News

FG to traders: Slash goods prices in one month or face penalties

FG to traders: Slash goods prices in one month or face penalties

The Federal Competition and Consumer Protection Commission (FCCPC) has granted a one-month grace period for traders and market stakeholders to lower prices on goods.

The decision, announced by the newly appointed Executive Vice Chairman, Mr. Tunji Bello came during a stakeholder engagement on exploitative pricing held in Abuja on Thursday.

Bello stated that enforcement actions against unfair pricing practices will begin after the grace period. The session aimed to confront the growing issue of excessive pricing and address the unethical practices observed within various market associations.

He highlighted an example of price inflation, noting that a Ninja fruit blender was priced at $89 (approximately N140,000) in a Texas supermarket, while the same item was listed at N944,999 in a Victoria Island, Lagos supermarket. Such stark differences, he remarked, reflect broader issues of market manipulation that threaten economic stability.

“Under Section 155 of the FCCPC Act, violators—whether individuals or corporations—face significant penalties, including hefty fines and imprisonment, if found guilty. This measure is intended to deter illicit practices. However, our approach is not punitive at this stage,” Bello explained. “We are providing a one-month grace period for stakeholders to adjust their pricing practices before we implement strict enforcement.”

READ ALSO:

- Troops kill 21 suspected IPOB members in August crackdown – DHQ

- Police release Dammy Krane six days after, apologises to Davido

- Troops neutralise 1,166 terrorists, arrest 1,096 suspects

He acknowledged the government’s awareness of the challenges faced by market participants and stressed the importance of cooperative solutions.

“While we recognize the genuine concerns raised by stakeholders; such as rising transportation costs and multiple layers of taxation; it is also essential to address any collusion among traders aimed at exploiting consumers.”

Stakeholders shared their perspectives on the factors driving price increases. Mr. Ifeanyi Okonkwo, Chairman of the National Association of Nigerian Traders (FCT Chapter), cited increased import duties at ports and urged the formation of a task force with association involvement for effective enforcement.

Emmanuel Odugwu from Kugbo Spare Parts Market reported a dramatic rise in transportation costs, with the price of moving a trailer load of tires from Lagos to Abuja increasing from N450,000 to over N1 million. Ms. Kemi Ashiri, Liaison Manager at Flour Mills, called for the harmonization of regulatory fines to support business sustainability.

Ikenna Ubaka, representing supermarket owners, attributed high costs to excessive bank interest rates, rent increases, and inflated prices from supply chains. He also noted that electricity distribution companies were imposing high charges on supermarkets.

Mr. Solomon Ukeme from the Master Bakers Association pointed out that the cost of essential baking ingredients, such as flour, sugar, and butter, has surged significantly, with a bag of flour now costing N74,000 compared to N34,000 previously. He linked these increases to multiple layers of taxation.

The engagement underscored the need for a concerted effort among market stakeholders and regulatory bodies to address pricing issues and promote fair market practices.

FG to traders: Slash goods prices in one month or face penalties

News

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

The University of Abuja (UniAbuja) has confirmed that 100-level student Sadiya Usman has been found safe after being reported missing earlier this week. The university expressed relief and gratitude to the public and security agencies for their assistance in locating the student.

Sadiya Usman, who is enrolled in the Department of Accounting, was last seen leaving her residence at Kontagora Estate, Gwagwalada, Abuja, on Tuesday, 18 February 2026, at around 8:00 a.m. She was on her way to the university’s Main Campus to sit for her Computer-Based Test (GST 111) but did not arrive for the exam.

READ ALSO:

- Lassa Fever Deaths in Nigeria Rise to 51 After 15 Killed in Early February – NCDC

- Mob Kills Injured Motorcycle Rider After AK‑47 Rifles, Ammunition Found in Crash Scene

- Tacha Condemns False Rape Allegations After Mirabel Admits Fabrication

After her disappearance, her guardian reported her missing when all attempts to reach her by phone were unsuccessful. The university promptly activated internal safety protocols and collaborated with security agencies, campus authorities, and the public to ensure her safe recovery.

The student was eventually located late on Thursday, 20 February 2026, around 11:49 p.m., and is reported to be safe, unhurt, and in stable condition. Authorities confirmed that coordinated efforts between the university, law enforcement, and concerned members of the public were instrumental in her recovery.

The university reaffirmed its commitment to student safety and welfare, promising continuous updates as necessary. It also thanked those who responded to the public appeal for information and urged students and parents to remain vigilant about safety.

This incident highlights the importance of campus security measures, timely reporting of missing persons, and the role of community involvement in safeguarding students.

UniAbuja Student Sadiya Usman Found Safe After Two Days Missing

News

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

The Ogun State Police Command has confirmed plans to arrest and prosecute TikTok user Mirabel after she admitted that her viral rape allegation was false, authorities and investigative reports indicate.

Mirabel, a social media influencer, first sparked national attention after posting videos alleging she had been sexually assaulted in her home in Ogijo, Ogun State. The posts quickly went viral, drawing widespread outrage, calls for justice, and prompting the police to launch an immediate investigation.

An audio recording of a phone conversation, shared online by social media personality VeryDarkMan (VDM), reportedly captures Mirabel acknowledging that parts of her story were fabricated. In the recording, she apologises and admits creating a threatening TikTok account to support her narrative, claiming she had been taking drugs at the time and “was not thinking clearly” when posting the videos.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

A police source said senior officers, including the Divisional Police Officer, were at the hospital where Mirabel was receiving medical care. Once she is discharged, she will be taken into custody and formally charged under provisions of Nigeria’s Criminal Code relating to false reporting of sexual offenses. “The essence is to serve as a deterrent to others,” the source added.

The Ogun State Police had earlier ensured that Mirabel received medical treatment and support, following procedures to protect her health while the investigation continued. The Lagos State Domestic and Sexual Violence Agency (DSVA) confirmed that the incident fell outside its jurisdiction and forwarded all relevant information to the Ogun authorities.

This development has sparked public debate about the responsible use of social media, the impact of false allegations, and the importance of evidence-based reporting. Legal experts warn that fabricating sexual assault claims can carry serious criminal penalties and may undermine the credibility of genuine victims.

Authorities continue to urge the public to avoid spreading unverified claims and to cooperate with law enforcement in ongoing investigations. Updates on the case will be issued by the Ogun State Police Command as formal legal proceedings begin.

News

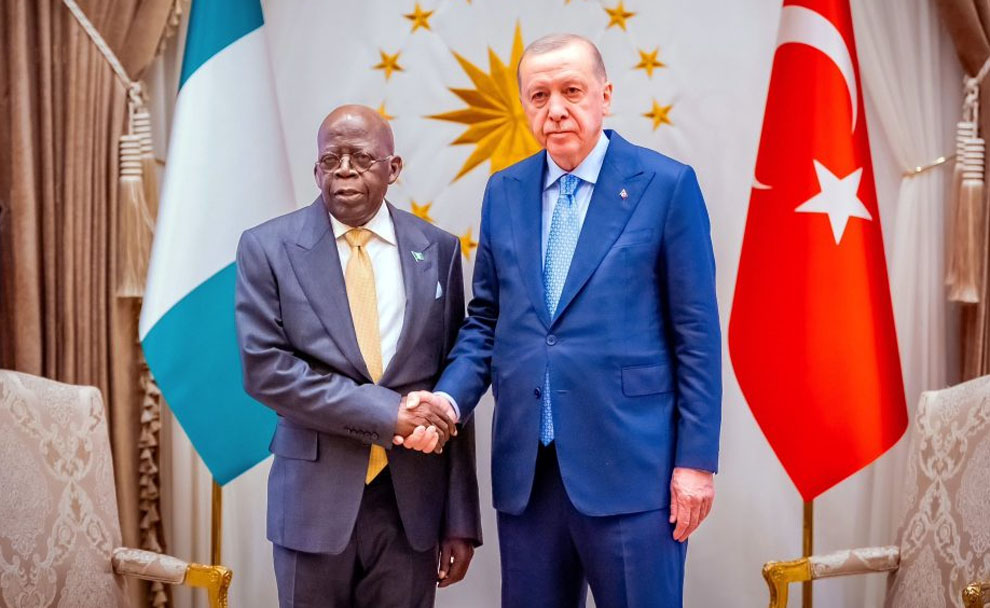

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

President Bola Tinubu has commenced a strategic expansion of Nigeria’s defence diplomacy, engaging the European Union (EU) and Turkey to strengthen the nation’s security architecture while reducing overreliance on the United States. The initiative comes as Nigeria faces multiple security threats, including Boko Haram insurgency in the north-east, farmer-herder clashes in the north-central region, separatist violence in the south-east, and escalating banditry in the north-west.

The move coincided with a visit to Brussels by National Security Adviser Mallam Nuhu Ribadu, who led discussions at the first EU-Nigeria Peace, Security, and Defence Dialogue. Both sides agreed to deepen collaboration on regional stability, counter-terrorism, and violent extremism, while enhancing intelligence sharing, maritime security, and cybersecurity cooperation. An EU diplomat in Abuja emphasized that the bloc would provide non-lethal military support, while respecting Nigeria’s sovereignty, describing the EU as “more consistent, more reliable, and more coherent than the United States” in delivering security assistance.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

During his state visit to Turkey in January 2026, President Tinubu also held defence discussions with Turkish officials. Turkish companies pledged to supply military equipment, advanced systems, and tactical hardware, while exploring joint local production arrangements with Nigeria. Türkiye is currently regarded as a global leader in armed drones, which could bolster Nigeria’s counter-terrorism operations and reconnaissance capabilities.

Despite these new partnerships, Nigeria continues security cooperation with the United States, including deployments by United States Africa Command (AFRICOM) to support training, intelligence sharing, and operational planning. Recent U.S. personnel arrivals in Bauchi State aim to enhance counter-terrorism capacity without taking direct combat roles, operating under Nigerian command structures.

Analysts say Nigeria’s diversified defence diplomacy seeks to reduce dependency on a single partner, while providing access to a wider range of technology transfer, training opportunities, procurement options, and operational expertise. The strategy also reflects a broader trend of African nations balancing traditional defence alliances with emerging strategic partners to better address evolving security threats.

With regional instability and domestic insurgency on the rise, Nigeria’s engagement with Turkey, the EU, and other partners is expected to strengthen the Nigerian Armed Forces, enhance counter-terrorism operations, and secure national and regional stability.

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

-

News3 days ago

News3 days agoRamadan Begins in Nigeria as Sultan Confirms Crescent Sighting

-

International1 day ago

International1 day agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

metro3 days ago

metro3 days agoSeven Killed in Horrific Crash at Ota Toll Gate

-

News2 days ago

News2 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

Health2 days ago

Health2 days agoRamadan Health Tips: Six Ways to Stay Hydrated While Fasting

-

News11 hours ago

News11 hours agoPolice to Arrest TikToker Mirabel After She Recants False Rape Claim

-

metro1 day ago

metro1 day agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors

-

Entertainment2 days ago

Entertainment2 days agoActress Destiny Etiko Breaks Silence on Alleged Nollywood Betrayal