days.”

The SEC DG decried how some market players were manipulating the value of the naira.

This, he said, was why the commission was “seeking collaboration and help in making sure that the crypto environment is respected globally”.

Business

Ikeja Electric cuts tariff for Band A customers

Ikeja Electric cuts tariff for Band A customers

The Ikeja Electricity Distribution Company has announced a reduction in the tariff for customers under Band A classification from N225 per kilowatt-hour to N206.80kw/h

This is coming about a month after the Nigerian Electricity Regulatory Commission (NERC) approved an increase in electricity tariff for customers under the Band A category to N225 per kwh — from N66.

The commission has clarified that customers under Band A receive between 20 and 24 hours of electricity supply daily.

Ikeja Electric said in a circular on Monday the cut in the new tariff rate would take effect from May 6, 2024.

Business

Finally, NERC unbundles TCN, creates new system operator

Finally, NERC unbundles TCN, creates new system operator

The Nigerian Electricity Regulatory Commission (NERC) has set up the Nigerian Independent System Operator of Nigeria Limited (NISO) as it unbundles the Transmission Company of Nigeria (TCN).

The transmission leg of the power sector has over the years been seen as weakest link with obsolete equipment.

The unbundling announcement is contained in an Order dated April 30, 2023 and jointly signed by NERC chairman, Sanusi Garba, and vice chairman, Musiliu Oseni.

By this order, the TCN is expected to transfer all market and system operation functions to the new company.

The commission had previously issued transmission service provider (TSP) and system operations (SO) licences to the TCN, in accordance with the Electric Power Sector Reform Act.

The Electricity Act 2023, which came into effect on June 9, provided clearer guidelines for the incorporation and licensing of the independent system operator (ISO), as well as the transfer of assets and liabilities of TCN’s portion of the ISO.

In the circular, the commission ordered the Bureau of Public Enterprises (BPE) to incorporate, unfailingly on May 31, a private company limited by shares under the Companies and Allied Matters Act (CAMA), 2020.

NERC said the company is expected “to carry out the market and system operation functions stipulated in the Electricity Act and the terms and conditions of the system operation licence issued to the TCN.

“The name of the company shall, subject to availability at Corporate Affairs Commission, be the Nigerian Independent System Operator of Nigeria Limited (“NISO”),” NERC said.

Citing the object clause of the NISO’s memorandum of association (MOU) as provided in the Electricity Act, NERC said the company would “hold and manage all assets and liabilities pertaining to market and system operation on behalf of market participants and consumer groups or such stakeholders as the Commission may specify.”

-

Sports2 days ago

Sports2 days agoRonaldo’s hat-trick leads Al Nassr to 6-0 victory over Al Wehda

-

International2 days ago

International2 days agoGaza: Thousands rally for hostage deal as ceasefire talks continue

-

Entertainment2 days ago

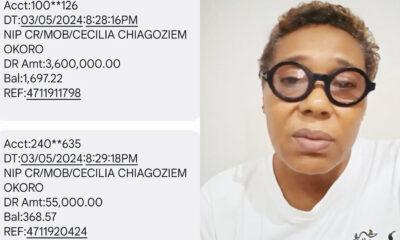

Entertainment2 days agoNollywood veteran Shan George weeps as fraudster clears ₦3.6m from her account (VIDEO)

-

metro1 day ago

metro1 day agoDSS seals Plateau clinic over patient’s death

-

News3 days ago

News3 days agoDon’t host US, French military bases in Nigeria, northern leaders warn Tinubu

-

News2 days ago

News2 days agoUpdated: NNPC blames fuel scarcity on panic buying, hoarding, marketers disagree

-

metro3 days ago

metro3 days agoEx-FCMB manager sentenced to 121-year imprisonment

-

metro1 day ago

metro1 day agoWe’ve arrested seven suspected cultists, armed robbers in Anambra – Police