News

USAID to invest N115bn in Nigeria’s power sector

USAID to invest N115bn in Nigeria’s power sector

The United States Agency for International Development and the Federal Ministry of Power signed a memorandum of understanding on Wednesday to secure Nigeria’s commitment to electricity sector reforms, market transparency, liquidity, and expanding access to affordable power.

The MOU was signed by USAID/Nigeria Mission Director, Melissa Jones, and the Permanent Secretary, Federal Ministry of Power, Mahmuda Mamman, to support the implementation of an N115.2bn US government grant-funded technical assistance programme intended to support power sector development and reforms in Nigeria. Both parties announced this in a statement issued in Abuja by the power ministry.

More than 85 million Nigerians have no access to grid power, and many have suffered from unreliable power supply. Given these challenges, many Nigerian families and businesses depend on expensive, emission-intensive petrol and diesel backup generators.

The Nigerian power sector’s long-standing challenges impair industrial growth and economic competitiveness, rural development, health and education sector performance, as well as the nation’s overall economic growth and development.

Jones reiterated the US government’s commitment to advancing electrification in Nigeria.

READ ALSO:

- Cooking oil contamination scandal rocks China

- Lagos needs 30,000 medical doctors – Health Commissioner

- Osun tops number of applicants for student loan

She said, “Today’s goal is to strengthen collaboration between USAID and the Federal Government of Nigeria and to provide a framework for our partnerships with other key actors, including state and Local Governments, electricity generation and distribution sectors and the off-grid sector. It is laudable and timely.”

The US government’s Power Africa Coordinator, Richard Nelson, observed the signing ceremony, during his first official visit to Nigeria.

“Nigeria is at the core of Power Africa’s strategy. I look forward to elevating our partnership to advance Nigeria’s progress towards our shared goal of ensuring access to reliable, sustainable affordable power for all,” he stated.

The Minister of Power, Adebayo Adelabu, expressed gratitude for USAID’s continued support, emphasising the collaboration’s transformative potential.

“This partnership with USAID is a significant milestone in the journey towards achieving a sustainable and reliable electricity supply for all Nigerians. Together, we will tackle the longstanding challenges in the power sector, ensuring transparency, enhancing market liquidity, and accelerating our transition to clean energy solutions,” he stated.

The statement stated that USAID works to mitigate these challenges through the Power Africa Initiative, a US government-led partnership that harnesses the collective resources of public and private sectors to double access to electricity in sub-Saharan Africa.

It said through the Power Africa Initiative, over 33 million Nigerians have been connected, about $4.5bn have been mobilised for on-grid and off-grid power projects in Nigeria, and over 200 private companies in the off-grid sector have received assistance.

“This initiative will strengthen policy frameworks, enhance regulatory capacities, and encourage private sector participation, ultimately driving the nation towards its clean energy and net zero carbon emissions targets.

“The ministry is committed to ensuring these interventions deliver tangible benefits to all Nigerians, promoting economic growth and sustainable development,” it stated.

USAID to invest N115bn in Nigeria’s power sector

News

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

The University of Abuja (UniAbuja) has confirmed that 100-level student Sadiya Usman has been found safe after being reported missing earlier this week. The university expressed relief and gratitude to the public and security agencies for their assistance in locating the student.

Sadiya Usman, who is enrolled in the Department of Accounting, was last seen leaving her residence at Kontagora Estate, Gwagwalada, Abuja, on Tuesday, 18 February 2026, at around 8:00 a.m. She was on her way to the university’s Main Campus to sit for her Computer-Based Test (GST 111) but did not arrive for the exam.

READ ALSO:

- Lassa Fever Deaths in Nigeria Rise to 51 After 15 Killed in Early February – NCDC

- Mob Kills Injured Motorcycle Rider After AK‑47 Rifles, Ammunition Found in Crash Scene

- Tacha Condemns False Rape Allegations After Mirabel Admits Fabrication

After her disappearance, her guardian reported her missing when all attempts to reach her by phone were unsuccessful. The university promptly activated internal safety protocols and collaborated with security agencies, campus authorities, and the public to ensure her safe recovery.

The student was eventually located late on Thursday, 20 February 2026, around 11:49 p.m., and is reported to be safe, unhurt, and in stable condition. Authorities confirmed that coordinated efforts between the university, law enforcement, and concerned members of the public were instrumental in her recovery.

The university reaffirmed its commitment to student safety and welfare, promising continuous updates as necessary. It also thanked those who responded to the public appeal for information and urged students and parents to remain vigilant about safety.

This incident highlights the importance of campus security measures, timely reporting of missing persons, and the role of community involvement in safeguarding students.

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

News

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

The Ogun State Police Command has confirmed plans to arrest and prosecute TikTok user Mirabel after she admitted that her viral rape allegation was false, authorities and investigative reports indicate.

Mirabel, a social media influencer, first sparked national attention after posting videos alleging she had been sexually assaulted in her home in Ogijo, Ogun State. The posts quickly went viral, drawing widespread outrage, calls for justice, and prompting the police to launch an immediate investigation.

An audio recording of a phone conversation, shared online by social media personality VeryDarkMan (VDM), reportedly captures Mirabel acknowledging that parts of her story were fabricated. In the recording, she apologises and admits creating a threatening TikTok account to support her narrative, claiming she had been taking drugs at the time and “was not thinking clearly” when posting the videos.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

A police source said senior officers, including the Divisional Police Officer, were at the hospital where Mirabel was receiving medical care. Once she is discharged, she will be taken into custody and formally charged under provisions of Nigeria’s Criminal Code relating to false reporting of sexual offenses. “The essence is to serve as a deterrent to others,” the source added.

The Ogun State Police had earlier ensured that Mirabel received medical treatment and support, following procedures to protect her health while the investigation continued. The Lagos State Domestic and Sexual Violence Agency (DSVA) confirmed that the incident fell outside its jurisdiction and forwarded all relevant information to the Ogun authorities.

This development has sparked public debate about the responsible use of social media, the impact of false allegations, and the importance of evidence-based reporting. Legal experts warn that fabricating sexual assault claims can carry serious criminal penalties and may undermine the credibility of genuine victims.

Authorities continue to urge the public to avoid spreading unverified claims and to cooperate with law enforcement in ongoing investigations. Updates on the case will be issued by the Ogun State Police Command as formal legal proceedings begin.

News

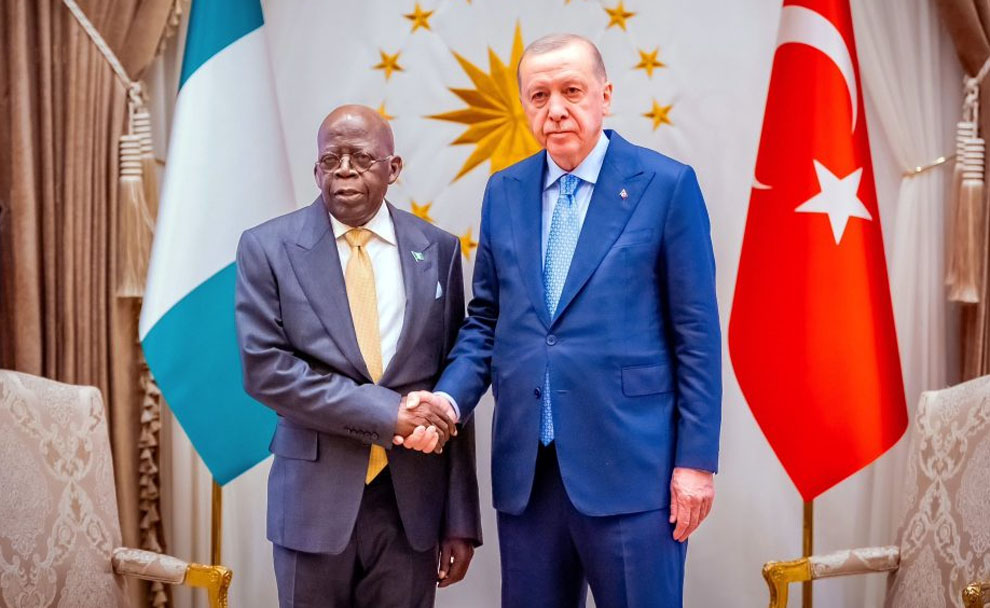

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

President Bola Tinubu has commenced a strategic expansion of Nigeria’s defence diplomacy, engaging the European Union (EU) and Turkey to strengthen the nation’s security architecture while reducing overreliance on the United States. The initiative comes as Nigeria faces multiple security threats, including Boko Haram insurgency in the north-east, farmer-herder clashes in the north-central region, separatist violence in the south-east, and escalating banditry in the north-west.

The move coincided with a visit to Brussels by National Security Adviser Mallam Nuhu Ribadu, who led discussions at the first EU-Nigeria Peace, Security, and Defence Dialogue. Both sides agreed to deepen collaboration on regional stability, counter-terrorism, and violent extremism, while enhancing intelligence sharing, maritime security, and cybersecurity cooperation. An EU diplomat in Abuja emphasized that the bloc would provide non-lethal military support, while respecting Nigeria’s sovereignty, describing the EU as “more consistent, more reliable, and more coherent than the United States” in delivering security assistance.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

During his state visit to Turkey in January 2026, President Tinubu also held defence discussions with Turkish officials. Turkish companies pledged to supply military equipment, advanced systems, and tactical hardware, while exploring joint local production arrangements with Nigeria. Türkiye is currently regarded as a global leader in armed drones, which could bolster Nigeria’s counter-terrorism operations and reconnaissance capabilities.

Despite these new partnerships, Nigeria continues security cooperation with the United States, including deployments by United States Africa Command (AFRICOM) to support training, intelligence sharing, and operational planning. Recent U.S. personnel arrivals in Bauchi State aim to enhance counter-terrorism capacity without taking direct combat roles, operating under Nigerian command structures.

Analysts say Nigeria’s diversified defence diplomacy seeks to reduce dependency on a single partner, while providing access to a wider range of technology transfer, training opportunities, procurement options, and operational expertise. The strategy also reflects a broader trend of African nations balancing traditional defence alliances with emerging strategic partners to better address evolving security threats.

With regional instability and domestic insurgency on the rise, Nigeria’s engagement with Turkey, the EU, and other partners is expected to strengthen the Nigerian Armed Forces, enhance counter-terrorism operations, and secure national and regional stability.

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

-

News3 days ago

News3 days agoRamadan Begins in Nigeria as Sultan Confirms Crescent Sighting

-

International1 day ago

International1 day agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

metro3 days ago

metro3 days agoSeven Killed in Horrific Crash at Ota Toll Gate

-

News2 days ago

News2 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

Health2 days ago

Health2 days agoRamadan Health Tips: Six Ways to Stay Hydrated While Fasting

-

News12 hours ago

News12 hours agoPolice to Arrest TikToker Mirabel After She Recants False Rape Claim

-

Politics5 hours ago

Politics5 hours agoPeter Obi Launches ‘Village Boys Movement’ to Rival Tinubu’s City Boys Ahead of 2027

-

metro1 day ago

metro1 day agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors