Business

Nigerians blast GTBank over customer’s stolen N3.1m

Nigerians blast GTBank over customer’s stolen N3.1m

Guaranty Trust Bank Plc (GTBank) has come under severe criticism from Nigerians over the alleged theft of N3.1 million from the account of one of its customers, Banjo Adedayo.

According to the Foundation for Investigative Journalism (FIJ), “Adedayo’s ordeal started on Monday, April 17, 2023, when some men forcefully collected his phone at his estate in Ogun State in the morning.”

He informed FIJ that, to prevent the potential loss of his funds, he promptly contacted his network provider to bar his line and informed GTBank to impose restrictions on his account.

“To be sure my account was safe, I inserted my GTBank ATM card into a machine to withdraw, but the machine said my account had been deactivated.

“The same thing was said when I inserted my Zenith Bank ATM card in it, and it was because I had blocked them both,” Adedayo told FIJ.

Three days later, Adedayo retrieved his SIM card and traveled to a GTBank branch in Ogun State to get the restriction lifted from his account, which he accomplished, but the next morning, he couldn’t believe his eyes.

“I woke up to the rudest shock of my life on April 21,” Adedayo said.

“An email had popped up, and upon opening it, I saw that all my hard-earned N3,130,000 had been wiped out.

“I went to the bank to make complaints, and all they did was print me the statement of account. I went to the police and did all that I could but to no avail.”

In retrospect, Adedayo suspected foul play, speculating that the theft had been planned inside, given the password protection on his SIM card and the quick action to block his bank accounts.

READ ALSO:

- Hardship: Nigerian government to distribute grains across states

- Soldier, two others killed in fresh herdsmen attacks on Benue communities

- Police storm criminal hideouts, arrest 18 street urchins in Kano

“Could the thieves be waiting for me to retrieve my SIM? Even if they did, they would not be able to steal my money. It was an inside job. I remember I was tired at the bank and wanted to go home, but this female cashier kept urging me to be patient,” he recalled.

“Later that day, she contacted me using her number and did not discuss anything related to banking matters. The next morning, my funds were gone. I strongly suspect an insider’s hand in this. It’s been nearly a year, and I demand restitution,” Adedayo stated.

In response to the statement, Ishowleck Omo Iya Pupa called GTBank and other banks in the country “incompetent.”.

“How could N3. 1 million miss in someone’s account, and you can’t account for it.

“An account you charge monthly maintenance on,” he said.

“All these banks are just so incompetent, with no maximum security for their customers after charging them high for maintenance. The ordinary digital bank is doing better than them.

“Aside from them deducting your money, being quick to charge you excess, and stressing you out, they have no other benefits they give to people. GTBank is one of them,” he added.

Jagaban Olu alleged that GTBank and other banks in the country are renowned for “nefarious” practices. He called on the Economic and Financial Crimes Commission, EFCC, to investigate the ‘unwholesome’ practice by banks.

Olu said, “Nigerian banks are a special case when it comes to nefarious practices like round-tripping, excessive charges, stealing from customer accounts, facilitating billion-dollar loans to politicians who have zero businesses, etc.

“EFCC should probe the banks just like they are doing with Binance! They should track where the forex they collect is going and how they facilitate corruption by some state institutions and governors.”

“GTB has too many incidences of these for it to be unintentional at this point. They should review their internal procedures because something is not working,” Taiwo, an X user, noted.

READ ALSO:

- Ondo 2024: Akeredolu’s wife blasts in-law for supporting Aiyedatiwa

- Again, hungry Abuja residents attack, loot truck carrying foodstuffs in Dei-Dei (VIDEO)

- Why some SIM cards linked to NIN were barred – NCC

Recounting a personal experience, a man simply identified as Diekolola on x states that “N150k was stolen from mine late last year. GTbank claims to still be making investigations.”

Also recounting a personal experience, Charles Ugwueze notes, “Each time I lodge substantial amounts, I will be getting a fishy email.

“I once lost some money through their Twitter handle. The guy was pretending to be helping me until I unknowingly gave out information that finished me.”

Balogun Olusegun argued that banks in Nigeria steal from their unsuspecting customers.

“I once said these people steal from us. You will notice some N5, and N10 deductions without seeing any details as to why they were deducted.

“Imagine a number like that from millions of customers monthly. I do notice this from my GTBank account. Most people may not notice,” Olusegun stated.

Ace Vinci notes that “banks in Nigeria are cooperated armed robbers. They take money out of people’s accounts without explanation.

“If you call them out or sue them, you are still the one they will blame. A guy sent money to me, and when I checked it, the bank deducted my money without any reason.”

Osaze argues that GTBank “is a hacker’s delight.”

“They don’t want to admit their system is not foolproof. GTBank is a hacker’s delight. Their system is very vulnerable to hacks,” he said.

At the time of filing this report, GTbank had yet to comment on Banjo Adedayo’s alleged missing N3.1 million.

Nigerians blast GTBank over customer’s stolen N3.1m

Business

PH refinery: 200 trucks will load petroleum products daily, says Presidency

PH refinery: 200 trucks will load petroleum products daily, says Presidency

No fewer than 200 trucks are set to load petroleum products at the government-owned Port Harcourt Refinery, the presidency has said.

A presidential spokesperson, Sunday Dare, made this known in a statement through his official X handle on Tuesday.

Newstrends had reported that the Nigerian National Petroleum Company on Tuesday announced that Port Harcourt Refinery has resumed operations and crude oil processing after years of inactivity.

READ ALSO:

- US-based Nigerians get 30-year sentence over $3.5m romance scam

- 4 Nigerians arrested in Libya for alleged drug trafficking, infection charges

- BREAKING: Port Harcourt refinery begins operation

Reacting, Dare said, “200 trucks are expected to load products daily from the refinery, Renewing the Hopes of Nigeria.”

He added that “the Port Harcourt refinery has two wings.

“The Old Refinery comes on stream today with an installed production capacity of 60, 000 barrels per day of crude oil.”

PH refinery: 200 trucks will load petroleum products daily, says Presidency

Business

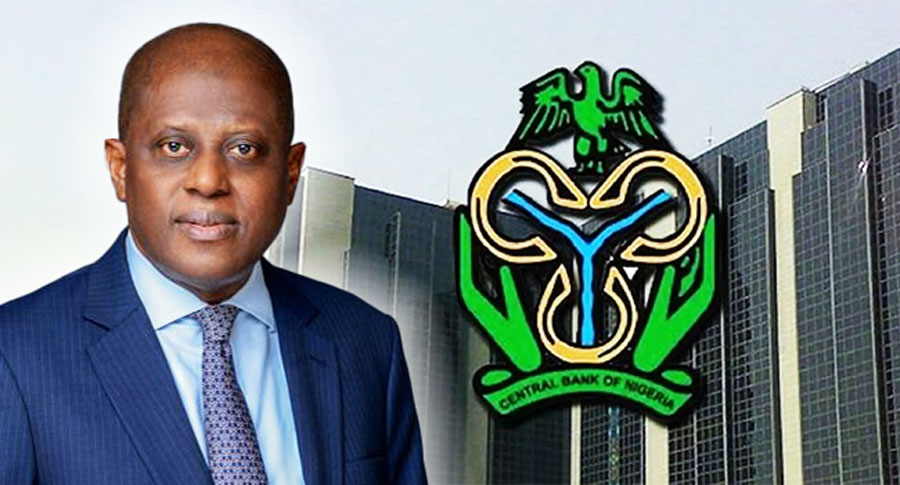

Breaking: CBN increases interest rate to 27.50%

Breaking: CBN increases interest rate to 27.50%

The Central Bank of Nigeria (CBN) has raised the lending interest to 27.50 per cent from 27.25 per cent.

This latest increase in the Monetary Policy Rate came after a meeting of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Monday and concluded Tuesday.

The Monetary Policy Rate measures the benchmark interest rate.

The CBN Governor, Yemi Cardoso, announced this in Abuja on Tuesday after the MPC meeting, last for the year, held at the apex bank’s headquarters.

He said the MPC voted unanimously to raise the MPR by 25 basis points from 27.25% to 27.50%; and retain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The CBN governor also said the MPC retained the Liquidity Ratio (LR) at 30% and Asymmetric Corridor at +500/-100 basis points around the MPR.

Business

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate stood at 4.3 per cent in the second quarter of 2024, the National Bureau of Statistics (NBS) has said in its latest report.

The report released on Monday said the unemployment rate decreased compared to the 5.3 per cent recorded in the Q1 of 2024.

The NBS defined the unemployment rate as the share of the labour force (the combination of unemployed and employed people) who are not employed but actively searching and are available for work.

“The unemployment rate for Q2 2024 was 4.3%, showing an increase of 0.1 percentage point compared to the same period last year,” the report stated.

“The unemployment rate among males was 3.4% and 5.1% among females.

“By place of residence, the unemployment rate was 5.2% in urban areas and 2.8% in rural areas. Youth unemployment rate was 6.5% in Q2 2024, showing a decrease from 8.4% in Q1 2024.”

Report also said the unemployment rate among persons with post-secondary education was 4.8 per cent; 8.5 per cent among those with upper secondary education, 5.8 per cent for those with lower secondary education, and 2.8 per cent among those with primary education in Q2 2024.

Employment rate – 76%

The report showed that the employment-to-population ratio, which measures the number of employed workers against the total working-age population, increased to 76.1 per cent in Q2 2024.

“In Q2 2024, 76.1% of Nigeria’s working-age population was employed, up from 73.1% in Q1 2024,” the report stated.

Self-employment – 85.6%

The report further showed that Nigeria’s labour market saw a notable shift as the proportion of self-employed individuals increased in Q2 2024.

It stated, “The proportion of persons in self-employment in Q2 2024 was 85.6%.”

-

metro11 hours ago

metro11 hours agoBREAKING: Port Harcourt refinery begins operation

-

Business2 days ago

Business2 days agoJust in: Dangote refinery reduces petrol price for marketers

-

metro1 day ago

metro1 day ago40-foot container falls on car in Lagos

-

Politics2 days ago

Politics2 days ago2027: Lagos Speaker, Obasa joins gov race, may battle Seyi Tinubu, others

-

Politics1 day ago

Politics1 day agoLagos 2027: Seyi Tinubu campaign team releases his life documentary

-

International1 day ago

International1 day agoTrump to sack 15,000 transgender officers from U.S. military: Report

-

Entertainment1 day ago

Entertainment1 day agoPolygamy best form of marriage for Africa – Okey Bakassi

-

metro1 day ago

metro1 day agoPolicewoman dismissed in Edo threatens to kill children, commit suicide