News

Gbajabiamila holds closed-door meeting with Buhari over cash withdrawal limit, trapped ‘N89trn’ stamp duty

President Muhammadu Buhari and the Speaker of the House of Representatives, Femi Gbajabiamila, held a closed-door meeting on Tuesday, discussing the cash withdrawal limits recently introduced by the Central Bank of Nigeria (CBN).

The CBN Governor, Godwin Emefiele, who was supposed to appear before the House of Representatives on Tuesday, did not honour the invitation, saying he was out of the country.

They also discussed issues related to the 2023 general elections and the alleged N89trn stamp duty controversy at the meeting held at the State House, Abuja.

“There were issues around cashless policy, issues around elections and violence that seem to be erupting here and there are a couple of other very important matters as well,” Gbajabiamila told journalists after the meeting.

The Speaker said the National Assembly has no connection with the task of being pursued by a member of the lower chamber and the Secretary of the dissolved Presidential Committee on Reconciliation and Recovery of Stamp Duties Revenue, Muhammadu Gudaji Kazaure.

Kazaure had said President Buhari secretly constituted the committee to recover the purportedly trapped N89 trillion stamp duties.

READ ALSO:

- FG to stop cash withdrawal from all govt accounts

- Bawa, EFCC Chairman, addresses OIC meeting in Jeddah as EFCC auctions forfeited cars in Ilorin

- As Atiku promises to open all borders, Katsina emir says his chances bright

However, the Senior Special Assistant to the President on Media and Publicity, Malam Garba Shehu, had said last week Tuesday that the claims of a missing N89 trillion from stamp duty appeared false and a figment of their malicious imaginations after President Buhari had rescinded the approval he gave via the late Abba Kyari’s letter of March 28 and asked that the committee be stopped from operating under the seal of his office long before he stirred up the latest controversy.

“The same set of consultants claimed in 2016 there was N20 trillion to be collected. It was found to be false. The entire banking sector deposit is not even up to half of N89 trillion.

“Indeed, if the Federal Government can find N89 trillion Naira, it can pay off all its debt, both foreign and local currency and all state government debts and still have over N10 trillion left.

“So, the claim by these so-called consultants and the disbanded committee is totally ridiculous and a complete mockery,” he also said.

He had added that a duly authorized committee under the Attorney-General and Minister of Justice, Abubakar Malami (SAN) was working to reconcile, recover and transfer all Stamp Duties into Stamp Duties Central Account.

Asked if he discussed the Kazaure issue as a member of the House of Representatives, the Speaker said: “Kazaure, from my understanding, he is working with whoever he is working with. If it necessitates the house coming in, we will come in. If he has an official function, he should go ahead and do his work. But this has nothing to do with National Assembly. Not that I know of.

READ ALSO:

- JAMB announces dates for 2023 UTME registration, exam proper

- Obi pledges tech-driven education, supporters shut down Uyo

- FG to stop cash withdrawal from all govt accounts

“It was not based on a resolution of the National Assembly. It was not based on a motion from the National Assembly, I believe he said he had the executive authority to do what he’s doing. If that’d be the case, I mean, then it’s got nothing to do with the National Assembly.”

Asked whether the house would call him to order since he was not representing them, he said: “The house can only call Kazaure to order to the extent that it is impugning on the integrity of the house or individuals or leadership of the House that have nothing to do with what heis doing.

“It is important to separate the two, if he has a mandate to do something, that’s on him. When it came up, we had asked members of the executive, they said they were not aware of any mandate or such mandate has been withdrawn. I don’t want to get into it. I don’t want to get into it except to the extent that he tries to impugn on the integrity of members of the House. And that’s a no no, we have nothing to do with this.”

On what the house would do between now and next year, Gbajabiamila said the 2023 budget would be passed on Thursday.

He said the lower chamber of National Assembly would use 10 days to do “house cleaning matters” and attend emergency issues before going back for campaigns and elections.

On his regular routine meeting with the President which he described as “fruitful”, Gbajabiamila said it was meant to get his perspectives on some state matters of national interest and shared the position of National Assembly with him.

He said the discussion focused on cashless policy, elections and related violence, adding that the opportunity was used to wish the President happy birthday and offer prayers for longer life and Allah’s continued protection and blessings on his life.

Daily Trust

News

Tinubu Rejects Calls to Suspend New Tax Laws, Insists Reforms Will Proceed

Tinubu Rejects Calls to Suspend New Tax Laws, Insists Reforms Will Proceed

President Bola Tinubu has rejected calls to suspend the implementation of Nigeria’s new tax laws, insisting that no substantial issue has been established to justify halting the reform process.

In a statement personally signed on Tuesday, Tinubu affirmed that the tax reform laws, including those that took effect on June 26, 2025, and others scheduled to commence on January 1, 2026, will be implemented as planned.

“No substantial issue has been established that warrants a disruption of the reform process,” Tinubu said. “Absolute trust is built over time through making the right decisions, not through premature, reactive measures.”

The president’s position comes amid growing public debate over alleged discrepancies between the tax acts passed by the National Assembly and versions published in the Official Gazette.

On December 26, the National Assembly ordered a re-gazetting of the tax laws after acknowledging differences between the legislative versions and the published documents. In separate statements, the House of Representatives spokesman, Akin Rotimi, and the Clerk to the National Assembly, Kamoru Ogunlana, assured Nigerians that the matter was being addressed within constitutional and statutory limits.

READ ALSO:

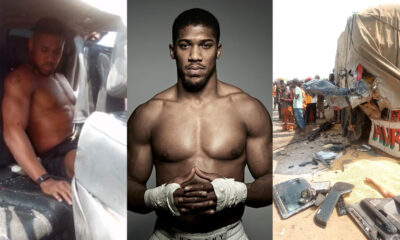

- Two Close Aides of Anthony Joshua Identified as Victims of Fatal Crash

- Court Orders Accelerated Hearing of Suit Challenging 2025 Tax Acts, Declines Injunction

- Sophia Momodu Asks Fans to Stop Calling Her Davido’s Wife

They explained that the review was being conducted in line with the 1999 Constitution, the Acts Authentication Act, and established parliamentary practice, stressing that the exercise was purely administrative and did not suggest any defect in legislative authority.

“This administrative action is intended solely to authenticate and formally reflect legislative decisions,” the statements said, adding that certified true copies would be made available to stakeholders and the public.

However, former Vice President Atiku Abubakar described the situation as “a grave constitutional issue,” arguing that any law published in a form not passed by the National Assembly amounts to a nullity.

“A law that was never passed in the form in which it was published is not law,” Atiku said, warning that any post-passage alteration without legislative approval would constitute a constitutional breach.

Despite the controversy, President Tinubu, who is currently on vacation in Europe, reiterated his administration’s commitment to due process and pledged continued collaboration with the National Assembly to resolve any outstanding issues.

“These reforms are a once-in-a-generation opportunity to build a fair, competitive, and robust fiscal foundation for our country,” Tinubu stated, adding that the new laws are aimed at harmonisation, structural reset, and strengthening the social contract, not increasing tax burdens.

The affected legislations include the Nigeria Tax Act 2025, Nigeria Tax Administration Act 2025, Joint Revenue Board of Nigeria (Establishment) Act 2025, and the Nigeria Revenue Service (Establishment) Act 2025.

Tinubu urged stakeholders to support the implementation phase, which he described as firmly in the delivery stage, assuring Nigerians that the reforms are designed to promote prosperity and shared responsibility.

Tinubu Rejects Calls to Suspend New Tax Laws, Insists Reforms Will Proceed

News

NAF Bombards Lakurawa, Bandit Camps in Zamfara after US airstrike

NAF Bombards Lakurawa, Bandit Camps in Zamfara after US airstrike

In a major escalation of counterterrorism operations across the North-West, the Nigerian Air Force (NAF) has carried out devastating precision airstrikes on notorious bandit enclaves in Zamfara State, coming on the heels of United States missile strikes that crippled Lakurawa terrorist camps in Sokoto.

The Air Component of Operation Fansan Yamma, Sector 2, executed two high-impact air interdiction missions at Turba Hill and the camp of feared bandit leader, Kachalla Dogo Sule, both located in Tsafe Local Government Area of Zamfara State. Several bandits were neutralised, while key operational facilities were destroyed.

Director of Public Relations and Information of the NAF, Air Commodore Ehimen Ejodame, described the strikes as a significant breakthrough in the sustained offensive against armed banditry.

He said the operations were intelligence-driven, relying on credible, multi-source intelligence and persistent surveillance. The first strike targeted Turba Hill, identified as a major bandit hideout. According to Ejodame, aerial reconnaissance revealed intense human activity and a zinc-roofed structure serving as the nerve centre of the enclave.

“Following positive identification, the target was engaged with precision. Post-strike assessments confirmed the complete destruction of the structure and the neutralisation of several bandits,” he said.

The second mission struck Kachalla Dogo Sule’s Camp, a notorious stronghold linked to the manufacture and deployment of improvised explosive devices (IEDs). Intelligence reports had connected the camp to recent deadly IED attacks along the Dan Sadau–Magami axis.

“The precision strike triggered intense fires that destroyed multiple active structures, effectively crippling the group’s IED production and operational capacity,” Ejodame added.

He noted that the airstrikes had significantly degraded bandit networks in Zamfara and reaffirmed the NAF’s commitment, in collaboration with other components of Operation Fansan Yamma, to denying criminal elements safe havens and restoring lasting peace across the North-West.

Army Confirms US Missile Strikes on Sokoto Terror Camps

Meanwhile, the Nigerian Army has confirmed that recent United States airstrikes targeted Lakurawa terrorist camps in Tangaza Local Government Area of Sokoto State, delivering a heavy blow to the group’s operational capability.

A senior Army Headquarters source disclosed that the strikes were conducted in coordination with US Africa Command (AFRICOM) following actionable intelligence on terrorist movements along the Kaurau axis. The missile strikes hit camps in the Bauni Forest near Waria and Alkassim villages on December 25.

Follow-up patrols carried out the next day confirmed extensive destruction of terrorist infrastructure. Troops later recovered missile debris in Kajiji town, Tambuwal LGA, Kebbi State, believed to be components of Tomahawk missiles.

Army engineers identified some of the debris as fuel boosters weighing about 300 kilograms, capable of penetrating soft ground up to two metres. The Army assured residents that investigations and recovery operations were ongoing and urged the public to report any suspicious objects.

Eight Killed as Terrorists Attack Kebbi Communities

Despite the military gains, terror struck Kebbi State as gunmen launched coordinated attacks on Kaiwa, Gelawu and Gebbe villages in Shanga Local Government Area, killing at least eight people and injuring several others.

The Kebbi State Police Command confirmed that seven victims died during the attacks, while another later succumbed to injuries in hospital. One injured person is currently receiving treatment.

Police spokesperson, CSP Bashir Usman, said security forces had intensified patrols and surveillance across the affected areas to prevent further attacks, though details of ongoing operations could not be disclosed.

Residents described the assaults as unprecedented and devastating, forcing many villagers to flee their homes in fear.

Troops Kill 80 Terrorists, Rescue 34 Victims Nationwide

In a broader update, the Nigerian Army announced that troops killed over 80 terrorists, rescued 34 kidnapped civilians and arrested several criminal suspects in coordinated operations across multiple states between December 25 and 29.

The operations spanned Borno, Adamawa, Sokoto, Katsina, Niger, Zamfara, Plateau, Delta, Cross River and the Federal Capital Territory.

In Borno State, air and ground offensives neutralised 57 terrorists and disrupted ISWAP/JAS networks, while operations in Niger and Katsina repelled coordinated attacks and recovered stolen livestock.

Troops also rescued kidnapped civilians in Kebbi and Plateau states, arrested illegal miners in the FCT, apprehended armed robbery suspects, and dismantled oil bunkering and piracy syndicates in Delta and Cross River states.

The Army said the successes underscore its resolve to sustain intelligence-driven operations, protect lives and property, and dismantle terrorist and criminal networks across the country.

News

Sokoto Operation: FG Reassures Investors, Says Nigeria’s Economy Remain Stable

Sokoto Operation: FG Reassures Investors, Says Nigeria’s Economy Remain Stable

The Federal Government has reassured investors, financial analysts, and international development partners that Nigeria remains peaceful, stable, and economically resilient despite concerns following a joint security operation in Sokoto carried out on Christmas Day.

The Minister of Finance and Coordinating Minister of the Economy, Wale Edun, gave the assurance in a statement issued on Sunday in Abuja, explaining that the operation—conducted in collaboration with the United States—was a targeted, intelligence-led action aimed solely at terrorist elements threatening national security and economic activities.

“What Nigeria is decisively confronting—alongside trusted international partners—is terrorism,” Edun said, stressing that the context of the operation was essential to understanding its broader economic implications.

He described the Sokoto operation as “precise, intelligence-led, and focused exclusively on terrorist elements that threaten innocent lives, national stability, and economic activity,” adding that the action was designed to strengthen security rather than unsettle financial markets or undermine investor confidence.

“Far from destabilising markets or weakening confidence, such actions strengthen the foundations of peace, protect productive communities, and reinforce the conditions required for sustainable economic growth. Security and economic stability are inseparable; every effort to safeguard Nigerians is, by definition, pro-growth and pro-investment,” the minister said.

READ ALSO:

- Ibadan Explosion: Fayose Releases Documents, Claims Makinde Got ₦50bn from FG

- Italy Arrests Nine Over €7M Hamas Funding Network, Seizes €8M in Assets

- Kennedy Center Sues Musician for $1M Over Trump Name Cancellation

Edun noted that under the leadership of President Bola Ahmed Tinubu, Nigeria has recorded measurable progress in security improvements and economic reforms, reflected in key macroeconomic indicators.

According to him, Nigeria’s GDP grew by 3.98 per cent in Q3 2025, following a strong 4.23 per cent growth in Q2, with expectations of an even stronger performance in Q4 2025. He added that inflation has slowed for the seventh consecutive period and now stands below 15 per cent, attributing the improvement to coordinated fiscal and monetary policies.

The minister said Nigeria’s financial markets remain stable, with both domestic and international debt markets functioning efficiently under prudent fiscal management. He recalled that the country recently secured credit rating upgrades from Moody’s, Fitch, and Standard & Poor’s, describing them as independent validation of the government’s reform agenda.

“We have maintained fiscal discipline, prioritised efficiency, and protected macroeconomic stability, demonstrating resilience in the face of external shocks,” Edun said.

Referring to President Tinubu’s recent national address, Edun stated that the administration’s focus for 2026 is to consolidate gains made in 2025, strengthen economic resilience, and sustain momentum toward inclusive and durable growth.

Assuring local and foreign investors ahead of market reopening on Monday, December 29, 2025, Edun said confidence in Nigeria’s economic direction remains justified.

“As markets reopen, investors can be confident that Nigeria remains reform-driven, stable, and focused on growth. The fundamentals are strengthening, the policy direction is clear, and this administration’s resolve to protect lives and secure prosperity is unwavering,” he said.

He concluded by reaffirming the country’s investment outlook: “Nigeria remains open for business, anchored in peace, and firmly focused on the future.”

Sokoto Operation: FG Reassures Investors, Says Nigeria’s Economy Remain Stable

-

metro2 days ago

metro2 days agoIbadan Explosion: Fayose Releases Documents, Claims Makinde Got ₦50bn from FG

-

metro2 days ago

metro2 days agoNiger Delta Crackdown: Army Seizes ₦150m Stolen Oil, Arrests 19 Suspects

-

metro2 days ago

metro2 days agoPlateau Kidnappers Demand ₦1.5m Each as 28 Muslim Travellers Remain in Captivity

-

Sports2 days ago

Sports2 days agoCristiano Ronaldo Wins Best Middle East Player at 2025 Globe Soccer Awards in Dubai

-

Opinion3 days ago

Opinion3 days agoHow a Misleading Channels TV Headline Reignited Nigeria’s Religious Tensions

-

Sports2 days ago

Sports2 days agoAnthony Joshua injured as two die in fatal Lagos-Ibadan Expressway crash (plus photos)

-

metro3 days ago

metro3 days agoNigerian Army Kills 438 Boko Haram, ISWAP Terrorists in Seven Months

-

metro2 days ago

metro2 days agoBello Turji Not Killed in US Airstrikes, Security Expert Debunks Reports