News

ATMs in Nigeria run dry due to short supply of new naira notes

Banks in Nigeria are running short of new naira notes, about four days to the deadline set by the Central Bank of Nigeria for old notes to be phased out.

This is coming as more people including traders have started rejecting the old N1,000, N500 and N200.

Some commercial banks still give old notes to their customers for Over- the- Counter Withdrawals (OTC) while very few Automated Teller Machines (ATMs) dispense the new naira notes.

Some officials of the commercial banks in major cities including Abuja and Lagos told customers they could only withdraw a maximum of N20,000 of the new notes while old notes are still being given to customers for withdrawals in the banking halls, against the directive of the CBN.

Daily Trust reported that the CBN had directed customers to start rejecting old naira notes from banks, insisting that the old notes cease to be legal tender by January 31 as earlier stipulated.

Our reporter who went to withdraw new notes was given old naira notes at a popular bank in the Garki Area of the FCT.

The bank officials simply told our reporter that “The central bank did not supply them and the little supply they have is what they load at ATMs in order to obey the CBN directive.

“Immediately the ATMs are loaded, customers rush immediately to exhaust the little cash in it.”

READ ALSO:

- Troops neutralise 84 terrorists in NE/NW, rescue 122 victims in 2 weeks

- IGP recommends Frank Mba as Ogun police commissioner, tips 2 others for AIG position

- Serie A: Peseiro praises Osimhen’s scoring feats for Napoli

Another bank Customer in Kano, Salihu Bello said “He was in the banking hall on Thursday where a customer was making trouble because he needed new cash to pay his own staff (labourers). The bank tellers said they didn’t have what they had expected to get today but they were not supplied. The bank is still paying old currencies”

Also another bank Customer, Ruth Tene stated that “Most banks today are claiming they don’t have cash to pay customers today, particularly Zenith Bank and GT Bank, Jabi all the same case,”

Meanwhile, Daily Trust observes that business owners in major markets and supermarkets have begun to reject the old naira notes.

At the popular Wuse Market in Abuja, Bashir Isa, a resident of the area who went to purchase some goods with the old naira notes could not do so as the traders there told him they won’t accept the old noted.

The same scenario is playing out at a popular Chinese store in the popular Jabi Lake mall located in the Jabi district where attendants are outrightly rejecting the old notes.

Reps tackle commercial Banks over new currency policy

Members of the House of Representatives Ad-hoc committee have tackled commercial bank operators over the hardship being experienced by Nigerians over the new currency policy imposed by the Central Bank of Nigeria (CBN).

Responding separately, the banks Chief Executives Officers (CEOs) revealed that the amount of new Naira notes allocated to the banks are not enough to meet the demands of their customers.

Speaking, one of the bank’s executives, Hadiza Ambursa informed that their bank collects about 10 per cent of what they deposit to the Central Bank.

On his part, Sterling Bank’s Orlando Umoren who corroborated what the Access Bank official said, noting that Sterling Bank received and disbursed varied amounts of the new notes.

He said: “We received a minimum of N150 million to be shared. In Kaduna, N150 million, in Kano, we received N100 million to be shared amongst the branches in the metropolis. They are being fed in the ATM only and not to be given to the customers across the counter. In Abuja here, what we are given is about 80 per cent. In Kano, it is less than 10.

“What we get in return is nothing comparable… The reason why the new naira note is not coming. It is in the furtherance of the cashless policy. The banks are still under pressure to ensure that they meet the deadline”.

READ ALSO:

- Protesters block Lagos-Benin road over fuel price hike, scarcity

- Nigeria next president likely to fail like Jonathan, Buhari – Prof Ibrahim

- Reps threaten Emefiele with warrant of arrest over new naira notes

The Regional Executive for Heritage Bank, Oniko Daniel called on the public to understand the policy as put up by the CBN and the position of the commercial banks as entities regulated by the apex bank.

He said, “If you load a cartridge, which is about 8 million, in less than 2 hours that 8 million is finished. It must be understood. People want to deposit N10 million and want to collect N10 million, but It is not possible. CBN is doing cash swaps in rural areas. The public needs to know the guidelines and what the CBN is saying. CBN guideline is more or less a rule to the commercial banks”.

While speaking on whether the policy and the deadline set by the CBN on the new currency is feasible, the Chief Executive of Retail and Commercial Banking, North, First Bank Nigeria Plc, Shehu Aliyu said, they are guided by the guidelines put by the CBN and cannot determine anything regarding the policy.

He said “We have seen an upsurge of people coming to open accounts and deposit money into those accounts. We have been handling this as much as we can. After this hearing, we will bring details. We have been paying out new notes across the country.

Speaking, the Chairman of the committee faulted the CBN on the policy saying that it violated the CBN Establishment Act by setting up a deadline of January 31st for the old currency to cease as a legal tender.

He said, “Section 20(3) made it necessary, mandatory on the CBN not at any point to refuse to accept old notes simply because of the expiry date.

“The position of the law is that our old notes must continue under every circumstance to have value. The values of the old notes must be respected and protected by the CBN and the commercial banks.

Daily Trust

News

Akpabio sues Natasha for ₦200bn over sexual harassment allegations

Akpabio sues Natasha for ₦200bn over sexual harassment allegations

Senate President Godswill Obot Akpabio has instituted a ₦200 billion defamation lawsuit against Senator Natasha Akpoti-Uduaghan, accusing her of spreading malicious sexual harassment allegations that he says have severely damaged his public image.

According to documents filed before the High Court of the Federal Capital Territory, Abuja, Akpabio is seeking substantial damages, public retractions, and nationwide broadcast apologies. He argues that Senator Akpoti-Uduaghan’s televised, radio, and online interviews portrayed him as a sexual predator who abused his office for personal gratification—claims he insists subjected him to widespread ridicule and reputational harm.

The lawsuit includes a comprehensive statement of claims and a list of witnesses. Akpabio is also asking the court to compel the removal of all online materials containing the disputed allegations and to order repeated public apologies across major media outlets.

READ ALSO:

- Nigeria joins global ICH elite as NAFDAC achieves full international regulatory Status

- Supreme Court Strikes Out Osun Suit on Withheld Local Govt Allocations

- DSS Arrests Doctor Providing Medical Support to Bandits in Kwara State

A court order issued on 6 November 2025 granted permission for substituted service through the Clerk of the National Assembly after initial attempts to reach Senator Akpoti-Uduaghan directly were unsuccessful. The case is now moving forward and is expected to become one of the most closely watched political legal battles in Nigeria.

Responding on 5 December 2025, Senator Natasha Akpoti-Uduaghan confirmed receipt of the suit and expressed readiness to defend her allegations before a competent court. She stated that she had previously been prevented from presenting a petition before the Senate Committee on Ethics and Privileges due to claims that a related case was already in court—an action she believes protected the Senate President from legislative scrutiny.

In a strongly worded response, the Kogi Central senator maintained that the court proceedings will finally provide the platform to substantiate her claims. She reiterated her stance that she experienced sexual harassment and that her refusal to comply with the alleged advances prompted sustained political retaliation.

“See you in court, Godswill Akpabio,” she declared.

Akpabio sues Natasha for ₦200bn over sexual harassment allegations

News

NLC threatens nationwide protests as insecurity worsens, withdraws support for Labour Party

NLC threatens nationwide protests as insecurity worsens, withdraws support for Labour Party

The Nigeria Labour Congress (NLC) has warned that it will no longer remain passive as criminal gangs intensify violent attacks across the country, declaring its readiness to hold a national day of mourning and mobilise nationwide protests over the escalating insecurity in Nigeria.

Speaking at the opening of the NLC’s National Executive Council (NEC) meeting in Lagos, NLC President Joe Ajaero said the country was “under siege,” condemning the latest school kidnapping and the reported withdrawal of security personnel before the attack. He demanded a full investigation to expose any possible compromise within the nation’s security architecture.

“The NLC cannot stand idly by and allow criminals to take over our country—never again. We want to know who ordered the withdrawal of security operatives from that school. We will not allow kidnappers and bandits to overrun our nation,” Ajaero said.

READ ALSO:

- Oshiomhole Seeks Tougher Regulation of Fintech Firms After Cyber Fraud Experience

- Boris Johnson Hails Kemi Badenoch as “Future UK Prime Minister” During Visit to Nigeria

- A troubling message from Guinea-Bissau, by Azu Ishiekwene

He stressed that the labour movement would soon announce details of the planned protests and national mourning, insisting the lives of teachers, students and workers were in grave danger. “It is getting out of hand. We can no longer bear this,” he added.

Ajaero also revealed that the NLC had withdrawn its representatives from the Labour Party, accusing them of pursuing personal interests rather than representing workers.

Human rights lawyer Femi Falana, SAN, who addressed the meeting, warned that the country was in “serious trouble” over rising kidnappings and attacks. He rejected calls for foreign military intervention, cautioning that such a move would undermine Nigeria’s sovereignty.

Falana criticised recent statements by former U.S. President Donald Trump, describing them as unacceptable. He urged President Bola Tinubu to take decisive action to protect citizens, saying: “We want to let the world know that we are not a conquered people.”

He called on labour unions, civil society organisations and Nigerians to prepare to resist any further decline in national security.

NLC threatens nationwide protests as insecurity worsens, withdraws support for Labour Party

News

Boris Johnson Hails Kemi Badenoch as “Future UK Prime Minister” During Visit to Nigeria

Boris Johnson Hails Kemi Badenoch as “Future UK Prime Minister” During Visit to Nigeria

Former British Prime Minister Boris Johnson has praised UK Conservative Party leader Kemi Badenoch, describing her as a “future Prime Minister of the United Kingdom” during his visit to Nigeria for the Imo State Economic Summit 2025.

Speaking in Owerri, Imo State, on Thursday, Johnson commended Governor Hope Uzodimma for his efforts to boost economic development and improve security, noting that he felt “perfectly safe” despite earlier warnings about Nigeria’s security situation.

Johnson highlighted the state government’s push to deliver 24-hour electricity, stressing that reliable power and clean, sustainable energy are essential for economic growth as the world moves into an Artificial Intelligence (AI)-driven future.

READ ALSO:

- A troubling message from Guinea-Bissau, by Azu Ishiekwene

- Siyan Oyeweso: Lessons in virtue and vanity

- Court Rules Only Lawyers Can Represent Nnamdi Kanu, Rejects Brother’s Appearance

He also emphasized the strong historical and economic ties between Nigeria and the United Kingdom, praising the exchange of goods, services, and highly skilled professionals between both countries.

In a humorous remark that sparked applause, Johnson said: “We send you former UK prime ministers, and you send us future UK prime ministers in the form of Kemi Badenoch.”

The summit, attended by Vice President Kashim Shettima, former UN Secretary-General Ban Ki-moon, business mogul Aliko Dangote, and other top government and private-sector leaders, focused on strategies to accelerate Imo State’s economic transformation.

Boris Johnson Hails Kemi Badenoch as “Future UK Prime Minister” During Visit to Nigeria

-

metro3 days ago

metro3 days agoSenate Launches Emergency Probe into Widespread Lead Poisoning in Ogijo, Lagos/Ogun

-

News3 days ago

News3 days agoBREAKING: Tinubu Sends Fresh Ambassadorial Nominations to Senate, Names Ibas, Ita Enang, Dambazau

-

Auto3 days ago

Auto3 days agoCourt of Appeal Affirms Ruling Barring VIO from Seizing Vehicles or Fining Motorists

-

Sports1 day ago

Sports1 day ago2026 FIFA World Cup Draw: England Draw Croatia as Brazil Face Morocco in Tournament Opener

-

News3 days ago

News3 days agoUS authorities arrest Nigerian CEO Cashmir Chinedu Luke for alleged $7m VA fraud

-

metro3 days ago

metro3 days agoFG secures release of three Nigerians detained in Saudi Arabia

-

metro3 days ago

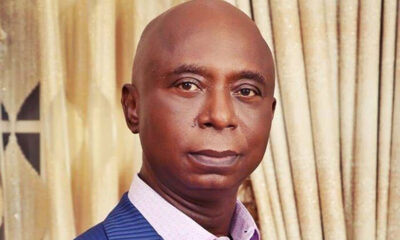

metro3 days agoNed Nwoko vows legal action against rising online harassment, criminal defamation

-

metro3 days ago

metro3 days agoBuratai Defends Nigeria’s Resilience, Says Nation Is “Rising, Not Failing” Despite Insecurity