metro

France-based Nigerian travels to Lagos, leads cyberattacks on 10 banks

The Police Special Fraud Unit in Lagos State on Wednesday said it arrested three suspects for allegedly attempting cyberattacks on 10 banks in the state.

The spokesperson for the unit, SP Eyitayo Johnson, in a statement, said the Commissioner of Police, PSFU, Nneka Anyasinti, while acting on intelligence received from a leading new generation bank, on March 30, 2022, arrested the suspects.

Johnson said the suspects were in the final stages of recruiting a worker from the information and technology department of one of the banks in order to perfect the hacking of the banks’ network/posting application with the intent to pull out huge sums of money.

He noted that the suspects were arrested with incriminating exhibits during a meeting held with the bank worker they attempted to recruit, adding that the fourth suspect, Chibuzor Holland, who flew into the country from France specifically for the operation, escaped.

He said, “The arrested members of the syndicate include Kehinde Oladimeji, 52, the mastermind; Olanrewaju Adeshina, 47; and Kolapo Abiodun, 42. Kolapo Abiodun is an ex-staff of the bank attached to the infotech department. He contacted and attempted to recruit a current worker of the bank’s infotech department with an offer of N200m and a visa out of Nigeria.

READ ALSO:

- Two more ladies accuse Lagos bishop of rape, narrate ordeal

- I’ll Relocate To Ghana If Tinubu Or Atiku Win 2023 Election – Charly Boy

- 2023: We Must Keep PDP Out Of Power – Tinubu

“The worker was asked to leave critical gateways open on the bank’s server for the syndicate to gain unauthorised access into the network and move money out using Python application and Zoom. After the arrests, forensic analysis of phones and electronic devices found in their possession disclosed a list of 10 other banks already earmarked to be hacked using a similar method once the first attack is successful.

“Operatives also discovered personal and corporate bank account details in the possession of the syndicate which they ought not to have. The case, charge no. FHC/L/238C/2022, is currently being prosecuted before Honourable Justice P.O. Lifu of the Federal High Court, Lagos Judicial Division, while effort is in top gear to apprehend Chibuzor Holland.”

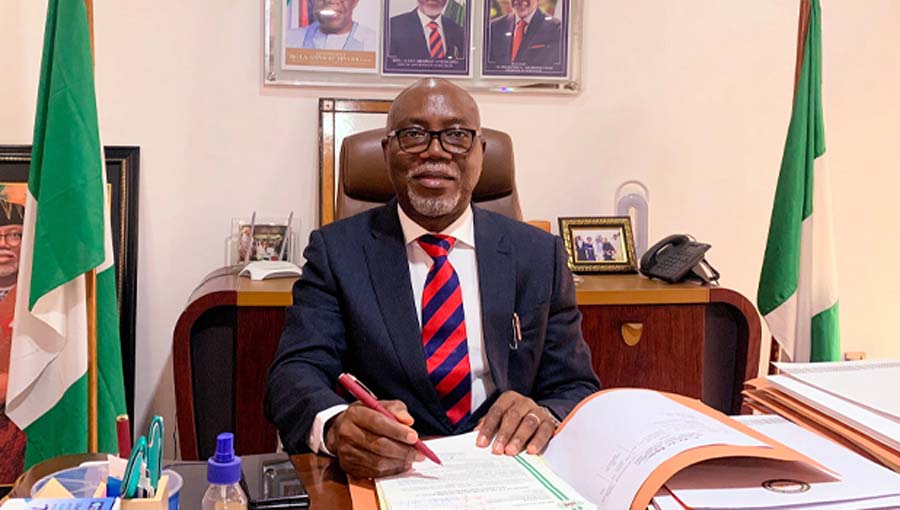

In a related development, the police unit confirmed the arrest of the Managing Director of Beedel Strategic Investment Co. Nigeria Limited, Moses Odeleye, over a fraud of N816m.

The PSFU spokesperson, Johnson, said discrete investigation by the unit’s operatives led to Odeleye’s arrest on May 24, 2022.

He noted that Odeleye was arrested in connection with the forgery of 11 local purchase orders of five multinational companies operating in Nigeria and one agency of the Federal Government.

Johnson stated that the suspect (Odeleye) paraded himself on social media as a successful contractor with interest in civil engineering, construction, real estate and supply, and importation of heavy engineering equipment.

He said, “Beedel (Odeleye), as the suspect is popularly known, operates in connivance with former and current procurement staff of the companies whose LPOs were used to perpetrate the fraud.

“He forged the LPOs of these companies/government agencies and approached numerous banks and investment companies with proposals to finance the LPOs, which he cleverly tenured to be paid between 30 and 60 days so as to make the LPO financing appear juicy.

“The suspect, using this modus operandi, was able to fraudulently obtain the sum of N816m from two finance companies and diverted same to fund extravagant lifestyles, which includes building a mansion, office complex and purchase of exotic automobiles.

“Investigation revealed that for over eight years, Beedel mastered the art of using cloned LPOs to consecutively secure huge sums via LPO financing from different banks/finance companies, while using monies from one bank/finance company to settle his commitments to another bank/finance company, to maintain the fraudulent cycle of robbing Peter to pay Paul.

“Beedel circumvented due diligence done by some of the banks/finance companies with the inputs of procurement staff of the companies whose LPOs were forged. These procurement staff conspired with the suspect to confirm invalid LPOs to third parties. The suspect will be charged to court as soon as the investigation is concluded.”

Meanwhile, Johnson said on April 15, 2022, the police unit was alerted to the risk and possible hack of the server of a non-interest financial institution located in Lagos State.

He said investigation by operatives attached to the Banking and Informal Financial Fraud Section of the PSFU revealed that between 3.45am and 4.55am on March 9, 2022, there was unauthorised modification of the profile of certain key staffers of the bank, which was done remotely.

“Investigation is ongoing to identify the persons responsible for the hack, while some of the staff initially alleged, have been exonerated,” he added.

metro

Man Arrested for Slitting Wife’s Throat During Farm Argument

Man Arrested for Slitting Wife’s Throat During Farm Argument

A tragedy occurred in Amaji Village, Umuoyoro Community, Omuma Local Government Area, Rivers State, when a man allegedly slit his wife’s throat during an argument on Thursday, February 19, 2026. The victim, a mother of two, reportedly died from a deep cut inflicted by her husband while they were at their farm, sources said.

According to witnesses, a domestic dispute escalated into violence after the suspect, identified as Mr. Abuchi, reportedly grabbed a kitchen knife and attacked his wife. Her screams attracted nearby villagers, who rushed to the scene, overpowered the suspect, and handed him over to the Rivers State Police Command.

The Police Public Relations Officer (PPRO), CSP Grace Iringe‑Koko, confirmed the arrest of the suspect and said the Commissioner of Police has ordered a detailed investigation to ensure timely justice.

READ ALSO:

- Armed Bandits Kill 30, Kidnap Villagers in Zamfara Attack

- Agege Council Announces Free 3kg Cooking Gas Refill for 4,000 Residents

- Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

“Yes, I can confirm the incident. The suspect has been arrested and a thorough investigation is ongoing to ensure justice is served,” she stated.

The incident has drawn condemnation from the Centre for Basic Rights and Accountability Campaign (CBRAC), which described the killing as the height of man’s inhumanity to man. The group called on the police to conduct a transparent investigation and ensure that justice is both served and seen to be served.

Prince Wiro, National Coordinator of CBRAC, said, “There is no justification for anyone to take another person’s life. This is a clear case of murder, and the Rivers State Police Command must ensure accountability.”

Residents of Amaji Village remain shocked and grieving, while community leaders urge peaceful resolution of disputes and enhanced measures to prevent domestic violence.

The case highlights the ongoing risks of domestic violence in Nigeria and the critical role of law enforcement and community awareness in protecting vulnerable family members.

Man Arrested for Slitting Wife’s Throat During Farm Argument

metro

Armed Bandits Kill 30, Kidnap Villagers in Zamfara Attack

Armed Bandits Kill 30, Kidnap Villagers in Zamfara Attack

At least 30 people have been killed and several others abducted following a late-night attack by armed bandits on Dutsin Dan Ajiya village in Anka Local Government Area, Zamfara State. The assault occurred on Thursday, February 19, 2026, when gunmen on motorcycles surrounded the community, blocked all exits, and opened fire on residents, witnesses said.

Eyewitnesses reported that the attackers stormed homes, shot indiscriminately, and kidnapped villagers, leaving many unaccounted for. Bodies were reportedly recovered early Friday morning, while several abducted residents were taken into nearby forests, according to local sources.

READ ALSO:

- Agege Council Announces Free 3kg Cooking Gas Refill for 4,000 Residents

- Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

- FCT Polls: S’Court, A’Court Defy Wike’s Public Holiday, Continue Judicial Activities

The attack comes just two days after the Zamfara State Government unveiled new security hardware, including drones and armoured vehicles, as part of ongoing efforts to combat banditry and rural violence. Despite these measures, the fresh raid highlights the persistent insecurity in Zamfara State, where bandit attacks, kidnappings, and property destruction have become recurring threats.

This incident follows a similar deadly raid in Arewa Local Government Area of Kebbi State, where at least 33 people were reportedly killed, underscoring the escalating insecurity across northwest Nigeria.

Attempts to obtain an official statement from the Zamfara State Police Command were unsuccessful as of press time. Security experts and residents are calling for urgent government and military intervention to protect vulnerable communities and prevent further bloodshed.

The latest attack is a grim reminder of the challenges facing rural communities in northwest Nigeria, where armed bandits continue to operate with impunity, threatening public safety, livelihoods, and social stability.

Armed Bandits Kill 30, Kidnap Villagers in Zamfara Attack

metro

Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

President Bola Tinubu has summoned Ondo State Governor Lucky Aiyedatiwa to Abuja following deadly violence during the All Progressives Congress (APC) ward congresses in Ondo State, which reportedly claimed four lives in Idanre and Akure North local government areas.

The President was said to be deeply disturbed by the killings, which occurred during what was expected to be a routine APC ward congress, especially in a state firmly controlled by the ruling party.

A senior government source in Akure disclosed that Governor Aiyedatiwa travelled to Abuja on Thursday after receiving the summons, following a series of security reports submitted to the Presidency detailing the violence that erupted during the APC congresses in Ondo State.

According to the source, the governor had earlier lined up activities to mark his one-year anniversary in office, but was forced to scale down the programme due to the presidential invitation.

The governor reportedly left Akure shortly after inaugurating the Igoba and Alagbaka Extension roads, without waiting for the commissioning of the 100,000-litre water supply project at the Federal University of Technology Akure Teaching Hospital (FUTATH) complex. His deputy, Dr. Olayide Adelami, represented him at other anniversary events.

READ ALSO:

- FCT Polls: S’Court, A’Court Defy Wike’s Public Holiday, Continue Judicial Activities

- Lassa Fever Deaths in Nigeria Rise to 51 After 15 Killed in Early February – NCDC

- Mob Kills Injured Motorcycle Rider After AK‑47 Rifles, Ammunition Found in Crash Scene

The source revealed that the summons was issued late Wednesday night, following the President’s review of multiple intelligence briefings.

“President Tinubu is said to be very angry over the Ondo killings and wants a clear explanation of what went wrong, particularly as the violence occurred within the APC, where there is no strong opposition,” the source said.

While it could not be independently confirmed if the governor met with the President, Aiyedatiwa was said to have returned to Akure later on Thursday, having been in Abuja ahead of a meeting expected on Friday.

Security Tension Deepens as Traditional Ruler Is Killed

Meanwhile, the security crisis in Ondo State worsened following the killing of the traditional ruler of Agamo Town, Oba Kehinde Jacob Faledun, who was murdered by suspected gunmen inside his palace on February 18, 2026, at about 7:10 p.m.

The killing triggered widespread fear and condemnation, prompting a swift response from security agencies.

The Ondo State Commissioner of Police, Adebowale Lawal, led a high-powered security delegation—including the Nigerian Army, the Nigeria Security and Civil Defence Corps (NSCDC), and the Department of State Services (DSS)—to the community.

Lawal assured residents that the police and military would track down the killers, stressing that justice would be served.

Preliminary investigations revealed that about six masked gunmen allegedly stormed the monarch’s residence, forcibly abducted him, and attacked him violently, leading to his death.

The Commissioner confirmed the deployment of additional security personnel, including tactical teams and operational assets, to Agamo and neighbouring communities, urging residents to provide credible intelligence to aid investigations.

He reassured the people of Ondo State that security agencies would continue to work together to restore peace, maintain stability, and protect lives and property.

Tinubu Summons Aiyedatiwa Over APC Congress Violence, Monarch’s Murder

-

International2 days ago

International2 days agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

Politics17 hours ago

Politics17 hours agoPeter Obi Launches ‘Village Boys Movement’ to Rival Tinubu’s City Boys Ahead of 2027

-

News24 hours ago

News24 hours agoPolice to Arrest TikToker Mirabel After She Recants False Rape Claim

-

News3 days ago

News3 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

Health3 days ago

Health3 days agoRamadan Health Tips: Six Ways to Stay Hydrated While Fasting

-

Entertainment3 days ago

Entertainment3 days agoActress Destiny Etiko Breaks Silence on Alleged Nollywood Betrayal

-

International1 day ago

International1 day agoEpstein, Ex-Israeli PM Named in Alleged Profiteering From Boko Haram Crisis

-

metro2 days ago

metro2 days agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors