News

Appeal Court fines Makinde N50m for withholding ex-council Chiefs’ funds

Appeal Court fines Makinde N50m for withholding ex-council Chiefs’ funds

The Court of Appeal in Abuja, on Friday awarded N50 million in damages against Governor Seyi Makinde of Oyo State, and six others for failure to pay the outstanding balance of N3,374,889,425.60 (N3.4 billion) from the N4,874,889,425.60 (N4.9 billion) debt, arising from a May 7, 2021 judgment of the Supreme Court.

A three-member panel of justices, in a unanimous judgment, condemned Makinde’s conduct, which it described as disrespectful of the nation’s judicial system.

The court affirmed the April 27 decision of the High Court of the Federal Capital Territory (FCT) ordering the state governor to paid the outstanding balance.

The N4.9 billion debt arose from the judgment of the Supreme Court given against Makinde, the state’s Attorney-General (A-G), Accountant-General and four others in an appeal by chairmen and councillors elected on the platform of the All Progressives Congress (APC), but sacked on May 29, 2019, by Makinde, upon assuming office.

In the judgment, the appellate court upheld the arguments by the lawyer to the ex-council chiefs, Musibau Adetunbi, SAN, resolved the two issues, identified for determination, against the appellants and dismissed the appeal filed by Makinde and six others for lacking in merit.

The court awarded N50 million cost against Makinde and co-appellants, to be paid to the ex-council chiefs led by Bashorun Mojeed Bosun Ajuwon.

READ ALSO:

- Policeman arrested for attacking s3x shop worker after wife demanded for big toys

- NNPP caucus denies coalition talks with PDP

- C’River ‘ll become largest cocoa producer in Nigeria soon – CFAN President

The judgment was on the appeal marked: CA/595/2023 filed by Makinde, the Oyo State’s A-G, the Commissioner for Local Government and Chieftaincy Affairs, Accountant-General of Oyo State, Speaker of Oyo State House of Assembly, the House of Assembly and Oyo State Independent Electoral Commission (OYSIEC).

In the lead judgment, Justice Danlami Senchi held that, as against the contention by the appellants, there was no dispute in relation to the amount that constituted the judgment debt.

The judge referred to a letter written on Dec. 13, 2021, by the A-G of Oyo State, where the state put the salaries and allowances due to the ex-council chiefs at N4,874,889,425.60 and pledged to pay everything within six months.

He said the court could not allow Oyo State Government and its officials to approbate and reprobate; blow hot and cold at the same time by claiming the amount constituting the debt was not ascertained despite the letter by the A-G and the fact that the appellants took steps to settle the debt by making part payment.

Justice Senchi also faulted the appellants’ contention that the ex-council chiefs failed to first obtain the consent of the Oyo State A-G before initiating a garnishee proceeding to seize the state’s funds to settle the judgment debt.

The judge said asking the ex-council chiefs to first seek and obtain the consent of the Oyo A-G, who was one of the judgment debtors, amounted to making him to be a judge in his own case, “which requirement is unfair to the judgment creditors.”

READ ALSO:

- Tempers flare as Tompolo’s Tantita, soldiers foil oil theft off Ondo coast

- Nigeria losing best brains to Japa syndrome — AfDB President

- Farooq Kperogi : Why the North suddenly cares about northern lives

“The ex-council chiefs were in order to have initiated the garnishee proceeding, because there was a judgment debt to be paid by the appellants by virtue of the judgment of the Supreme Court,” he said.

The Supreme Court had, in its May 7, 2021 judgment, declared the action of the ex-council chiefs, who sued through 11 representatives, led by Bashorun Majeed Ajuwon, as lawful and ordered the Oyo State Government to compute and pay them their entitled salaries and allowances within three months of the judgment.

Rather than comply with the judgment, the Oyo State Government paid only N1.5 billion, prompting the judgment creditors (the ex-council chiefs) to initiate a garnishee proceeding against Makinde and others before the High Court of the FCT.

In the April 27 ruling, Justice A. O. Ebong of the High Court of the FCT issued a garnishee order absolute, directing Makinde and others to pay the balance of the judgment debt on instalment basis, begining with N1,374,889,425.60 to be paid immediately.

Justice Ebong ordered them to subsequently pay the remaining N2b billion at N500 million quarterly, with the first instalment payable on July 31, a decision Makinde and others challenged at the Court of Appeal.

NAN reports that it was the April 27 ruling by Justice Ebong that the Court of Appeal affirmed in the judgment delivered on Friday.

Appeal Court fines Makinde N50m for withholding ex-council Chiefs’ funds

News

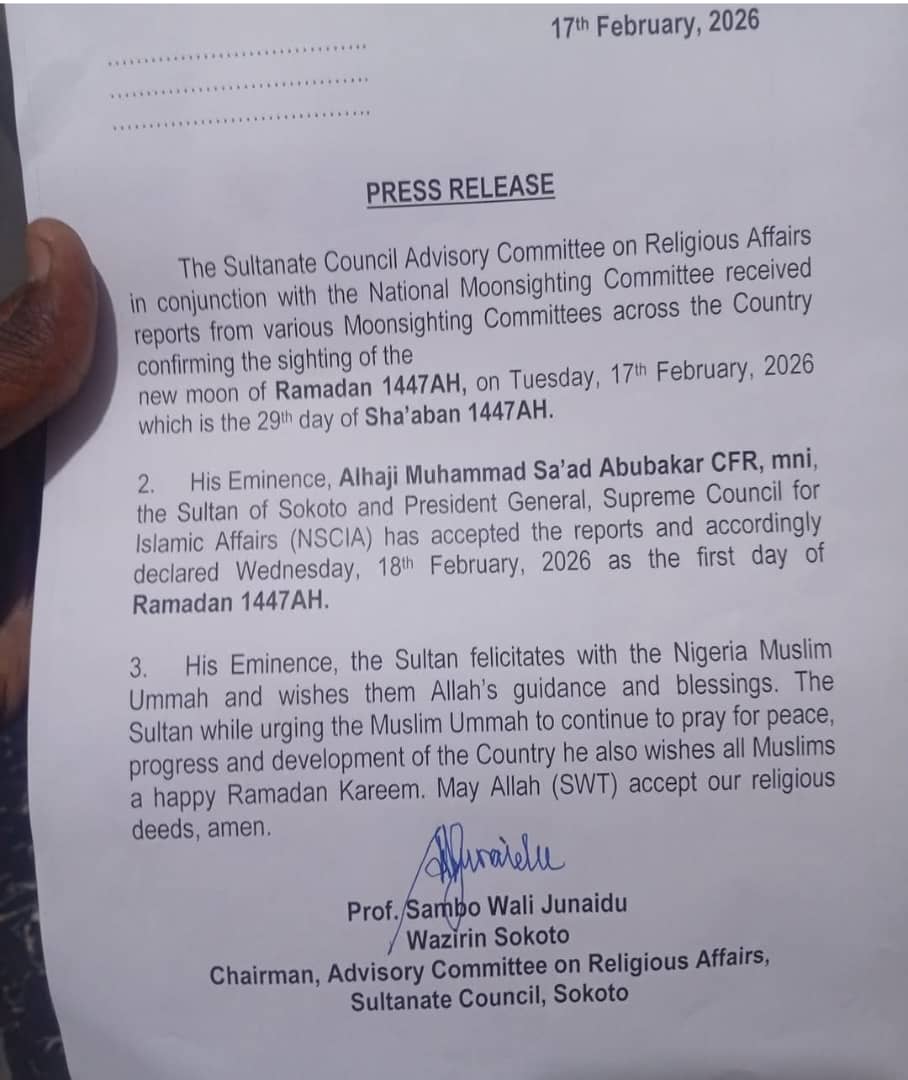

Ramadan Begins in Nigeria as Sultan Confirms Crescent Sighting

Ramadan Begins in Nigeria as Sultan Confirms Crescent Sighting

Abuja — The Sultanate Council on Tuesday night confirmed the sighting of the crescent moon, officially signaling the commencement of Ramadan 1447AH in Nigeria.

The President-General of the Nigerian Supreme Council for Islamic Affairs (NSCIA) and Sultan of Sokoto, Muhammad Sa’ad Abubakar III, announced that the new moon was sighted in parts of the country, thereby declaring Wednesday, February 18, 2026, as the first day of fasting for Muslims nationwide.

The announcement followed verified reports from moon-sighting committees across several states, in line with Islamic tradition which requires physical sighting of the crescent to mark the beginning of the ninth month of the Islamic lunar calendar.

In his message to the Muslim faithful, the Sultan urged Nigerians to use the holy month to pray for peace, unity, and national development. He also called on Muslims to embody the virtues of patience, compassion, charity, and self-discipline which Ramadan represents.

READ ALSO:

- Deadlock at National Assembly as House Snubs Electoral Act Bill Meeting on E-Transmission Clause

- Maikori Accuses Ex‑Governor El‑Rufai of Persecution Over 2017 Tweet

- Shari’ah Council Defends Kwankwaso, Rejects US “Christian Genocide” Claims

Ramadan, one of the five pillars of Islam, requires adult Muslims to abstain from food, drink, and other physical needs from dawn until sunset throughout the month. The period is also marked by increased devotion, nightly congregational prayers in mosques, recitation of the Qur’an, and acts of charity to the less privileged.

Ramadan, one of the five pillars of Islam, requires adult Muslims to abstain from food, drink, and other physical needs from dawn until sunset throughout the month. The period is also marked by increased devotion, nightly congregational prayers in mosques, recitation of the Qur’an, and acts of charity to the less privileged.

Across major cities including Abuja, Lagos, Kano, and Port Harcourt, mosques recorded increased attendance for special night prayers following the announcement. Markets also witnessed heightened activity as families made last-minute purchases in preparation for the fasting period.

Ramadan will last 29 or 30 days, depending on the sighting of the next crescent, and will culminate in the celebration of Eid al-Fitr, marking the end of the fasting month.

Muslim leaders have encouraged faithful to observe the fast in accordance with Islamic teachings while maintaining harmony and mutual respect within Nigeria’s diverse society.

Ramadan Begins in Nigeria as Sultan Confirms Crescent Sighting

News

Saudi Arabia Confirms Sighting of Ramadan Crescent, Fasting Begins Wednesday

Saudi Arabia Confirms Sighting of Ramadan Crescent, Fasting Begins Wednesday

Riyadh, February 17, 2026 — Authorities in Saudi Arabia have officially confirmed the sighting of the crescent moon marking the beginning of the holy month of Ramadan, signaling that fasting will commence on Wednesday, February 18, 2026.

The announcement was made Tuesday evening following reports from moon-sighting committees across the Kingdom. In a statement carried by state media, the Supreme Court confirmed that verified testimonies of the crescent’s sighting had been received after sunset on the 29th day of Sha’ban.

With the confirmation, Muslims throughout the Kingdom will begin the first fast of Ramadan at dawn on Wednesday.

READ ALSO:

- Deadlock at National Assembly as House Snubs Electoral Act Bill Meeting on E-Transmission Clause

- Maikori Accuses Ex‑Governor El‑Rufai of Persecution Over 2017 Tweet

- Shari’ah Council Defends Kwankwaso, Rejects US “Christian Genocide” Claims

Religious authorities had earlier called on citizens and residents to look for the crescent on Tuesday evening and report any confirmed sightings to the nearest court. Observations were conducted in various regions, including areas around Riyadh and Mecca, as part of the Kingdom’s longstanding tradition of physical moon sighting.

Ramadan, the ninth month of the Islamic lunar calendar, is observed by Muslims worldwide as a period of fasting, prayer, charity, and spiritual reflection. The start of the month is determined by the sighting of the new crescent moon, in accordance with Islamic tradition.

Several other countries in the Gulf region are also expected to begin fasting on Wednesday following similar confirmations, while some nations may rely on local moon sightings to determine their own start date.

Further announcements regarding the duration of nightly Taraweeh prayers and official Ramadan working hours are expected from relevant authorities in the coming days.

Saudi Arabia Confirms Sighting of Ramadan Crescent, Fasting Begins Wednesday

News

Former INEC REC Warns of “Chaos” in 2027 Over E-Transmission of Election Results

Former INEC REC Warns of “Chaos” in 2027 Over E-Transmission of Election Results

A former Resident Electoral Commissioner (REC) of the Independent National Electoral Commission (INEC), Mike Igini, has raised concerns that Nigeria’s ongoing debate over electronic transmission of election results exposes unresolved legal, institutional, and technological challenges, despite years of electoral reforms. Speaking on Channels Television’s Politics Today on Monday, Igini warned that recent Senate amendments to the Electoral Act could create confusion and vulnerabilities in future elections, particularly the 2027 general polls. He stressed that failing to clarify rules on electronic results transmission risks undermining democracy, transparency, and public confidence.

The controversy stems from the Senate’s recent amendment to the Electoral Act, which now allows electronic transmission of results but removed the “real-time” requirement that had previously been proposed to enable direct uploading from polling units to the INEC Result Viewing Portal (IREV). Under the amendment, Form EC8A, the physical result sheet, remains the primary document in cases of internet outages or connectivity failure. Igini cautioned that this creates a grey area that could trigger disputes in 2027 if presiding officers are allowed discretion over network availability, highlighting that legal and technological clarity is essential to avoid chaos.

READ ALSO:

- DHQ Confirms 100 US Military Personnel Arrive in Bauchi for Counter-Terrorism Training

- Dokpesi Jr, Ex-GMD Akiotu Clash Over DAAR Communications Mgt Restructuring

- EFCC Holds El-Rufai Overnight Over ₦423bn Kaduna Corruption Allegations

Referencing a 2021 technical report by INEC and the Nigerian Communications Commission (NCC), Igini said Nigeria possesses adequate telecommunications coverage, with 2G and 3G networks covering about 93% of the country, making electronic transmission feasible nationwide. INEC had also mapped polling units to mobile network operators and prepared SIM cards and data arrangements to ensure smooth uploads to IREV. He explained that Nigeria had previously relied on interim innovations, including biometric voter registers, card readers, and digital result-viewing platforms, to enhance transparency where legal provisions prohibited full electronic transmission.

Igini further warned that introducing discretionary fallbacks for “network issues” could reintroduce vulnerabilities, as presiding officers might abuse their authority to manipulate results. He emphasised that modern election devices, such as BIVAS machines, can operate both online and offline, uploading results at the nearest connectivity point to ensure integrity in IREV. “The whole purpose of IREV is to make results verifiable and immutable once entered. Allowing manual override defeats the reforms we have painstakingly implemented over the years,” he said.

He also noted that judicial interpretations and evolving legislative amendments have contributed to uncertainty over the legality of technological innovations in elections. Igini urged lawmakers to consider the long-term implications of changes to the Electoral Act, stressing that Nigeria’s democratic stability relies on cooperation between INEC, the judiciary, and key stakeholders. “Our democracy’s future depends on the rule of law. Without it, society risks being dominated by those who act for personal interest rather than public good,” he added.

With the 2027 elections approaching, Igini’s warnings underscore the need for clear legal frameworks, technological preparedness, and robust institutional coordination. He urged all stakeholders to work collaboratively to ensure that electronic transmission of results enhances transparency, accountability, and credibility in Nigeria’s electoral process.

Former INEC REC Warns of “Chaos” in 2027 Over E-Transmission of Election Results

-

Education3 days ago

Education3 days agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

News2 days ago

News2 days agoOsogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

-

News8 hours ago

News8 hours agoSaudi Arabia Confirms Sighting of Ramadan Crescent, Fasting Begins Wednesday

-

metro2 days ago

metro2 days agoUS Freezes Assets of Eight Nigerians Over Boko Haram, ISIL, Cybercrime Links

-

News3 days ago

News3 days agoAfenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

-

metro2 days ago

metro2 days agoTerror in Lagos Traffic: Cutlass Gang Unleashes Mayhem on Mile 12–Ketu Road

-

Entertainment2 days ago

Entertainment2 days agoMystery in Lekki: Police Probe Death of Two Nollywood Crew Found Lifeless in Parked Car

-

metro3 days ago

metro3 days agoUS Military Boosts Support for Nigeria’s Fight Against Insurgency With Ammunition, Troop