Business

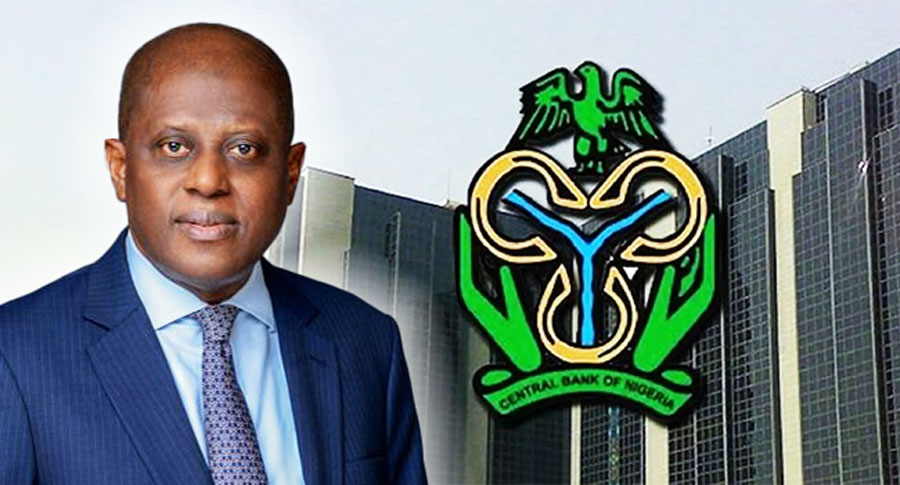

CBN lifts ban on cryptocurrency transactions

CBN lifts ban on cryptocurrency transactions

The Central Bank of Nigeria has changed its stance on crypto assets in the country and asked banks to disregard its earlier ban on crypto transactions.

This is according to a circular dated December 22, 2023, with reference number FPR/DIR/PUB/CIR/002/003, and signed by the apex bank’s Director, Financial Policy and Regulation Department, Haruna Mustafa.

The circular is titled ‘Circular to all Banks and other Financial Institutions Guidelines on Operations of Bank Accounts for Virtual Assets Service Providers (VASPS).’

The apex bank stated that current trends globally have shown the need for crypto regulation.

It said, “The CBN, in February 2021 issued a circular restricting banks and other financial institutions from operating accounts for cryptocurrency service providers in view of the money laundering and terrorism financing (ML/TF) risks and vulnerabilities inherent in their operations as well as the absence of regulations and consumer protection measures.

“However, current trends globally have shown that there is a need to regulate the activities of virtual assets service providers (VASPs) which include cryptocurrencies and crypto assets. Following this development, the Financial Action Task Force (FATF) in 2018 also updated its Recommendation 15 to require VASPS to be regulated to prevent misuse of virtual assets for ML/TF/PF.

READ ALSO:

- Blackout in Borno, Yobe as vandals destroy transmission towers

- Rivers crisis: Stakeholders reject Abuja peace accord

- Rivers elders drag Tinubu, Fubara, INEC, others to court

“Furthermore, Section 30 of the Money Laundering (Prevention and Prohibition) Act, 2022 recognises VASPs as part of the definition of a financial institution.

“In addition, the Securities and Exchange Commission in May 2022 issued Rules on Issuance, Offering and Custody of Digital Assets and VASPs to provide a regulatory framework for their operations in Nigeria.

“In view of the foregoing, the CBN hereby issues this guideline to provide guidance to financial institutions under its regulatory purview in respect of their banking relationship with VASPs in Nigeria. “

The apex bank noted that this new guideline supersedes its old ones referenced FPR/DIR/GEN/CIR/06/010 of January 12, 2017, and BSD/DIR/PUB/LAB/014/001 of February 5, 2021 on the subject.

It also affirmed that banks and other financial institutions are still prohibited from holding, trading and/or transacting in virtual currencies on their own account.

It added all banks and other financial institutions are required to immediately comply with its new guideline.

In its circular with reference number BSD/DIR/PUB/LAB/014/001, dated February 5, 2021, the apex bank reminded banks that dealing in crypto currencies or facilitating payments for cryptocurrency exchanges was prohibited.

At the time, it asked banks to identify persons or entities transacting in or operating crypto currency exchanges within their systems and ensure that their accounts were closed.

CBN lifts ban on cryptocurrency transactions

Business

PH refinery: 200 trucks will load petroleum products daily, says Presidency

PH refinery: 200 trucks will load petroleum products daily, says Presidency

No fewer than 200 trucks are set to load petroleum products at the government-owned Port Harcourt Refinery, the presidency has said.

A presidential spokesperson, Sunday Dare, made this known in a statement through his official X handle on Tuesday.

Newstrends had reported that the Nigerian National Petroleum Company on Tuesday announced that Port Harcourt Refinery has resumed operations and crude oil processing after years of inactivity.

READ ALSO:

- US-based Nigerians get 30-year sentence over $3.5m romance scam

- 4 Nigerians arrested in Libya for alleged drug trafficking, infection charges

- BREAKING: Port Harcourt refinery begins operation

Reacting, Dare said, “200 trucks are expected to load products daily from the refinery, Renewing the Hopes of Nigeria.”

He added that “the Port Harcourt refinery has two wings.

“The Old Refinery comes on stream today with an installed production capacity of 60, 000 barrels per day of crude oil.”

PH refinery: 200 trucks will load petroleum products daily, says Presidency

Business

Breaking: CBN increases interest rate to 27.50%

Breaking: CBN increases interest rate to 27.50%

The Central Bank of Nigeria (CBN) has raised the lending interest to 27.50 per cent from 27.25 per cent.

This latest increase in the Monetary Policy Rate came after a meeting of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Monday and concluded Tuesday.

The Monetary Policy Rate measures the benchmark interest rate.

The CBN Governor, Yemi Cardoso, announced this in Abuja on Tuesday after the MPC meeting, last for the year, held at the apex bank’s headquarters.

He said the MPC voted unanimously to raise the MPR by 25 basis points from 27.25% to 27.50%; and retain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The CBN governor also said the MPC retained the Liquidity Ratio (LR) at 30% and Asymmetric Corridor at +500/-100 basis points around the MPR.

Business

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate stood at 4.3 per cent in the second quarter of 2024, the National Bureau of Statistics (NBS) has said in its latest report.

The report released on Monday said the unemployment rate decreased compared to the 5.3 per cent recorded in the Q1 of 2024.

The NBS defined the unemployment rate as the share of the labour force (the combination of unemployed and employed people) who are not employed but actively searching and are available for work.

“The unemployment rate for Q2 2024 was 4.3%, showing an increase of 0.1 percentage point compared to the same period last year,” the report stated.

“The unemployment rate among males was 3.4% and 5.1% among females.

“By place of residence, the unemployment rate was 5.2% in urban areas and 2.8% in rural areas. Youth unemployment rate was 6.5% in Q2 2024, showing a decrease from 8.4% in Q1 2024.”

Report also said the unemployment rate among persons with post-secondary education was 4.8 per cent; 8.5 per cent among those with upper secondary education, 5.8 per cent for those with lower secondary education, and 2.8 per cent among those with primary education in Q2 2024.

Employment rate – 76%

The report showed that the employment-to-population ratio, which measures the number of employed workers against the total working-age population, increased to 76.1 per cent in Q2 2024.

“In Q2 2024, 76.1% of Nigeria’s working-age population was employed, up from 73.1% in Q1 2024,” the report stated.

Self-employment – 85.6%

The report further showed that Nigeria’s labour market saw a notable shift as the proportion of self-employed individuals increased in Q2 2024.

It stated, “The proportion of persons in self-employment in Q2 2024 was 85.6%.”

-

metro21 hours ago

metro21 hours agoBREAKING: Port Harcourt refinery begins operation

-

Business3 days ago

Business3 days agoJust in: Dangote refinery reduces petrol price for marketers

-

metro2 days ago

metro2 days ago40-foot container falls on car in Lagos

-

Politics3 days ago

Politics3 days ago2027: Lagos Speaker, Obasa joins gov race, may battle Seyi Tinubu, others

-

Politics2 days ago

Politics2 days agoLagos 2027: Seyi Tinubu campaign team releases his life documentary

-

International2 days ago

International2 days agoTrump to sack 15,000 transgender officers from U.S. military: Report

-

Entertainment2 days ago

Entertainment2 days agoPolygamy best form of marriage for Africa – Okey Bakassi

-

Education13 hours ago

Education13 hours agoUS University opens 2025 scholarships for international students