CBN directs banks to start deducting cybersecurity levies from customers

Business

Tougher times ahead as FG plans borrowing N11tn for 2023 budget

The Federal Government may borrow about N11.3 trillion to fund expenditure in the 2023 budget as the deficit is projected to be over 12.41 trillion next year.

Minister of Finance, Budget and National Planning, Mrs Zainab Ahmed, stated this on Monday while presenting the draft 2023-2025 Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF&FSP) before the House Committee on Finance.

On government expenditure, the minister stated that given the constrained fiscal space, the deficit was projected to be N12.41tn in 2023, up from N7.35tn in 2022, representing 196 per cent of total Federal Government’s revenue of 5.50 per cent of the estimated GDP.

She said, “This is significantly above the three per cent threshold stipulated in the Fiscal Responsibility Act (FRA) 2007, and there will be no provision for treasury-funded MDAs capital projects in 2023.

“Scenario two, the federal government’s 2023 aggregate expenditure is estimated at N19.76trn (inclusive of GOEs). In this scenario, the budget deficit is projected to be N11.30trn in 2023 up from N7.35tn in 2022

“This represents 5.01 per cent of the estimated GDP, above the three per cent threshold stipulated in the Fiscal Responsibility Act (FRA), 2007.”

On petrol subsidy, Zainab said the government might spend N3.36tn or N6.7tn in 2023. The first scenario, tagged “Business as Usual”, assumes that the subsidy on Premium Motor Spirit (PMS), estimated at N6.72tn for the full year 2023 will remain and be fully provided for.

However, she said the second scenario, tagged “The Reform Scenario”, assumed that petrol subsidy would remain up to mid-2023 based on the 18 months extension announced early 2021.

She said, “In which case only N3.36trn will be provided for. Additionally, there will be tighter enforcement of the performance management framework for Government Owned Enterprises (GOEs) that will significantly increase operating surplus/dividend remittances in 2023. Both scenarios have implications for net accretion to the Federation Account and projected deficit levels.

“The 2023 Federal Government revenue is projected at N6.34trn, out of which only N373.17bn or 5.9 per cent comes from oil-related sources. The balance of N5.97trn is to be earned from non-oil sources.

On oil revenues this year, she said despite higher oil prices, oil revenue had been underperforming due to significant oil production shortfall adding that crude oil production challenges and PMS subsidy deductions by NNPC constitute significant threats.

Zainab also said despite pegging N3.2 billion for pipeline security, Nigeria is not getting enough value on it to address energy theft

She said, “From what has happened in 2022, clearly what we are spending is not giving us much value because production continues to decline and what this means is whatever we are doing is not working and therefore we have to do something totally different.

“Oil production in April was 1.3 million barrels per day and by July it was 1.4 million. We do hope that the increase will be very significant because it’s costing us not just N3.2 billion in terms of security cost, but the revenue we have earned.”

She said for the new MTEF, the government has removed the federation spending on pipeline security, assuming that with the transition of NNPC to NNPC Limited, they will be carrying that cost directly, not the federation.

“A lot of the expenditure the federation used to carry, will now be carried by NNPC limited. NNPC will be paying taxes and dividends and we believe in the medium term, the federation will end up earning more revenue.”

Chairman of the House Committee on Finance, James Faleke, said, given Nigeria’s current financial situation, all revenue sources must be explored as the government was short of revenue.

Business

CBN directs banks to start deducting cybersecurity levies from customers

The apex bank announced this on Monday, May 6, 2024, in a circular signed by Chibuzor Efobi, Director of Payments System Management, and Haruna Mustafa, Director of Financial Policy and Regulation.

Business

Forex: FG to delist naira from P2P platforms

Forex: FG to delist naira from P2P platforms

The Federal Government is set to delist the naira from all Peer-to-Peer platforms to reduce the manipulation of the local currency value in the foreign exchange market.

Director General of the Securities and Exchange Commission, Emomotimi Agama, made this known on Monday at a virtual conference with blockchain stakeholders.

The goal of this resolution is to combat manipulation of the value of the local currency in the foreign exchange market.

In past months, the nation’s regulatory bodies have started looking into and closely examining cryptocurrency exchanges.

This is part of a number of regulations to be rolled out in the coming days.

He said, “That is one of the things that must be done to save this space. The delisting of the naira from the P2P platforms to avoid the level of manipulation that is currently happening.

“I want your cooperation in dealing with this as we roll out regulations in the coming days.”

The SEC DG decried how some market players were manipulating the value of the naira.

This, he said, was why the commission was “seeking collaboration and help in making sure that the crypto environment is respected globally”.

Business

Ikeja Electric cuts tariff for Band A customers

Ikeja Electric cuts tariff for Band A customers

The Ikeja Electricity Distribution Company has announced a reduction in the tariff for customers under Band A classification from N225 per kilowatt-hour to N206.80kw/h

This is coming about a month after the Nigerian Electricity Regulatory Commission (NERC) approved an increase in electricity tariff for customers under the Band A category to N225 per kwh — from N66.

The commission has clarified that customers under Band A receive between 20 and 24 hours of electricity supply daily.

Ikeja Electric said in a circular on Monday the cut in the new tariff rate would take effect from May 6, 2024.

-

metro2 days ago

metro2 days agoDSS seals Plateau clinic over patient’s death

-

International3 days ago

International3 days agoGaza: Thousands rally for hostage deal as ceasefire talks continue

-

Entertainment2 days ago

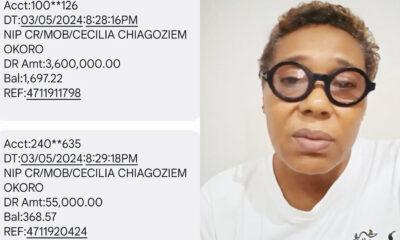

Entertainment2 days agoNollywood veteran Shan George weeps as fraudster clears ₦3.6m from her account (VIDEO)

-

Sports3 days ago

Sports3 days agoRonaldo’s hat-trick leads Al Nassr to 6-0 victory over Al Wehda

-

International13 hours ago

International13 hours agoNetanyahu rubbishes Hamas ceasefire proposal

-

Politics2 days ago

Politics2 days agoPDP: Sule Lamido blames court for mass resignation from party

-

Opinion3 days ago

Opinion3 days agoWho has bewitched our beloved America? – Femi Fani-Kayode

-

News22 hours ago

News22 hours agoNigerian varsity VC suspended over alleged gross misconduct