Business

Nigeria’s debt of N31tn unsustainable, says LCCI

- Backs increase in electricity tariff, fuel price

- Seeks more mass transit buses, rail system

- Urges reopening of borders

The Lagos Chamber of Commerce and Industry has expressed worry about the nation’s state of economy, particularly the rising debt profile, currently put at N31tn, without corresponding output growth and economic development.

According to the LCCI, the growing level of the country’s debt is fast becoming unsustainable in the light of dwindling oil prices and production.

President of the LCCI, Toki Mabogunje, gave this position at a press conference on the state of the economy on Tuesday in Lagos.

She said the high level of debt servicing had continued to hinder robust investment in hard and soft infrastructure, described as key to stimulating productivity and improving living standards.

She said, “We note the increase in public debt stock was fueled by fresh domestic and external borrowing required to plug the wider fiscal deficit in the revised 2020 budget, given the impact of the pandemic on oil and non-oil sources of revenue.

“We also note the impact of recent exchange rate depreciation on the country’s level of external indebtedness.

“At the peak of the pandemic in the second quarter, the Federal Government received financial support worth $3.4 billion and $288.5 million from the International Monetary Fund (IMF) and African Development Bank (AfDB) respectively, while negotiations are also on-going for a cumulative $1.8 billion credit support from the World Bank, African Development Bank (second tranche) and Islamic Development Bank.

“Adding this to prospective domestic issuances could possibly push the country’s public debt stock to around N34 trillion by year-end, equivalent to 23 per cent of the GDP.”

On the nation’s accelerated inflation rate, Mabogunje said the persistent pressure on consumer prices stemmed largely from the sustained uptrend in food inflation.

She said the recent incidents of flooding in key food-producing states in the North had wiped off food and cash crops on a large scale and disrupted output projections in agriculture.

Mabogunje said that the situation, if not urgently addressed, would escalate the pressure on food prices, thereby putting the country on the verge of a food crisis.

She noted, “According to local media reports, over two million tons of rice were lost to flood; other crops such as sorghum, corn and millet were also affected.

“Rising inflation trajectory has serious implications for businesses regarding production cost, investment real return rate, and overall economic performance.

“Looking forward, the Chamber expects inflation to sustain its upward trajectory for the rest of the year.

“The Lagos Chamber calls on the fiscal and monetary authorities on the need to synergise to moderate domestic prices to a level conducive for sustainable and inclusive economic growth.

“The Federal Government might need to reopen the land borders to give succour to food prices in the light of lower domestic food supply amid huge demand for food.

“Similarly, both the federal and state governments also need to promptly address the issue of food wastage, majorly responsible for the food supply gap being experienced in the country.”

The LCCI president also advised policymakers on the formulation and implementation of policies to facilitate sustainability as business operators grapple with the devastating impact of the COVID-19 pandemic.

Mabogunje said such policies must support businesses, protect jobs, preserve investment and foster economic competitiveness at both national and subnational levels.

She said the chamber endorsed the adoption of the cost-reflective tariff regime in the power sector.

The LCCI president said the new tariff would attract investment and improve power supply, even as she noted that safeguards were needed to protect consumers from exploitation.

She said, “If the economics of the investment is not right, investors will not inject capital into the sector. However, there should be safeguards to protect consumers from exploitation.

“There should comprehensive metering of consumers and there should be value for money. We believe that policy should be given a chance.”

The LCCI president said the Solar Home Initiative, aimed at expanding energy access to 25 million individuals through the provision of solar home systems or connection to a mini grid was a step in the right direction.

She said the initiative would stimulate growth and productivity in the country’s rural economy.

Mabogunje also commended government on the recent reforms implemented in the downstream segment of the oil sector.

She said the removal of petrol subsidy and the proposal by the Nigerian National Petroleum Corporation to give up majority stakes in the four local refineries were laudable.

Mabogunje, however, appealed for the provision of mass transit buses, development of rail system for intra city and intercity transportation, and the acceleration of the auto gas programme so that more vehicles could be powered by gas.

She said, “We believe these measures are steps in the right direction in rescuing the economy from deepening fiscal crisis.

“We note that the subsidy regime had for long constituted a huge burden on public finances, encouraged corruption, inefficiencies, deterred investment flows, and weakened the earnings performance of oil refining and marketing companies.

“We acknowledge the effect of the price hike on the vulnerable segments of the society. Accordingly, we request that palliatives be provided in form of mass transit buses among other initiatives to ease the burden on consumers.”

Mabogunje also called for the expeditious passage of the Petroleum Industry Bill to consolidate recent reforms in the sector.

On the various fiscal and monetary interventions by the government, Mabogunje said the schemes would help with fulfilling payroll obligations and protect the jobs within the SMEs sector.

She said, “The Lagos Chamber acknowledges the various interventions of the fiscal and monetary sides of authorities in mitigating the adverse impact of the pandemic on economic and business environment.

“The federal and state governments need to expeditiously redirect attention to these sectors, including aviation, hospitality, entertainment, and manufacturing.

“This has become necessary to protect jobs, preserve investments and provide the much-needed liquidity required to revive these sectors.”

The LCCI president said the chamber noted the weak performance of the economy at the sectoral level, particularly among key sectors with potential to drive economic diversification.

Mabogunje said the 6.1 per cent contraction of the Gross Domestic Product in the second quarter reflected the profound impact of the pandemic on the economy.

She said the Chamber anticipated a marginal improvement in the GDP growth performance by the third quarter.

She attributed the anticipated improvement to the declining trend in the rate of confirmed cases of COVID-19, relaxation of various containment measures and the increasing tempo of economic activities.

On foreign exchange, the LCCI President said inappropriate forex policies could discourage fresh capital inflows on foreign direct investment, portfolio investment, remittances, and non-oil export proceeds into the economy.

Mabogunje said this was evidenced by the sharp plunge in the level of capital imported into Nigeria from $5.9 billion in the first quarter to $1.2 billion in the second quarter, partly caused by the capital control policy of the Central Bank of Nigeria.

She said, “The Chamber notes the various policy measures taken by the Central Bank of Nigeria to conserve the country’s foreign exchange resources in the light of weakening dollar inflows precipitated by the global pandemic.

“While the Lagos Chamber appreciates the efforts of the apex bank in preserving the scarce foreign exchange resources at a time the economy is confronted with the twin challenge of lower oil price and production, we believe demand management strategies alone are not sustainable solutions to the recurring foreign exchange crises.”

Business

Finally, NERC unbundles TCN, creates new system operator

Finally, NERC unbundles TCN, creates new system operator

The Nigerian Electricity Regulatory Commission (NERC) has set up the Nigerian Independent System Operator of Nigeria Limited (NISO) as it unbundles the Transmission Company of Nigeria (TCN).

The transmission leg of the power sector has over the years been seen as weakest link with obsolete equipment.

The unbundling announcement is contained in an Order dated April 30, 2023 and jointly signed by NERC chairman, Sanusi Garba, and vice chairman, Musiliu Oseni.

By this order, the TCN is expected to transfer all market and system operation functions to the new company.

The commission had previously issued transmission service provider (TSP) and system operations (SO) licences to the TCN, in accordance with the Electric Power Sector Reform Act.

The Electricity Act 2023, which came into effect on June 9, provided clearer guidelines for the incorporation and licensing of the independent system operator (ISO), as well as the transfer of assets and liabilities of TCN’s portion of the ISO.

In the circular, the commission ordered the Bureau of Public Enterprises (BPE) to incorporate, unfailingly on May 31, a private company limited by shares under the Companies and Allied Matters Act (CAMA), 2020.

NERC said the company is expected “to carry out the market and system operation functions stipulated in the Electricity Act and the terms and conditions of the system operation licence issued to the TCN.

“The name of the company shall, subject to availability at Corporate Affairs Commission, be the Nigerian Independent System Operator of Nigeria Limited (“NISO”),” NERC said.

Citing the object clause of the NISO’s memorandum of association (MOU) as provided in the Electricity Act, NERC said the company would “hold and manage all assets and liabilities pertaining to market and system operation on behalf of market participants and consumer groups or such stakeholders as the Commission may specify.”

Business

Naira depreciates again, trades at N1,402/$

Naira depreciates again, trades at N1,402/$

The Nigerian currency, naira, on Thursday slightly depreciated at the official market, trading at N1,402.67 to the dollar.

Data from the official trading platform of the FMDQ Exchange, a platform that oversees the Nigerian Autonomous Foreign Exchange Market (NAFEM), showed that the naira lost N11.71

READ ALSO:

- Why I killed my one-year-old son – Delta woman

- Bandits kill nine civilian JTF members, kidnap three in Sokoto

- Yahaya Bello govt spending third term in office through Ododo – Clark

This represents a 0.84 per cent loss when compared to the previous trading date on Tuesday April 30, when it exchanged at 1,390.96 to a dollar.

However, the total daily turnover increased to 232.84 million dollars on Thursday, up from 225.36 million dollars recorded on Tuesday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the naira traded between 1,445.00 and N1,299.42 against the dollar.

Naira depreciates again, trades at N1,402/$

Auto

Appeal court takes over NURTW case as NIC withdraws

Appeal court takes over NURTW case as NIC withdraws

The National Industrial Court has withdrawn from a case involving Alhaji Najeem Usman Yasin, Board of Trustees chairman of the National Union of Road Transport Workers (NURTW), and Alhaji Tajudeen Ibikunle Baruwa’s ambition to return as president of the union over lack of jurisdiction.

The industrial court’s decision was made to avoid conflict with the Court of Appeal, where the matter is already being heard.

Before the NIC announced its decision to hands-off the case, the defendants’ counsel, Mr. O.I. Olorundare SAN, had informed the court that the matter is currently before the Court of Appeal, Abuja division, and that the industrial court could not continue to adjudicate on the same matter.

The counsel cited authorities to support his claim, adding that the National Industrial Court does not have concurrent jurisdiction with the Court of Appeal.

The presiding judge, O.O. Oyewunmi, struck out the case, stating that the Appeal Court had taken over the matter and that the Industrial Court must respect the hierarchy of courts.

Alhaji Yasin and six others took the case to the Appeal Court, challenging the decision of the industrial court recognising a delegates’ conference held on May 24, 2023, where Baruwa was proclaimed as President of the union for a second term in office.

With the latest NIC judgement, both parties will now proceed to defend their positions at the Court of Appeal and await the final judgement.

-

International3 days ago

International3 days agoUS students slam Biden’s comments on Gaza encampments

-

Business3 days ago

Business3 days agoNaira depreciates again, trades at N1,402/$

-

Entertainment14 hours ago

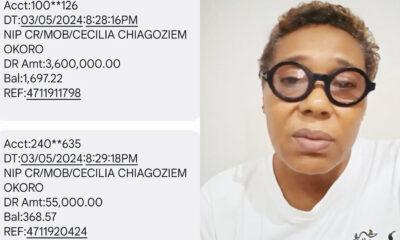

Entertainment14 hours agoNollywood veteran Shan George weeps as fraudster clears ₦3.6m from her account (VIDEO)

-

International3 days ago

International3 days agoDam collapses, death toll rises in Brazil floods

-

News3 days ago

News3 days agoLagos GDP hits N41tn, earns N433bn from IGR

-

News2 days ago

News2 days agoDon’t host US, French military bases in Nigeria, northern leaders warn Tinubu

-

International16 hours ago

International16 hours agoGaza: Thousands rally for hostage deal as ceasefire talks continue

-

Sports16 hours ago

Sports16 hours agoRonaldo’s hat-trick leads Al Nassr to 6-0 victory over Al Wehda

You must be logged in to post a comment Login