News

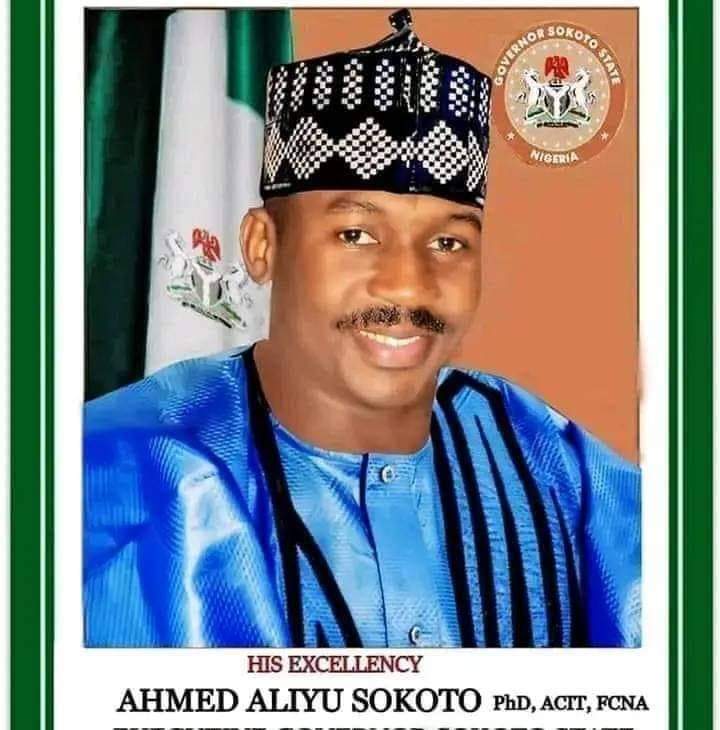

just in: Supreme Court upholds election of Aliyu as Sokoto gov

just in: Supreme Court upholds election of Aliyu as Sokoto gov

The Supreme Court on Thursday affirmed Ahmad Aliyu as the truly elected governor of Sokoto State.

The apex court, in its lead judgement delivered by Justice Tijjani Abubakar, dismissed an appeal the Peoples Democratic Party, PDP, and its candidate, Saidu Umar, filed to challenge the outcome of the governorship election held in the state on March 18, 2023.

The court held that it found no reason to set aside the concurrent judgements of the Court of Appeal and the Sokoto State Governorship Election Petition Tribunal, which dismissed the appeal that aaaaasought to upturn the election victory of Governor Aliyu, who was the candidate of the All Progressives Congress, APC.

The Independent National Electoral Commission, INEC, had announced that Governor Aliyu polled a total of 453,661 votes to defeat his closest rival, Umar of the PDP who polled 404,632 votes.

Dissatisfied with the outcome of the election, Umar and the PDP approached the tribunal, alleging that Aliyu and his deputy, Idris Gobir, were not eligible to contest the gubernatorial poll.

The petitioners contended that Governor Idris and his deputy did not secure the majority of valid votes that were cast at the election to be declared winners by INEC.

They further alleged that the election was not only marred by irregularities but was also not conducted in substantial compliance with provisions of the Electoral Act 2022.

Aside from alleging that the governor and his deputy submitted forged certificates, with variations of names, to INEC in aid of their qualification to contest the election, the petitioners added that electoral fraud occurred in 138 polling units in the state.

However, the three-man panel tribunal, in a judgement it delivered on September 30, 2023, dismissed the petition as lacking in merit.

The Justice Haruna Mshelia-led tribunal held that the petitioners were unable to prove any of the allegations they raised in the petition.

It held that evidence of most of the witnesses who testified for the PDP and its candidate were incompetent as their statements on oath were not front-loaded alongside the petition as required by law.

The tribunal held that the allegation of forgery, being criminal, ought to have been proved beyond reasonable doubt, a burden it said the petitioners failed to discharge.

More so, the tribunal noted that 70 per cent of exhibits the petitioners adduced before it, were out of context and they related to the State House of Assembly elections that were conducted on the same date the governorship poll was held.

The Abuja Division of the Court of Appeal, on November 27, 2023, upheld the decision of the tribunal.

The appellate court panel held that most of the proof of evidence the petitioners produced in support of their case was legally inadmissible.

It held that the tribunal was right when it expunged the incompetent exhibits that were either not pleaded or irrelevant to the case that was brought before it.

Not happy with the judgement, the PDP and its candidate went to the Supreme Court, where they also lost the case on Thursday.

News

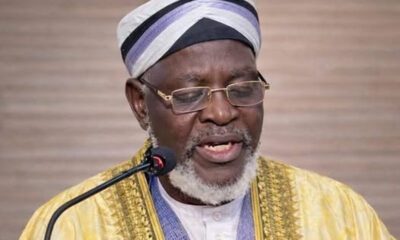

NSCIA Secretary-General Clarifies Council Receives No Government Funding

NSCIA Secretary-General Clarifies Council Receives No Government Funding

The Secretary-General of the Nigerian Supreme Council for Islamic Affairs (NSCIA), Prof. Is-haq Oloyede, has clarified that the council has never received financial support from any government, either within or outside Nigeria. Speaking in Lagos at the 31st Annual Pre-Ramadan Lecture of the University of Lagos Muslim Alumni (UMA), Oloyede stressed that the NSCIA operates independently and relies largely on modest private donations to sustain its activities.

Oloyede, who also serves as Registrar of the Joint Admissions and Matriculation Board (JAMB), explained that in his 15-year tenure as NSCIA Secretary-General, the council had not received “a kobo” from any government. He added that fewer than 20 individuals have donated amounts up to ₦500,000 since 2013, highlighting that the council functions without significant external funding. He decried misinformation and divisive narratives suggesting government involvement under the leadership of the Sultan of Sokoto, Muhammad Saad Abubakar, noting that such speculation undermines unity within Nigeria’s Muslim community.

READ ALSO:

- Saudi Supreme Court Calls on Muslims to Sight Ramadan Crescent Moon on Tuesday Evening

- Nigeria Tax Act 2025: FG Clarifies No New Construction or Bank Taxes

- Israeli Airstrikes Kill 12 in Gaza as Violence Persists Despite Ceasefire

Speaking on the theme “Muslims: The Challenge of National Security,” Oloyede warned against viewing insecurity, terrorism, and banditry through a religious lens. He said extremists often cloak their violent acts in religious language, but such actions do not reflect Islam. “Islam cannot be determined by what extremists say or do. We have a duty to correct that narrative,” he said, urging Muslims to reject all forms of extremism while understanding that insurgency thrives on enabling political, social, and economic conditions.

Oloyede stressed that security is central to Sharia, emphasizing that a true Muslim is someone “from whose actions neighbours — regardless of their faith — are safe and secure.” He cautioned against reducing insecurity to regional or religious differences, noting that all parts of Nigeria face security challenges. He called on Muslims to embrace moral responsibility, civic accountability, and practical partnerships to improve national security.

Other speakers at the lecture also highlighted the societal dimensions of insecurity. Dr. Ridwan Jamiu, Chief Imam of Lekki Central Mosque, described insurgents as agents of evil and stressed the need for religious leaders to promote peace and guide followers toward positive community engagement. Lagos State Assembly Speaker Mudashiru Obasa identified poverty and economic inequality as key drivers of insecurity and urged the government and policymakers to focus on job creation, education, and inclusive development as long-term solutions.

The lecture, part of the annual pre-Ramadan engagements, comes at a time when Nigeria continues to grapple with complex security challenges, including insurgency in the Northeast, banditry in the Northwest and North-Central, and rising violent crime in the South. Experts emphasize that national cohesion, interfaith cooperation, and community-led security initiatives are vital to tackling these threats effectively.

NSCIA Secretary-General Clarifies Council Receives No Government Funding

News

Saudi Supreme Court Calls on Muslims to Sight Ramadan Crescent Moon on Tuesday Evening

Saudi Supreme Court Calls on Muslims to Sight Ramadan Crescent Moon on Tuesday Evening

The Supreme Court of Saudi Arabia has urged Muslims across the Kingdom to look for the Ramadan crescent moon on the evening of Tuesday, February 17, 2026, to determine the official start of Ramadan 1447 AH. The court emphasized that community participation in moon sighting is vital for confirming the beginning of the holy month.

In an official statement relayed by the Saudi Press Agency, the Supreme Court instructed anyone who spots the new moon crescent — either with the naked eye or using binoculars — to report their observation to the nearest court and ensure their testimony is recorded. Local centres have also been set up to assist observers in reaching judicial offices.

The Kingdom has established moon sighting committees across regions to coordinate observations and support public involvement. Authorities encouraged citizens to actively participate, noting that their contributions are essential to help Muslims across Saudi Arabia begin Ramadan in unity.

READ ALSO:

- Nigeria Tax Act 2025: FG Clarifies No New Construction or Bank Taxes

- Israeli Airstrikes Kill 12 in Gaza as Violence Persists Despite Ceasefire

- FBI Probe Continues as Ex‑Church Minister Who Confessed to Child Abuse Remains Free

Tuesday corresponds to 29 Sha’ban 1447 AH in the Islamic lunar calendar. If the crescent moon is sighted, Ramadan 1447 AH will commence on Wednesday, February 18, 2026. If the moon is not visible, Sha’ban will be completed as 30 days, and Ramadan will begin on Thursday, February 19, 2026. This aligns with centuries-old Islamic tradition of lunar observation.

Muslims worldwide, including in the Gulf Cooperation Council (GCC) countries, are preparing for Ramadan, a sacred month of fasting, prayer, reflection, and charity. Astronomical forecasts suggest visibility may vary across regions, making local observations and testimonies crucial. Similar calls for crescent moon sightings have also been issued by authorities in countries such as Qatar and the United Arab Emirates.

The Supreme Court’s announcement underscores the importance of lunar observation in Islamic practice and encourages public engagement to ensure a synchronized start of Ramadan across the Kingdom.

Saudi Supreme Court Calls on Muslims to Sight Ramadan Crescent Moon on Tuesday Evening

News

Presidency Dismisses El-Rufai’s Thallium Claim as Diversion From N432bn Probe

Presidency Dismisses El-Rufai’s Thallium Claim as Diversion From N432bn Probe

The Presidency has dismissed former Kaduna State Governor Nasir El-Rufai’s recent claim that the Office of the National Security Adviser (ONSA) procured thallium sulphate, describing it as a politically motivated attempt to stir tension and divert attention from corruption allegations linked to his tenure in Kaduna State.

Officials said the allegation comes shortly after the Kaduna State House of Assembly reportedly endorsed a petition to the Independent Corrupt Practices and Other Related Offences Commission (ICPC) and the Economic and Financial Crimes Commission (EFCC), urging investigations into alleged financial improprieties totaling N432 billion during El-Rufai’s administration. The anti-graft agencies have since invited him for questioning.

Reacting to El-Rufai’s inquiry to the NSA, the Senior Special Assistant to the President on Media and Publicity, Temitope Ajayi, said the former governor was spreading misinformation capable of generating fear and unrest, while attempting to portray himself as a victim. Ajayi stressed that no government procurement or importation of thallium sulphate had taken place through ONSA.

READ ALSO:

- Ghana Moves to Extradite Russian Man Over Secret Sex Video Scandal

- Residents Flee as Gunmen Launch Fresh Attack on Kwara Community

- DSS Probes El-Rufai’s Claim of Toxic Chemical Import by Ribadu

“Mallam El-Rufai certainly got a reply to his letter from the NSA’s office, and he should be honourable enough to release it just as he mischievously released his own letter,” Ajayi said in a statement shared on social media.

According to the Presidency, El-Rufai’s actions are designed to create political instability and shift public focus away from the corruption allegations he faces. The statement argued that he is attempting to “nationalise his personal challenges” with the Kaduna State Government, insisting the controversy is not about President Bola Tinubu or the NSA, but about his waning political influence after eight years in office.

The Presidency further claimed El-Rufai had lost support from key stakeholders in Kaduna, including political allies, and had fallen out with his successor, Uba Sani, whom he had previously endorsed. Government officials urged the former governor to abandon political theatrics and address the allegations through appropriate legal and institutional channels.

The controversy comes amid heightened attention to both the thallium sulphate claim and the ongoing N432 billion Kaduna corruption probe, with analysts observing potential political and legal implications for the former governor.

Presidency Dismisses El-Rufai’s Thallium Claim as Diversion From N432bn Probe

-

Education22 hours ago

Education22 hours agoCheck Your Name: UNILORIN Releases Updated NELFUND Refund List for 2024/2025 Students

-

News13 hours ago

News13 hours agoOsogbo Sons and Daughters Mark 5th Anniversary with Awards, Political Undertones

-

metro2 days ago

metro2 days agoWoman Arrested Over Murder of Nigerian E-Hailing Driver in South Africa

-

metro2 days ago

metro2 days agoBoko Haram Terrorists Release Video of 176 Abducted Kwara Residents

-

News24 hours ago

News24 hours agoAfenifere Calls for Immediate Take-Off of State Police as Terror Threats Rise in Yorubaland

-

metro3 days ago

metro3 days agoCourt Orders DIA to Produce Cleric Accused of Coup Plot by February 18

-

metro24 hours ago

metro24 hours agoUS Military Boosts Support for Nigeria’s Fight Against Insurgency With Ammunition, Troop

-

metro23 hours ago

metro23 hours agoArgungu Festival 2026 Highlights Peace, Stability, Economic Growth — Tinubu