“The Commissioner of Police FCT, CP Benneth Igweh, psc, mni, urges those circulating the video to desist from such actions as it may cause apprehension and unwarranted panic among the populace”, the statement added.

metro

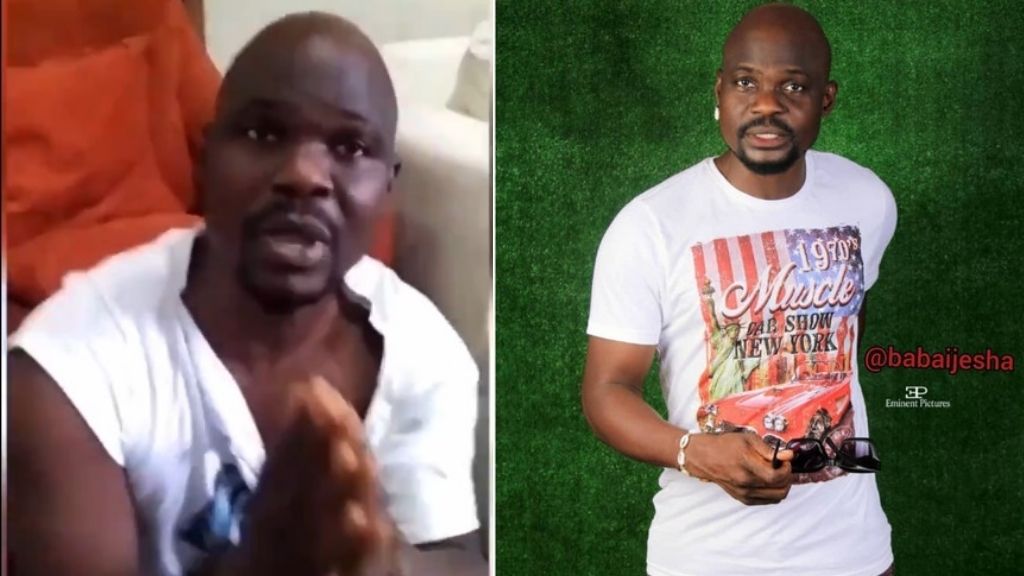

Defilement: Police say no plans to release Baba Ijesha

The police command in Lagos State has reacted to rumours of plans to release Nollywood actor, Baba Ijesha, who was arrested for alleged defilement, saying it is far from the truth.

Nollywood actress Iyabo Ojo and comedian Princess, among others, had stormed the SCID Panti on Thursday to protest alleged plans to release Baba Ijesha by the police. The Police Public Relations Officer (PPRO) in Lagos, CSP Olumuyiwa Adejobi, told journalists that there were no plans to release the suspect.

He added that the Commissioner Police in Lagos State, CP Hakeem Odumosu, had ordered the detention of the suspect pending the receipt of legal advice from the Directorate of Public Prosecutions (DPPs). “The CP had already said that the suspect would remain in police custody and would not be released.

“His case file has been sent to the DPP for advice. After the DPP’s advice, we will know what to do,” he said.

The 48-year-old Baba Ijesha was arrested on April 22 for allegedly defiling a minor. Adejobi had said in a statement that preliminary findings revealed that the suspect started assaulting the victim sexually since she was seven.

There was an uproar following a report that a directive had been given for the release of the Nollywood acto from custody.

The report was that the suspect could be released as he could not be detained indefinitely due to the ongoing strike by members of the Judicial Staff Union of Nigeria (JUSUN).

A video of the suspect confessing to the crime and begging for forgiveness had gone viral following the rumour that investigation revealed that Baba Ijesha did not defile the victim.

metro

In fresh attack, bandits invade two Zamfara communities, kill three, abduct many

In fresh attack, bandits invade two Zamfara communities, kill three, abduct many

Bandits have attacked two communities, Dauran and Zurmi in the Zurmi Local Government Area of Zamfara State, killing three persons and abducting an unconfirmed number of people.

The attack reportedly occurred on Wednesday night along with the razing down of the MTN service mast in the town, shutting down the network service in the area.

Channels TV quoted spokesperson for Zamfara State Police Command Yazid Abubakar as confirming the attack on Thursday.

He said three persons were killed in the attack but added that only one person was abducted.

“Yes, there was an attack in Zurmi town yesterday night and our men fought gallantly to repel that attack but unfortunately, three persons were killed and one person kidnapped,” he said.

“The MTN network operating in the town was also set ablaze during the attack.”

A resident of the town Nasiru Zurmi said the bandits invaded the town around 9pm after kidnapping five people in Dauran town.

According to him, three persons were killed in Zurmi town while a yet-unknown number of persons were abducted at the Emir’s Palace.

He said, “The bandits entered the town with sophisticated weapons around 9pm. They killed three persons and kidnapped three persons at the Emir’s Palace. The bandits also attacked Dauran and kidnapped five people there.”

metro

119 inmates escape Suleja prison after stormy rain

119 inmates escape Suleja prison after stormy rain

No fewer than 119 inmates yesterday escaped from the the Medium Security Custodial Centres, Suleja, Niger state, following the heavy downpour that destroyed the facility.

According to a statement signed by the Public Relations Officer, Federal Capital Territory (FCT), Command, Adamu Duza, at least 10 of the escapees have been recaptured and taken into custody following the the immediate activation of recapturing mechanism in collaboration with sister security agencies.

“A heavy downpour that lasted for several hours on yesterday night has wreaked havoc on the Medium Security Custodial Centres, Suleja, Niger state, as well as surrounding buildings, destroying part of the custodial facility, including its perimeter fence, giving way to the escape of a total of one hundred and eighteen (119) inmates of the facility.

“The Service has immediately activated its recapturing mechanisms, and in conjunction with sister security agencies have so far recaptured 10 fleeing inmates and taken them into custody, while we are in hot chase to recapture the rest.”

READ ALSO:

- Why we withdrew appeal against Kogi court order on Yahaya Bello – EFCC

- NiMet predicts three days sunshine, thunderstorms across Nigeria

- No robbery incident in Abuja, police reacting to viral video

Dazu said that the heavy rainfall that wreaked havoc on the custodial facility which was constructed during the colonial era, lasted over several hours, forcing it to give way for the inmates to escape.

“The Service is not unmindful of the fact that many of its facilities were built during the colonial era, and that they are old and weak.

“The Service is making frantic efforts to see that all ageing facilities give way for modern ones. This is evidenced in the ongoing construction of six (6) number of 3000-capacity ultra-modern custodial centres in all the geo-political zones in Nigeria as well as the ongoing reconstruction and renovation of existing ones.

“The Service wishes to assure the public that it is on top of the situation and that they should go about their businesses without fear or hindrance. The public is further enjoined to look out for the fleeing inmates and report any suspicious movement to the nearest security agency.” The statement reads in parts

119 inmates escape Suleja prison after stormy rain

metro

No robbery incident in Abuja, police reacting to viral video

No robbery incident in Abuja, police reacting to viral video

The FCT police command has said the video clip circulating online depicting a robbery incident, which purportedly occurred in Abuja, involving a “Right Hand Drive” vehicle, “did not take place within the territory”.

In a statement issued on Wednesday night by the command’s spokesperson, Josephine Adeh, said that upon analysis of the viral video, it was evidently clear that the robbery incident did not even occur in Nigeria.

READ ALSO:

- Naira in continues fall against dollar despite CBN $10,000 to BDCs

- Worry as long queues return to Abuja filling stations, five other states

- Iranian rapper sentenced to death for supporting anti-hijab protests

According to her, the conclusion was drawn from the vehicle registration number plate design and the steering position of the vehicle, which is Right Hand Drive, RHD.

“It is important to note that Nigeria does not allow RHD vehicles on its roads, neither are the roads fashioned to accommodate such cars as seen in the video.

-

Education5 days ago

Education5 days agoWhy we charge N42m fees for primary school pupils — Charterhouse Lagos

-

News7 days ago

News7 days agoUpdated: More trouble for Yahaya Bello as Immigration places him on watch list

-

Auto5 days ago

Auto5 days agoWe expect massive roll-outs of Nigeria-made cars by December 2024 – Minister

-

metro5 days ago

metro5 days agoJUST IN : Borrow pit collapses, kills seven Qur’anic school pupils

-

metro3 days ago

metro3 days agoHow gunmen killed Babcock university lecturer, abducted two – Police

-

International7 days ago

International7 days agoUpdated: Tragedy hits Kenya, Defence chief, nine others die in military helicopter crash

-

News4 days ago

News4 days agoWe’re not part of Yoruba Nation agitation, says MKO Abiola family

-

Politics5 days ago

Politics5 days agoOndo APC primary: Ododo, gov aspirant in open confrontation