metro

IGP opposes bill seeking police exit from contributory pension scheme

IGP opposes bill seeking police exit from contributory pension scheme

Inspector General of Police, Kayode Egbetokun has kicked against the bill seeking to exempt the police from the Contributory Pension Scheme (CPS).

Egbetokun who spoke while addressing police officers in Abuja said exiting the scheme will not favour the police force.

He stated that if the police exit the CPS, they will go back to square one.

He said: “Yes it is true that a bill has been passed by the National Assembly for the police to exit the CPS and that bill is awaiting presidential assent, but has anyone of you seen the details of the content of that bill? You need to go and look at the bill and see where you are exiting to?

“Everybody is shouting ‘let us go, let us go’. You must know where you are going before you start shouting, ‘I want to go”. When I became IG, I set up a committee to look into the pension issue and we discovered that the bill awaiting the assent of the President does not favour us. If we exit the present Contributory Pension Scheme, we are going back to square one, where we were before the introduction of the scheme. Our pension will be in the hands of politicians and they will be the one to address our pension. Our pension will be subject to budgetary allocation every year and when the government does not have money, you will not be paid.

READ ALSO:

- Couple arrested in Anambra for threatening residents with abduction, murder

- Ndume threatens to quit APC over Tinubu’s tax reform bills

- Shocking, Port Harcourt refinery stops working days after operation resumed – Investigation

“You remember those days when retirees would go and line up and wait for months and they would not get anything, that is the place you want us to go back to. So we have to be careful not to go from the frying pan to the fire. I am the Inspector General of police, you must trust me that I care about your welfare and I will fight this pension issue to make sure that police officers who retire get the best of pension in retirement”.

He disclosed that what he is rather working on is a situation where police officers upon retirement receive their final salary as monthly pension.

“Let me disclose to you what I am working on, I am working on a pension scheme where every police officer will retire with his salary. That is the best and that is what I want for the police. Not the exit you are all shouting about. Where are you going, where are you exiting to, you don’t know where you people are going and you are saying let us go. Can you tell me where you are going before you say let us go. So let us be very careful with this emotion we are attaching to exiting the scheme”, he added.

IGP opposes bill seeking police exit from contributory pension scheme

metro

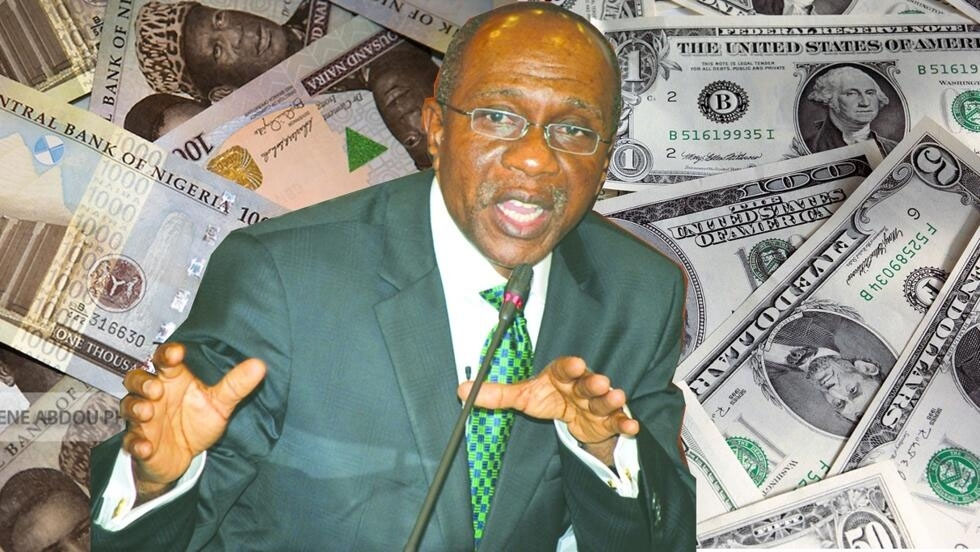

Ex-CBN Governor Godwin Emefiele Denies Allegations of Financing Terrorism

Ex-CBN Governor Godwin Emefiele Denies Allegations of Financing Terrorism

Former Central Bank of Nigeria (CBN) Governor, Godwin Emefiele, has strongly denied allegations linking him to terrorism financing in Nigeria, describing the claims as “mischievous and malicious.”

In a statement released on Saturday, December 6, 2025, Emefiele said the reports were “entirely fabricated, baseless, and a deliberate attempt to malign my name, mislead the public, and sow confusion for motives best known only to the publishers and their sponsors.”

He emphasized that the fight against terrorism is too important to be trivialized by irresponsible reporting, warning that Nigerians deserve accurate information rather than “reckless misinformation.”

READ ALSO:

- Doctor Charged With Sexually Assaulting 38 Patients in West Midlands Hospitals

- Shettima Inaugurates Multi-Million Naira Juma’at Mosque in Gumel

- Police Launch Special Enforcement Team to Enforce Tinubu’s Ban on VIP Escorts

“Throughout my service to the nation and in my private life, at no time have I been involved in any activity remotely connected to terrorism, terrorist financing, or any action that threatens the peace and security of our nation,” Emefiele stated. He added that he has never been invited, questioned, or investigated regarding such allegations and has no connection to the individual cited in the media reports.

“There is no scintilla of truth in the allegation,” he said, urging the public to disregard the claims entirely and calling on media organizations to verify facts before publishing sensational stories.

Emefiele’s statement seeks to reaffirm his reputation and distances him from any activities undermining national security.

Ex-CBN Governor Godwin Emefiele Denies Allegations of Financing Terrorism

metro

Shettima Inaugurates Multi-Million Naira Juma’at Mosque in Gumel

Shettima Inaugurates Multi-Million Naira Juma’at Mosque in Gumel

Vice President Kashim Shettima on Friday inaugurated the newly constructed multi-million-naira Juma’at Mosque located within the Emir of Gumel’s Palace in Jigawa State.

According to a statement by Zainab Rabo, Senior Special Assistant on Media Affairs to Governor Umar Namadi, the event drew high-level dignitaries, including top politicians, first-class emirs, captains of industry, and prominent Islamic scholars from across the country.

Rabo disclosed that the mosque was built by the Kashim Shettima Foundation, adding that Governor Umar A. Namadi and the Sultan of Sokoto graced the ceremony.

READ ALSO:

- Police Launch Special Enforcement Team to Enforce Tinubu’s Ban on VIP Escorts

- Akpabio denies filing new ₦200bn lawsuit against Natasha

- Two Pilots Survive as Nigerian Air Force Alpha Jet Crashes in Niger State (Video)

During the occasion, the Vice President congratulated the Emir of Gumel, Alhaji Ahmed Mohammed Sani, on marking 45 years on the throne, describing the milestone as a blessing and testament to exemplary leadership.

Shettima also reaffirmed his commitment—through his foundation—to initiatives that would improve the lives of Nigerians.

The Vice President further commended Governor Namadi for his notable strides in modern agriculture, noting that Jigawa’s progress under his leadership had positioned the state competitively within Nigeria and beyond.

“Governor Namadi is equal to the task, looking at his two-year achievements and the way he transformed Jigawa in modern agriculture,” Shettima stated.

Shettima Inaugurates Multi-Million Naira Juma’at Mosque in Gumel

metro

Police Launch Special Enforcement Team to Enforce Tinubu’s Ban on VIP Escorts

Police Launch Special Enforcement Team to Enforce Tinubu’s Ban on VIP Escorts

The Nigeria Police Force (NPF) has deployed a Special Enforcement Team in Lagos to enforce President Bola Tinubu’s directive ending the use of police officers as escorts and guards for Very Important Persons (VIPs).

The operation, according to a statement posted on the Force’s official X account on Saturday by the Force Public Relations Officer, CSP Benjamin Hundeyin, commenced at about 10:00 a.m. on December 6, 2025, across key locations in Lagos State.

Hundeyin confirmed that the team carried out compliance checks at major points, including the Lekki–Ikoyi Link Bridge, the Murtala Muhammed International Airport domestic terminal, and other strategic hotspots within the state.

READ ALSO:

- Akpabio denies filing new ₦200bn lawsuit against Natasha

- Two Pilots Survive as Nigerian Air Force Alpha Jet Crashes in Niger State (Video)

- FG Clarifies WAEC Subject Selection, Says Students Free to Choose Across All Fields

He disclosed that officers found “satisfactory and commendable” compliance with the presidential directive, with no incidents of unauthorised police escort and no arrests recorded.

“The Inspector-General of Police, IGP Kayode Adeolu Egbetokun, reiterates the Force’s commitment to the full implementation of the presidential directive,” the statement said. “The Nigeria Police Force remains resolute in redeploying its personnel to core policing duties aimed at enhancing general security, crime prevention, and the protection of lives and property nationwide.”

Hundeyin added that enforcement would continue across the country “without fear or favour,” urging Nigerians to support the push for a more professional and citizen-focused policing system.

President Tinubu had, on November 23, ordered the immediate withdrawal of police officers from VIP protection, directing that they be reassigned to frontline policing roles. According to the President’s Special Adviser on Information and Strategy, Bayo Onanuga, VIP protection will now be handled by armed operatives of the Nigeria Security and Civil Defence Corps (NSCDC).

The policy aims to free up police manpower for critical security operations, particularly in underserved communities, and enhance overall national security efficiency.

Police Launch Special Enforcement Team to Enforce Tinubu’s Ban on VIP Escorts

-

News3 days ago

News3 days agoDefence Minister Unveils New Security Strategy, Orders Troops to Shoot Armed Bandits on Sight

-

Entertainment3 days ago

Entertainment3 days ago2Baba Breaks Silence, Says Viral Aid Post Endangered Wife, Natasha

-

metro3 days ago

metro3 days agoTeam Justice accuses authorities of attempting to exclude Mohbad’s father from DNA test process

-

metro2 days ago

metro2 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

International3 days ago

International3 days agoMeta to Block Under-16s from Instagram, Facebook, Threads ahead of Australia’s World-First Youth Social Media Ban

-

metro3 days ago

metro3 days agoShocking confession: Boyfriend admits luring FRSC officer, child to death in Osun ritual murder

-

Sports3 days ago

Sports3 days agoLeeds United Stun Chelsea 3-1 at Elland Road to Climb Out of Relegation Zone

-

News2 days ago

News2 days agoBREAKING: Tinubu Sends Fresh Ambassadorial Nominations to Senate, Names Ibas, Ita Enang, Dambazau