News

Alleged N3.5bn Paris Club Fraud: Supreme Court to deliver judgment June 7

Alleged N3.5bn Paris Club Fraud: Supreme Court to deliver judgment June 7

The Supreme Court of Nigeria, Abuja has reserved judgment till June 7, 2024 in the final forfeiture suit of N1,222,384,857.84 (One Billion, Two Hundred and Twenty Two Million, Three Hundred and Eighty Four Thousand, Eight Hundred and Fifty Seven Naira, Eighty Four Kobo) brought before it by Melrose General Services Limited.

The appellant is challenging the judgment of the Court of Appeal ordering the forfeiture of the money to the Federal Government of Nigeria, being proceeds of an unlawful activity in the Paris Club fund involving Melrose General Services Limited.

At the resumed session of the court on Thursday, March 14, 2024, counsel to the appellant, Kehinde Ogunwumiju informed the apex court of a motion seeking the setting aside of the judgment of the Court of Appeal on the premise that the money involved in the forfeiture suit is not a proceed of any unlawful activity but payment for a contractual and consultancy agreement. He prayed that the decision of the appellant court on the forfeiture be reversed.

However, counsel to the Economic and Financial Crimes Commission, EFCC, Ekele Iheanacho, informed the court of his counter -affidavit dated March 11, 2024, praying the court to adopt his brief of argument and dismiss the appeal of the appellant.

READ ALSO:

- Man allegedly kills in-law over N20 salt in Kano

- Court dismisses kingmakers’ suit challenging monarch appointed by Oyetola

- German school faces backlash for water ban during Ramadan

“My Lords, we seek the leave of your noble Lordships to undertake a brief overview of the concept of forfeiture granted by the two courts below in a bid to drive home the 1st respondent `s case. There are generally two types of forfeitures used to recover the proceeds and instrumentalities of crimes. They share the same objective, namely the forfeiture to the state of the proceeds and instrumentalities of crime. Both share common two-fold rationales”, he said.

Arguing further, he stressed that, “recall that appellant filed his notice of appeal against the well-considered judgment of the Federal High Court which was equally dismissed by the Court of Appeal on May 31, 2019, having found that the appellant failed to show that the said funds are not proceeds of crime.

“Further to the background of the matter, the EFCC carried out investigations which revealed among others the sum of N3.5bn was fraudulently paid to the appellant to carry out a consultancy job for the Nigerian Governors Forum, NGF, under the guise that the appellant carried out a consultancy job for the NGF entitling it to the money when it did not do any such work. The appellant made several withdrawals within a short time leaving N1,222,384,857.84 before the EFCC intervened.

“Further investigation led to the recovery of an additional sum of N220m which the appellant had paid to WASP Networks Ltd and Thebe Wellness Services”.

After listening to all the submissions, the five-man panel of the apex court reserved judgment in the matter till June 7, 2024.

Alleged N3.5bn Paris Club Fraud: Supreme Court to deliver judgment June 7

News

What Trump should do to stop killing of innocent people in Nigeria, others – Ex-minister

What Trump should do to stop killing of innocent people in Nigeria, others – Ex-minister

Former Minister of Aviation, Femi Fani-Kayode, has advised United States President, Donald Trump, on various steps to take stop the killing of innocent Nigerians and other people across the world.

In a statement posted on his verified Facebook page on Sunday, Fani-Kayode criticized U.S. foreign policy, alleging that American agencies fund terrorism in Nigeria while simultaneously imposing sanctions.

He stated: “First you confess that #USAID is funding Boko Haram, ISWAP, and other terrorist organisations in Nigeria, and now you say you want to impose sanctions on us for the very same terrorist activities that your USAID is funding.

“It appears that you Yankees are as confused as the autumn morning and a victim of your own obsession for power and control.”

Fani-Kayode further outlined actions he believes the U.S. should take to ensure global peace, including halting financial corruption, ending foreign wars, and holding American political figures accountable.

READ ALSO:

- Rivers crisis: Adopt political solution, PANDEF tells Tinubu

- TCN, BEDC disagree on electricity supply problems in Delta communities

- Police gun down six kidnappers in Abia, rescue victims

“If you want the killing of innocent people to stop in Nigeria or elsewhere and if you truly desire world peace then get rid of your monumental appetite for money laundering, thievery, misappropriation of public funds, stealing, and corruption through contrived and premeditated foreign wars and conflicts,” he said.

He also urged the U.S. to reconsider its stance on Israel and its involvement in global conflicts, stating: “Stop supporting and funding the genocide in #Gaza and turmoil in the Middle East, stop giving Israel a free pass on all her atrocities, bring peace to Ukraine and reign in #NATO, get rid of Zelensky, build bridges with Russia, desist from troubling the #EU, stay in your lane, mind your business and stop interfering in the affairs of other countries.”

Fani-Kayode concluded by calling for sweeping reforms in the U.S. government, including jailing several prominent American figures, dismantling the “Deep State,” and releasing classified files related to historical events.

“Do all these things, and not only will your country become a better place, but peace will return to the world,” he added.

What Trump should do to stop killing of innocent people in Nigeria, others – Ex-minister

News

FG refutes US Congress claim of terrorists targeting Nigeria’s Christians

FG refutes US Congress claim of terrorists targeting Nigeria’s Christians

The federal government has dismissed claims that Christians are being deliberately targeted for killings in parts of Nigeria, describing such assertions as misinformation designed to pressure the international community into designating Nigeria as a Country of Particular Concern (CPC).

This stance was outlined in a statement issued by Kimiebi Ebienfa, spokesperson for the Ministry of Foreign Affairs, who attributed the narrative to “fifth columnists” seeking to misrepresent the country’s security situation.

Former Interior Minister and retired military general, Abdulrahman Dambazau, also strongly refuted the claims made by the US Congress regarding religious persecution, arguing that Muslims—particularly in the northern regions—are disproportionately affected by the ongoing security crisis.

The statements come in response to US Congressional hearings and potential sanctions initiated under former President Donald Trump, following reports of increasing attacks on Christians in Nigeria.

In its statement, the Ministry of Foreign Affairs expressed deep concern over what it described as misleading reports, stating:

“While the federal government acknowledges the security challenges confronting the nation, it is imperative to clarify that these negative activities are not driven by religious bias, nor targeted against any particular religious group.”

The ministry stressed that insurgency and banditry in predominantly Muslim northern Nigeria do not single out any faith for attack. It added that portraying the situation as Christian persecution is “erroneous and misleading.”

READ ALSO:

- Jimoh Ibrahim speaks on Senator Natasha’s petition to IPU

- SDP warns Kaduna gov against persecuting El-Rufai

- Natasha: Protesters at UN House demands evidence of allegation

The government reiterated its commitment to safeguarding all Nigerians regardless of religion, ethnicity, or gender, and emphasized that the country’s security issues are complex, involving criminal activities, terrorism, and communal clashes—including farmer-herder conflicts—which are not rooted in religious discrimination.

The statement further highlighted efforts by President Bola Ahmed Tinubu’s administration to tackle insecurity, including the deployment of security forces, intelligence operations, and community engagement strategies. It noted progress made in curbing banditry and insurgency and the establishment of a Ministry of Livestock Development to address tensions between farmers and pastoralists.

The Ministry of Foreign Affairs called on the international community to verify information before drawing conclusions that could inflame tensions within Nigeria.

“We call on all stakeholders, including the media, civil society organizations, and foreign partners, to refrain from spreading unverified claims that could undermine national unity and stability.

In a related development, Dambazau criticized the US Congress for mischaracterizing Nigeria’s security challenges, insisting that Muslims in the North have borne the brunt of violence.

“The US Congress got it wrong,” he asserted. “While it’s true that churches and Christian pastors have been attacked, mosques and Islamic clerics have not been spared. The vast majority of victims, especially in the Northeast, are Muslims.”

He pointed to Zamfara State, where he said 99% of the population is Muslim, yet violent attacks occur almost weekly.

READ ALSO:

- Plot to impeach Fubara thickens

- Shell wraps up Nigeria onshore business sale, to focus on deepwater

- BREAKING: Appeal Court stops Sanusi’s reinstatement as Kano emir

Dambazau also criticized figures such as Bishop Matthew Kukah, accusing them of presenting an inaccurate and divisive picture of the conflict.

“It is not about religion,” he said. “It is about the fact that these victims are Nigerians, and they require protection against these horrible people. They make it look as if it is a systemic issue, that maybe the government is coming out, as a matter of policy, to persecute these people. That is wrong.”

He further argued that data indicates that the most affected regions, such as the Northeast and Northwest, have predominantly Muslim populations.

“Reports of mass killings and kidnappings in these regions often involve Muslim victims. While precise statistics are difficult to obtain due to the fluid nature of the conflict, reports consistently highlight that Muslim communities are heavily impacted.”

Dambazau urged the US Congress to adopt a more nuanced view of Nigeria’s security crisis, warning that imposing sanctions based on an incomplete understanding of the conflict could have serious consequences.

Quoting a post from his X handle @mypd2020, he wrote:

“To impede the progress of a country like Nigeria has been made easy mainly by using the religious and ethnic fault lines.The idea that insurgency and banditry are targeting only Christians is unfortunate. The same US Congress recently said that USAID is the main sponsor of Boko Haram and other terrorist organizations.The question is, who is killing the Muslims and displacing them in their thousands and millions? Is it a USAID project, or those making the false accusations, or both? Nigerians should learn to approach and solve their problems while the US solves theirs, otherwise, we remain in perpetual stagnation.”

FG refutes US Congress claim of terrorists targeting Nigeria’s Christians

News

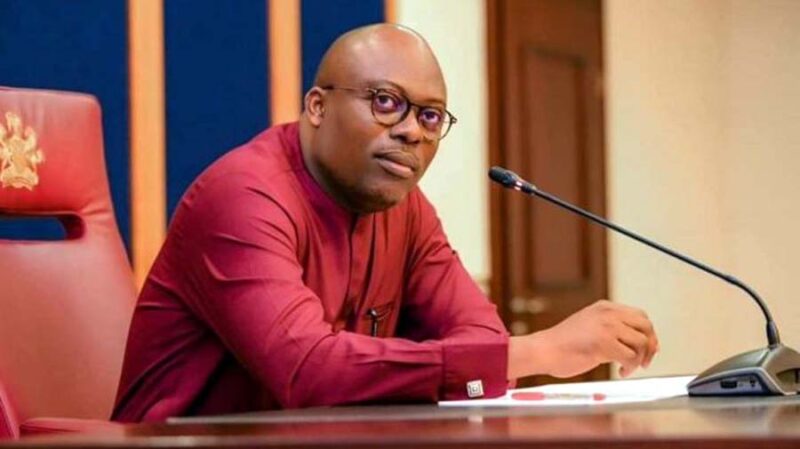

Plot to impeach Fubara thickens

Plot to impeach Fubara thickens

The political camp of the Rivers state Governor, Siminalayi Fubara was again pushed into a deeper trench by the decision of the state House of Assembly to probe the alleged age falsification of the Chief Judge of the state, Justice Simeon Amadi.

At its 135th legislative sitting, the House resolved to write to the Department of the State Service, DSS, to investigate the CJ following allegations against him by the Leader of the House, Hon Major Jack.

The House agreed that falsification of age was a “serious offence” but the allegation must be confirmed and doing so, the CJ has to be thoroughly investigated to establish the authenticity of the allegation.

Responding to this development, the Speaker, Rt. Hon Martins Amaewhule said by section 128 of the constitution, the House is empowered to investigate the allegation but quickly accused Governor Fubara of barring heads of ministries, departments and agencies from appearing before the House.

Remember that Justice Amadi was screened to become the Chief Judge of the state about three years when Wike was a governor. Unconfirmed report has it that Amadi, who hails from the same Ikwerre ethnic nationality with Wike, turned down alleged N5 billion gratification and tastefully furnished houses in London and America to ditch the governor and clear the grounds for his eventual impeachment.

Commenting on the CJ’s ordeal, Hon Ogbonna Nwuke, former House of Representatives member in the 7th National Assembly said the action of the Assembly members was just to intimidate the Chief Judge in order to get at the governor.

“The process of impeaching the governor is not easy. That is why they are intimidating the loyalists of the governor just to create a state of emergency, at most”.

READ ALSO:

- Shell wraps up Nigeria onshore business sale, to focus on deepwater

- BREAKING: Appeal Court stops Sanusi’s reinstatement as Kano emir

- Nigeria dominating Africa spare parts market, says ASPAMDA boss

Giving the quick succession at which events happened in the state in the course of the week barely few hours after the Minister of the federal capital territory, FCT, Nyesom Wike on Wednesday publicly declared that the state Governor, Siminalayi Fubara could be impeached by the House of Assembly and “heaven will not fall”, it shows that there is more in the offing.

The minister’s audacity came just a day after a crucial meeting between President Bola Ahmed Tinubu and the delegation of the pan Niger Delta Elders Forum, PANDEF, in Abuja wherein the latter was asked to go back home and prevail on the embattled Governor to “obey the rule of law”, in other words, the Supreme Court judgment.

Meanwhile, Wike’s impeachment threat to Fubara and his vituperations on the Ijaw ethnic nationality has since attracted the ire of the Supreme Egbesu Assembly, SEA, a religious deity of the Ijaws and other revered topnotch organizations such as the Ijaw national Congress, INC and its youth wing, Ijaw Youth Council, IYC.

Recall that in the early years of militancy in the Niger Delta with Rivers, Bayelsa and Delta states being the hotbed of the crisis, the Egbesu god was said to have been invoked to wade off the incursion of the federal troops into the flashpoints of the crisis.

Leader of the Supreme Egbesu Assembly, SEA, an ancestral religious institution of the Ijaw people, Sergeant Werinipre Digifa, told Saturday Vanguard on phone that the Ijaw people would “shock” President Bola Ahmed Tinubu at the appropriate time in the event that the Governor of Rivers state, Siminalayi Fubara is impeached.

Digifa hit back at the President who he said lacks the capacity to tame Wike. “Tinubu should be held responsible for the recklessness and arrogance Wike is exhibiting against the Ijaw nation.

“This is why I say that Nigeria is a banana republic. Somebody has turned the judiciary to his personal estate. He manipulates the judiciary the way he wants it just to suit his desire. If they impeach Fubara, we will not go into violence because Ijaw people don’t believe in violence. We will take everything in good faith. But we will shock them”.

The head of the Egbesu Assembly added that ”we are keenly watching the ongoing political trend which is pure harassment and the intimidation of the Governor of Rivers state. We are listening to the insults, the unguarded utterances and the abuse that is being heaped on the Ijaw ethnic nationality by Hon Wike.

READ ALSO:

- Fernandes nets hat-trick in Man United big win over Real Sociedad

- Tragedy as 25-year-old man hangs self in Ogun forest

- 2027: Southern Kaduna group rejects El-Rufai, supports Tinubu

”The Niger Delta is a community and when controversies arise in a community, reasonable people don’t jump in to talk. There is an African adage which says ‘two mad people never behave madly at the same time.’

“We are not sleeping, neither are we cowards. But note that we have always won our just battles and this will be no exception. This crass arrogance being displayed by Wike was avoidable”.

Digifa expressed disappointment that President Tinubu has allowed the crisis to fester, saying ”I had earlier thought that he had the capacity to rule Nigeria as a president, but from the showings on ground, it is evident that we had a misplaced value on President Tinubu’s leadership capacity.”

He warned President Tinubu that “by the time Wike finishes with you, the Yoruba nation would have incurred the anger of the Ijaw man. The spirits that have protected the Ijaw Nation over the years will bring the wrath on the Yoruba to teach them a lesson that could be worse than what has happened to those who attempted to humiliate us”.

INC’s position on Wike’s bluster to oust Fubara from power is that people should look at issues from the broader perspective and not through the prism of sectarian sentiment.

Professor Benjamin Okaba, President of INC, said Wike’s so called insult on Ijaws smacks off the smart game of giving it an ethnic coloration to get the sympathy of other ethnic groups and distract their attention from the sympathy they have for governor Fubara.

“When the Ijaws led the struggle for the creation of Rivers state, where were Wike’s ancestors? He quipped. “You don’t flirt after a hyena. Wike will regret, mark my words, and become a political orphan. When an empire rises to its peak, another empire will rise. We are heading towards the Marxian synthesis as the political denouement is already unfolding ahead of 2027.

“Wike’s bravado is clearly stimulated by nothing else but the tacit support and encouragement from the Presidency. Remove Wike from Power, he will automatically transform into an empty and most vulnerable entity in Nigerian political history”, he said.

In its declaration after a zonal emergency meeting, the Ijaw Youth Council, IYC, Eastern Zone put the federal government on notice that it will stoutly resist every attempt by the planners to impeach Governor Fubara, “until he has served out his two tenures of eight years as his predecessors did, by any means necessary”.

The Ijaw youths announced that the planners of the Governor’s impeachment, “if they do not desist from their evil plot, should be ready to bear the consequences of their actions in the event of the breakdown of law and order in the State”.

Also, a statement from the Ijaw Matters viewpoint said the Ijaw Nation has been patient for too long, saying “our patience is not weakness. Nyesom Wike, in his ……arrogance, has crossed every line of decency and respect. His continued insults against the Ijaw people will not go unanswered”.

It said it was a disgrace that a man who once begged for the support of Ijaw leaders and communities now dares to spit on the same people who made him. “We will not forget. We will not forgive. And when the time comes, Wike will beg, he will crawl before the Ijaw Nation seeking mercy, but he will find none”.

The group vowed that “Wike will pay for every insult, every slight, and every word of disrespect. The day of reckoning is closer than he thinks”.

Plot to impeach Fubara thickens

-

Entertainment24 hours ago

Entertainment24 hours agoVIDEO: Asake reconciles with father, promises to purchase house, cover medical bills

-

Education2 days ago

Education2 days agoRomanian university offers fully funded scholarships to non-EU and non-EEA students for 2025

-

metro2 days ago

metro2 days agoObasa: Tinubu’s Abuja meeting fails to calm Lagos Assembly impasse as crisis deepens

-

metro2 days ago

metro2 days agoWhy we supported Tinubu despite Chicago University issues — El-Rufai

-

metro2 days ago

metro2 days agoNatasha: Senate President Akpabio considers stepping down

-

metro2 days ago

metro2 days agoEx-England star John Fashanu sues police for £100k after arrest in Nigeria

-

Africa2 days ago

Africa2 days agoFuel hits N8,000/litre in Niger, country seeks help from Nigeria

-

metro2 days ago

metro2 days agoDSS, NIA probe Natasha Akpoti’s attendance at IPU meeting