CBN directs banks to start deducting cybersecurity levies from customers

Business

Reps to probe Zenith Bank over alleged freezing of customers’ FX accounts

Reps to probe Zenith Bank over alleged freezing of customers’ FX accounts

The House of Representatives has resolved to probe Zenith Bank over the alleged freezing of the bank accounts of some of its customers.

This resolution was a sequel to a motion of a matter of urgent public importance moved by Femi Bamishile (APC, Ekiti) on Wednesday during plenary.

Moving the motion, Mr Bamishile informed the lawmakers that Zenith Bank has an App for the transaction of FX. According to him, the app has been running for years with no limit cap on transactions.

He stated that customers of the bank have been using the platform for transactions but that the app stopped recently.

Mr Bamishile said shortly after the App stopped, the bank also froze the bank accounts of some of the customers using the software.

READ ALSO:

- BREAKING: Access Holdings chairman Osunkoya dies

- Letter to Governor Ademola Adeleke, by Tunde Odesola

- Letter to Governor Ademola Adeleke, by Tunde Odesola

“This App has been ongoing for a period of time, and there is no cap to the limit of money that can be bought or transferred either by an individual or business.

“Three weeks ago customers’ accounts were frozen and a message was sent out by Zenith Bank to their customers, asking them to refund the money they transferred using the App,” he said.

“A young man was invited and detained by the Special Fraud Unit. He was made to pay a $100,000 back to the bank and also made to give an undertaken under duress stating that he made an illegal transaction,” the legislator said in the motion.

Mr Bamishile explained that Zenith Bank made money from all transactions via the App, therefore, they should be equally liable for any disruption.

Following the adoption of the motion, the Speaker, Abbas Tajudeen mandated the committee on Digital Banking to look into this issue and come to an amicable resolution.

The committee is to report back to the House in two weeks.

Reps to probe Zenith Bank over alleged freezing of customers’ FX accounts

Business

CBN directs banks to start deducting cybersecurity levies from customers

The apex bank announced this on Monday, May 6, 2024, in a circular signed by Chibuzor Efobi, Director of Payments System Management, and Haruna Mustafa, Director of Financial Policy and Regulation.

Business

Forex: FG to delist naira from P2P platforms

Forex: FG to delist naira from P2P platforms

The Federal Government is set to delist the naira from all Peer-to-Peer platforms to reduce the manipulation of the local currency value in the foreign exchange market.

Director General of the Securities and Exchange Commission, Emomotimi Agama, made this known on Monday at a virtual conference with blockchain stakeholders.

The goal of this resolution is to combat manipulation of the value of the local currency in the foreign exchange market.

In past months, the nation’s regulatory bodies have started looking into and closely examining cryptocurrency exchanges.

This is part of a number of regulations to be rolled out in the coming days.

He said, “That is one of the things that must be done to save this space. The delisting of the naira from the P2P platforms to avoid the level of manipulation that is currently happening.

“I want your cooperation in dealing with this as we roll out regulations in the coming days.”

The SEC DG decried how some market players were manipulating the value of the naira.

This, he said, was why the commission was “seeking collaboration and help in making sure that the crypto environment is respected globally”.

Business

Ikeja Electric cuts tariff for Band A customers

Ikeja Electric cuts tariff for Band A customers

The Ikeja Electricity Distribution Company has announced a reduction in the tariff for customers under Band A classification from N225 per kilowatt-hour to N206.80kw/h

This is coming about a month after the Nigerian Electricity Regulatory Commission (NERC) approved an increase in electricity tariff for customers under the Band A category to N225 per kwh — from N66.

The commission has clarified that customers under Band A receive between 20 and 24 hours of electricity supply daily.

Ikeja Electric said in a circular on Monday the cut in the new tariff rate would take effect from May 6, 2024.

-

metro2 days ago

metro2 days agoDSS seals Plateau clinic over patient’s death

-

International3 days ago

International3 days agoGaza: Thousands rally for hostage deal as ceasefire talks continue

-

Entertainment2 days ago

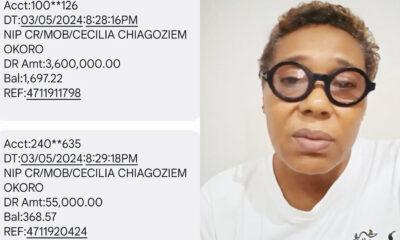

Entertainment2 days agoNollywood veteran Shan George weeps as fraudster clears ₦3.6m from her account (VIDEO)

-

Sports3 days ago

Sports3 days agoRonaldo’s hat-trick leads Al Nassr to 6-0 victory over Al Wehda

-

International14 hours ago

International14 hours agoNetanyahu rubbishes Hamas ceasefire proposal

-

Politics2 days ago

Politics2 days agoPDP: Sule Lamido blames court for mass resignation from party

-

Opinion3 days ago

Opinion3 days agoWho has bewitched our beloved America? – Femi Fani-Kayode

-

News22 hours ago

News22 hours agoNigerian varsity VC suspended over alleged gross misconduct