Business

Updated: CBN to introduce new forex guidelines

Updated: CBN to introduce new forex guidelines

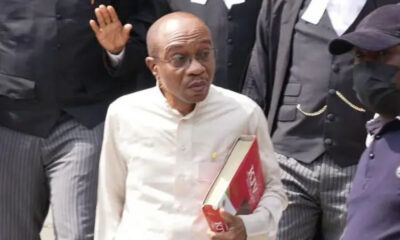

The Central Bank of Nigeria (CBN) Mr says it will soon introduce a new set of foreign exchange laws and guidelines to address naira depreciation.

Governor of the CBN, Mr Yemi Cardoso, said on Friday the measure would help Nigeria achieve exchange rate stability.

The CBN, according to him, will also conduct a new recapitalisation exercise for the banking industry.

He said thus would be done by directing banks to increase their minimum capital base to a level sufficient to support the vision of a $1trillion economy.

Cardoso disclosed this in Lagos in a keynote speech at the 2023 Annual Bankers Dinner of the Chartered Institute of Bankers of Nigeria.

He also said that the CBN would introduce a new licensing framework for fintechs and payment banks, warning that operators found engaging in activities outside their licenses will be sanctioned.

He cited the need to curtail the challenge of rising inflation, adding that the apex bank would further tighten money supply for the next two quarters.

To further reduce excess cash in the banking system, he said the management of the CBN would soon conduct another round of liquidity mop up via issuance of Open Market Operations, treasury bills.

He said, “Our monetary policies will aim to achieve price stability, foster sustainable economic growth, stabilize the exchange rate of the naira, and reduce interest rates to facilitate borrowing and investments in the real sector.

“In order to ensure the proper functioning of domestic and foreign currency markets, clear, transparent, and harmonized rules governing market operations are essential.

“New foreign exchange guidelines and legislation will be developed, and extensive consultations will be conducted with banks and FX market operators before implementing any new requirements.

“Considering the policy imperatives and the projected economic growth, it is crucial for us to evaluate the adequacy of our banking industry to serve the envisioned larger economy.

“It is not just about the stability of the financial system in the present moment, as we have already established that the current assessment shows stability.

“However, we need to ask ourselves: Will Nigerian banks have sufficient capital relative to the financial system’s needs in servicing a $1.0 trillion economy in the near future? In my opinion, the answer is No, unless we take action.

“Therefore, we must make difficult decisions regarding capital adequacy. As a first step, we will be directing banks to increase their capital.”

On new licensing framework for fintechs, Cardoso said, “Technology will continue to play a critical role in delivering financial services and enhancing financial inclusion. “However, recent developments in the payment services landscape have raised concerns regarding the use of technology and the existing licensing and regulatory framework.

“We have observed that some licensees are operating outside the approved activities, breaching the boundaries set for them.

“Any intentional or unintended noncompliance will be subject to sanctions, as operators have the responsibility to ensure that they are licensed for the activities they undertake. “Concurrently, as we conduct a comprehensive review of the licensing framework for payment services, we will engage in extensive consultations to develop a new regulatory and compliance framework that is suitable for the technology-driven payment services sector.”

Business

NNPC Raises Petrol Price to ₦933 in Lagos, ₦960 in Abuja

NNPC Raises Petrol Price to ₦933 in Lagos, ₦960 in Abuja

The Nigerian National Petroleum Company Limited (NNPC) has increased the pump price of petrol at its retail stations to ₦933 per litre in Lagos and ₦960 per litre in Abuja, triggering fresh concerns among motorists and businesses over rising fuel costs in Nigeria.

The national oil company raised the price by ₦103 in Lagos, moving from ₦830 per litre to ₦933, while motorists in the federal capital Abuja now pay ₦960 per litre, representing an ₦85 increase from the previous ₦875 price.

Checks on Wednesday showed that the new petrol price has already been implemented at several NNPC retail outlets, including stations at Apple Junction and Ago Palace Way in Lagos, while stations along Airport Road in Lugbe, Abuja, were dispensing petrol at the new ₦960 rate.

The latest fuel price hike comes shortly after the Dangote Petroleum Refinery increased its ex-gantry petrol price to ₦874 per litre on March 2, up from ₦774 per litre, a development that has influenced retail pricing across the downstream petroleum sector.

Industry analysts say the rise in petrol prices in Nigeria is closely linked to growing geopolitical tensions in the Middle East, which have unsettled global energy markets and pushed up crude oil prices.

READ ALSO:

- Yul Edochie Blasts Arise TV Anchor Rufai Oseni in Viral Video

- Court Discharges Abba Kyari, Brothers in NDLEA Non-Disclosure of Assets Case

- Kano State House of Assembly Initiates Impeachment Proceedings Against Deputy Gov

Recent market data shows that Brent crude oil rose to about $85 per barrel on March 3, compared with around $72 per barrel recorded on February 28, intensifying pressure on petrol landing costs for markets that still rely partly on imports.

Experts note that Nigeria’s deregulated fuel market means pump prices now fluctuate in response to international oil prices, exchange rate volatility, and supply chain costs.

Meanwhile, the Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) has called on the federal government to ensure steady crude oil supply to domestic refineries, particularly as Nigeria seeks to strengthen local refining capacity.

The association warned that continued instability in global oil markets could weaken the naira, raise petrol prices further, and push inflation higher, thereby worsening the cost-of-living challenges faced by Nigerians.

Energy stakeholders have also stressed the importance of expanding local refining operations, including production from the Dangote refinery and rehabilitation of government-owned refineries, to reduce dependence on imported fuel.

The latest price adjustment reflects the ongoing transition in Nigeria’s downstream petroleum sector following the removal of fuel subsidies and the adoption of a market-driven pricing system.

Motorists across Lagos, Abuja and other major cities have expressed concern that rising petrol prices could increase transportation costs, food prices and overall inflation, placing additional pressure on households and businesses.

NNPC Raises Petrol Price to ₦933 in Lagos, ₦960 in Abuja

Business

TCAN Targets Logistics Reforms to Drive Economic Growth at 2026 Transport Summit

TCAN Targets Logistics Reforms to Drive Economic Growth at 2026 Transport Summit

The Transportation Correspondents Association of Nigeria (TCAN) has begun preparations for its 2026 Annual Transport Summit, placing Nigeria’s logistics value chain at the centre of national economic discourse.

Scheduled for September 2026 in Lagos, the summit will be held under the theme, “Unlocking Economic Growth Through Transportation Logistics.”

It is expected to draw major stakeholders across the aviation, maritime, rail and road transport sectors, alongside logistics service providers, policymakers, regulators, development partners and financial institutions.

In a statement, TCAN said the summit would critically examine how efficient transportation logistics can serve as a catalyst for sustainable economic growth, trade facilitation, job creation and regional integration, especially in the context of ongoing reforms and infrastructure investments within the sector.

Chairman of TCAN, Tola Adenubi, described transportation logistics as the backbone of economic development, stressing that the performance of Nigeria’s logistics ecosystem directly impacts the nation’s competitiveness.

“From cargo handling at airports and seaports to inland freight movement and last-mile delivery systems, the efficiency of Nigeria’s logistics architecture plays a decisive role in determining the competitiveness of the nation’s economy,” Adenubi said.

He noted that the 2026 summit would explore innovative strategies to strengthen the sector, including digital transformation, infrastructure financing models, public-private partnerships and regulatory reforms aimed at optimising performance.

Chairman of the 2026 Conference Committee, Suleiman Idris, said the summit would feature high-level panel discussions, keynote addresses and interactive sessions designed to assess the current state of Nigeria’s transportation logistics framework.

According to him, deliberations will focus on identifying bottlenecks hindering seamless cargo and passenger movement, examining the impact of multimodal transport integration on economic expansion, and highlighting investment opportunities within the logistics and supply chain ecosystem.

Idris added that experts at the summit would also provide policy recommendations targeted at enhancing operational efficiency and boosting Nigeria’s global competitiveness in trade and transportation.

As part of the programme, TCAN will confer its Champions of Transport Industry Development (COTID) certificates on selected government agencies and private operators that have made significant contributions to the advancement of Nigeria’s transportation sector.

Over the years, the TCAN Annual Transport Summit has evolved into a credible platform for constructive engagement between regulators, operators and other industry stakeholders.

The association said the 2026 edition aims to deepen policy conversations, promote transparency and accountability, and accelerate reforms capable of unlocking the full economic potential of Nigeria’s transport and logistics industry.

With logistics increasingly recognised as a key enabler of economic growth, industry observers expect the 2026 summit to set the tone for fresh strategies that could reshape Nigeria’s transportation landscape in the years ahead.

Business

Petrol Jumps to ₦937 in Lagos, ₦975 in Abuja Amid Middle East Oil Crisis

Petrol Jumps to ₦937 in Lagos, ₦975 in Abuja Amid Middle East Oil Crisis

Nigeria’s fuel market is under renewed strain as escalating tensions in the Middle East push global crude oil prices above $80 per barrel, driving domestic petrol prices toward the ₦1,000 per litre mark. Motorists across the country, from Lagos to Abuja, have woken to sharp increases at filling stations, with pump prices rising almost overnight.

In Lagos, several outlets raised the price of Premium Motor Spirit (PMS) from ₦830–₦835 per litre to ₦937, while in the Federal Capital Territory, major retailers including NNPC Limited and MRS Oil Nigeria Plc increased prices from ₦875 to ₦975 per litre. Independent marketers were dispensing fuel at about ₦960 per litre, reflecting the immediate effects of rising international oil prices.

The surge followed a fresh upward review in the ex-depot price by Dangote Petroleum Refinery & Petrochemicals, which moved its gantry price from ₦774 to approximately ₦874–₦875 per litre. Industry insiders linked the hike to rising replacement costs and the ongoing surge in crude prices. A senior refinery official confirmed that petrol loading operations were temporarily suspended earlier in the week, further tightening supply expectations and accelerating retail price adjustments.

READ ALSO:

- US Military Says It Has Struck Nearly 2,000 Targets in Iran as War Escalates

- FG Bans Roadblocks, Cash Tax Collection Nationwide

- Trade Row Looms as Trump Threatens Spain After Refusal to Support Iran Strikes

The Middle East conflict, particularly involving the United States, Israel, and Iran, has heightened fears of disruption around the Strait of Hormuz, a strategic maritime route responsible for nearly one-fifth of global crude supply. Analysts warn that prolonged instability in the corridor could push global oil prices to $100 per barrel or higher, with direct consequences for Nigeria’s cost-reflective petrol pricing system.

The Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN) described the situation as worrisome, noting that rising crude prices inevitably feed into domestic pump prices, given the current deregulated pricing regime. PETROAN’s National President, Mr Billy Gillis-Harry, emphasized the urgent need to strengthen Nigeria’s domestic refining capacity as a protective buffer. The association also called for consistent crude supply to local refineries and accelerated rehabilitation of the country’s four state-owned refineries to cushion the economy against external shocks.

For Nigerians, the impact has been immediate. Commercial drivers and commuters report that rising fuel costs are forcing them to adjust transport fares, adding pressure to household budgets. “I bought fuel yesterday at ₦875, and this morning it is ₦975. Every increase affects us directly. If we don’t raise fares, we run at a loss,” said Mr. Chinedu Okeke, a driver in Abuja.

Commuters fear the ripple effect of higher petrol costs on everyday goods. “If fuel is almost ₦1,000 per litre, it means fares and prices of essentials will rise. Things are becoming unbearable,” said Mrs. Aisha Ladan, a civil servant in the capital city. Analysts warn that increased transport costs could widen inflationary pressures, as businesses pass on higher operational expenses to consumers.

The psychological impact of petrol nearing the four-digit mark is also significant. For many Nigerians, it represents another milestone in a period already marked by subsidy removal, currency volatility, and persistent price adjustments. Unless global energy markets stabilize or domestic refining capacity is expanded, petrol prices in Nigeria may soon cross ₦1,000 per litre, with broad implications for the economy.

Petrol Jumps to ₦937 in Lagos, ₦975 in Abuja Amid Middle East Oil Crisis

-

metro8 hours ago

metro8 hours agoIslamic Scholar Barred From Ramadan Tafseer After Criticising Tinubu, Governors

-

metro1 day ago

metro1 day agoHow Ikwechegh’s ₦1.15tr Interrogation Led to Tinubu’s Cabinet Shake-Up

-

metro2 days ago

metro2 days agoDSS Busts Alleged Arms Trafficking Network in Gombe, Seizes RPGs

-

Politics2 days ago

Politics2 days agoAtiku’s Son Resigns as Adamawa Commissioner Following Fintiri’s APC Defection

-

News2 days ago

News2 days agoRelief Radiant Hearts Foundation Launched in Iwo, Promises Hope for the Vulnerable

-

International1 day ago

International1 day agoMystery as Iranian Warship Sinks off Sri Lanka, Over 100 Feared Missing

-

Opinion2 days ago

Opinion2 days agoThe world dislikes the weak, by Hakeem Baba-Ahmed

-

metro4 hours ago

metro4 hours agoLeadership Reshuffle: IGP Tunji Disu Removes Hundeyin as Nigeria Police Force PRO