Business

JUST IN: Nigeria’s forex reserves hit 3-month high

JUST IN: Nigeria’s forex reserves hit 3-month high

Nigeria’s foreign exchange (FX) reserves have climbed to their highest level since March 28, 2024, marking a significant financial achievement that aligns with the longest stretch of exchange rate stability seen in over a year.

This milestone comes as Nigeria secures a series of financial commitments from the World Bank through new multilateral loans.

The latest data from the Central Bank of Nigeria (CBN) reveals that the reserves now stand at $33.58 billion as of June 19, 2024. This marks a substantial recovery from the end of March 2024, when the reserves peaked at $33.83 billion before entering a period of decline.

The rise in FX reserves follows three months of notable fluctuations, which saw the reserves plummet to a low of $32.11 billion on April 19, 2024, raising concerns about the nation’s financial stability. In response, the central bank Governor addressed the issue at the IMF Spring meeting in April.

Since then, a steady and consistent upward trajectory has been observed, coinciding with a period of exchange rate stability. This month, the official exchange rate has averaged N1,481/$1, fluctuating within a narrow band of plus or minus 0.06%.

READ ALSO:

- PSC asks IG to provide evidence of corruption in recruitment exercise

- Security forces arrest two notorious kidnappers in Raraba

- NFIU alerts banks to new fraudulent ways of claiming money from abroad

According to CBN data, forex reserves have risen by 5%, or $1.47 billion, in the last two months, climbing from $32.11 billion on April 19, 2024, to $33.58 billion by June 19, 2024. This growth represents a significant boost for the country’s external reserves, as the CBN continues to implement policies that attract forex liquidity.

Critics, however, will note the improved liquidity position, considering the myriad of policies implemented by the central bank over the past year and several promises of potential forex inflow from foreign portfolio investors. Improved liquidity in forex turnover has been observed, with the average turnover for June to date at $199 million daily compared to $168 million in the same period in May. Total forex turnover in June is now $2.1 billion, spanning 11 days of trading.

The Monetary Policy Committee (MPC) recently urged the CBN to focus on boosting external reserves. The Monetary Policy Communique from its 295th meeting noted:

“The Committee also noted the marginal increase in the external reserve balance between March and April 2024 and urged the Bank to sustain its focus on accretion to reserves.”

To ensure a steady flow of foreign exchange into the country, the CBN plans to double diaspora remittance inflows this year.

Additionally, Afrexim Bank recently disbursed $925 million, another tranche of the $3.3 billion crude oil-backed loan agreement with the NNPC from last year. This brings the total payment for the facility to $3.175 billion, aiming to stabilize the forex market amid severe volatility.

Moreover, the World Bank has approved $2.25 billion in loans to Nigeria to bolster economic stability and support vulnerable populations. This financial injection is designed to provide immediate financial and technical support for Nigeria’s urgent economic stabilization efforts.

JUST IN: Nigeria’s forex reserves hit 3-month high

(NAIRAMETRICS)

Business

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Africa’s richest man, Aliko Dangote, has called on wealthy Nigerians to redirect funds currently spent on luxury cars and private jets into industrial investments that can generate jobs and foster sustainable economic growth.

In a widely shared interview, the Dangote Group chairman warned that the country’s elite have increasingly prioritized lavish spending over productive ventures. “If you have money to buy a Rolls-Royce, you should take that money and put up an industry in your locality or anywhere there is need,” Dangote said.

He expressed concern over the number of private jets parked at local airports, arguing that the resources tied up in such assets could instead create employment opportunities.

READ ALSO:

- Mohamed Salah Slams Liverpool Boss Arne Slot, Hints at Anfield Exit Ahead of AFCON Departure

- Indonesia Flood Disaster: Death Toll Exceeds 900 as Search for Hundreds Continues

- Russia Intensifies Airstrikes on Ukraine as Zelensky, Trump Envoys Advance Peace Talks

Dangote highlighted Nigeria’s growing population, with an estimated 7.8 million births annually, stressing that both government and private sector actors must invest in infrastructure, power, and productive businesses.

Acknowledging the country’s high taxes, he maintained that businesses must still meet their obligations. “For a company like ours, the tax we pay is too much, but we don’t mind… What we are asking for is an enabling environment, but we too must do our civic duties,” he said.

He also urged Nigerians to prioritize domestic investment over foreign capital, noting that attracting investment depends on good policy and rule of law. “We should stop calling for foreign investors because there’s no foreign investor anywhere. What attracts investment is good policy and rule of law,” Dangote added.

Dangote urges wealthy Nigerians to invest in industries, not luxury cars, private jets

Business

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

OWERRI — Africa’s richest man, Aliko Dangote, has assured Imo State Governor Hope Uzodimma that the Dangote Group is prepared to become one of the biggest investors in Imo State, reaffirming the conglomerate’s commitment to expanding its footprint in Nigeria.

Speaking on Thursday during the opening session of the Imo Economic Summit 2025, Dangote called on the state government to specify key sectors requiring investment, promising immediate action once directives are given.

Dangote, who described Governor Uzodimma as a long-time friend, commended him for fostering an enabling environment for business and economic growth in the state.

READ ALSO:

- NSCDC rejects VIP protection requests from senators as demand surges after police withdrawal

- Edo Assembly Moves to Arrest Obaseki, Others Over MOWAA, Radisson Hotel Probe

- Three Top Contenders to Replace William Troost-Ekong as Super Eagles Captain

“We will be one of your biggest investors in Imo. So please tell me the area to invest and we will invest,” he said.

The African industrialist also encouraged Nigerian entrepreneurs to focus on developing their home regions, stressing that sustainable economic growth cannot depend on foreign capital alone.

“What attracts foreign investors is a domestic investor. Africa has about 30 percent of the world’s minerals. We are blessed,” he noted.

Dangote further highlighted progress at the Dangote Refinery, announcing that the facility is on track to achieve a 1.4 million barrels-per-day production capacity, making it the largest single-train refinery in the world.

The assurance marks a significant boost for Imo State’s investment outlook as the government continues efforts to strengthen its economy and attract large-scale private sector participation.

Imo Economic Summit: Aliko Dangote Vows to Become State’s Largest Investor

Auto

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

The Court of Appeal, Abuja, on Thursday, upheld a previous Federal High Court judgment prohibiting the Vehicle Inspection Officers (VIO) and the Directorate of Road Traffic Services (DRTS) from confiscating vehicles or imposing fines on motorists without lawful authority.

A three-member panel of appellate justices, led by Justice Oyejoju Oyewumi, dismissed the appeal filed by the VIO, describing it as lacking merit and affirming the October 16, 2024 ruling of the high court.

The original suit, marked FHC/ABJ/CS/1695/2023, was filed by public interest lawyer Abubakar Marshal, who alleged that he was unlawfully stopped and had his vehicle confiscated by VIO officials at Jabi District, Abuja, on December 12, 2023. He contended that the action was a violation of his fundamental rights.

READ ALSO:

- FG secures release of three Nigerians detained in Saudi Arabia

- Groups Reject Senator’s Call for Removal of NSA Nuhu Ribadu

- US authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

Justice Nkeonye Maha of the Federal High Court had declared that no law empowers the VIO to stop, seize, impound, or fine motorists, and granted a perpetual injunction restraining the agency and its agents from further violating citizens’ freedom of movement, presumption of innocence, and right to own property.

The court held that only a court of competent jurisdiction can impose fines or sanctions on motorists. It further ruled that the actions of the Respondents violated Section 42 of the 1999 Constitution and relevant articles of the African Charter on Human and Peoples’ Rights.

Although the applicant had sought N500 million in damages and a public apology, the court awarded him N2.5 million. Respondents included the Director of the Directorate of Road Traffic Services, the Abuja Area Commander, the team leader, and the Minister of the Federal Capital Territory.

The appellate court’s decision confirms that the VIO and DRTS cannot legally harass motorists, reinforcing citizens’ constitutional rights on the road.

Court of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

metro3 days ago

metro3 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

News3 days ago

News3 days agoBREAKING: Tinubu Sends Fresh Ambassadorial Nominations to Senate, Names Ibas, Ita Enang, Dambazau

-

Auto3 days ago

Auto3 days agoCourt of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

Sports1 day ago

Sports1 day ago2026 FIFA World Cup Draw: England Draw Croatia as Brazil Face Morocco in Tournament Opener

-

News3 days ago

News3 days agoUS authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

-

metro3 days ago

metro3 days agoFG secures release of three Nigerians detained in Saudi Arabia

-

metro3 days ago

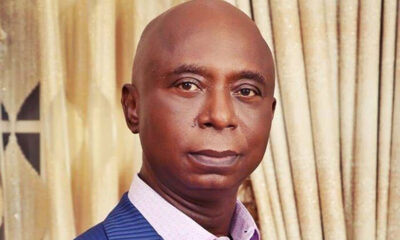

metro3 days agoNed Nwoko vows legal action against rising online harassment, criminal defamation

-

metro3 days ago

metro3 days agoBuratai Defends Nigeria’s Resilience, Says Nation Is “Rising, Not Failing” Despite Insecurity