Business

Consumer Rights Group Kicks Against Proposed Sale of NIPP/NDPHC Power Plants

The Nigeria Consumer Protection Network (NCPN) says the proposed sale of the five National Integrated Power Projects (NIPP) assets by the Bureau of Public Enterprises (BPE) poses a national security risk.

President of the organisation, Kola Olubiyo, in a statement in Abuja, on Monday noted that the planned disposal of the plants under the Niger Delta Power Holding Company (NDPHC), smacked of national assets stripping at a time the President Muhammadu Buhari’s administration is winding down.

The BPE recently pre-qualified 16 firms for the privatisation of the five NIPPs, including Geregu, Omotosho, Olorunsogo, Calabar and Benin-Ihovbor.

But the NCPN said it had seen the records of the firms described as the bidders for the NIPP plants, maintaining that some of the firms hardly have any experience in the business of power generation.

“The plants under the NIPP of the NDPHC have always been infrastructure providing power supply and national energy security.

“For instance, during the COVID-19 pandemic when the private Generation Companies (Gencos) ramped down electricity generation due to low revenue returns, the NIPPs being public assets, provided Nigeria with the much-needed energy security and its attendant socio-economic stability.

“They increased power supply to avoid economic and administrative shut down in the country.

“The private firms in the power sector so far have not fared better than the NDPHC Gencos which have its gas obligations, gas pipeline assets, contributed to both transmission and distribution networks nationwide,” the group argued.

READ ALSO:

- Something will soon happen in PDP, says Wike

- ‘How APC will share N30b from nomination forms’

- Pastor charged with impregnating two sisters

- Artemis 1: Nasa cancels moon mission launch over engine problem

Olubiyo, a member of the National Technical Investigative Panel on Power System Collapses/System Stability and Reliability and Presidential Ad-hoc Committee on Review of Electricity Tariff in Nigeria, argued that if at any point other Gencos shut down operations because of legacy debts allegedly owed them, the NIPPS could act as a buffer.

“What BPE and any designated agency of government should be thinking of at the moment is how to optimise the NIPP/NDPHC Gencos so that Nigerians can make the best use of this power sector intervention, as that was what they were designed for.

“The NIPP interventions which cut across the power sector value chain and implemented by NDPHC require that the Nigerian Electricity Regulatory Commission (NERC) would have evaluated them and determined their real value.

“However, for over nine years, NERC has been endlessly doing evaluation of these investment values without result,” the group added.

Without this evaluation to determine the Capital Expenditure (CAPEX) in the NIPP power sector intervention projects, NDPHC, it argued, has been continually short-changed of revolving funds that should be re-invested into other power interventions.

“The NCPN at the moment opposes any move to sell off five of the NIPP Gencos for now. We are not saying that the plants would not be sold at the appropriate prices and time in the future.

“But not now, when Nigeria is seriously battling challenges of deliberate load rejection by the Distribution Companies (Discos) and deliberate low energy dispatch by the Transmission Company of Nigeria (TCN)

“It is already election time and we believe that even if the five NIPP plants are sold, the proceeds may go into the hands of political cronies,” the NCPN stated.

It argued that selling off the five NIPP plants may not guarantee their optimal performance as the new investors will have to begin a fresh journey of having some levels of Power Purchase Agreements (PPAs) and Vesting Contracts with the Nigerian Bulk Electricity Trading PLC (NBET).

However, at the moment, it maintained that the NDPHC has some already signed bilateral contracts for a “Take or Pay” deal for gas supply agreement for some of the Gencos which can come handy.

“We advise the government to join hands with experts and professionals as well as like-minded people within and outside the power sector to come up with a comprehensive mechanism to address the decline in growth.

“As the House of Representatives sit this week to take a deeper look at the issues at stake, the group urged the Special Investigative Committee to look into the basic and fundamental challenges.

“The Nigerian government should also learn from the poor delivery of the 2013 power sector privatisation exercise also carried out by the same BPE,” the group said.

Aviation

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Emirates Airlines on Thursday announced that its flight operations to Nigeria would resume on October 1, 2024.

It said this in a statement, “The service will be operated using a Boeing 777-300ER. EK783 will depart Dubai at 0945hrs, arriving in Lagos at 1520hrs. The return flight EK784 will leave Lagos at 1730hrs and arrives in Dubai at 0510hrs the next day.

“Tickets can be booked now on Emirates.com or via travel agents.”

It quoted Emirates’ Deputy President and Chief Commercial Officer, Adnan Kazim, as saying the Lagos-Dubai service has traditionally been popular in Nigeria.

“We thank the Nigerian government for their partnership and support in re-establishing this route and we look forward to welcoming passengers back onboard,” Kazim said.

Minister of Aviation and Aerospace Development, Festus Keyamo, on Wednesday said the Emirates Airlines had given a definite date to resume flight operations to Nigeria and would make the announcement in a matter of days.

Emirates Airlines suspended flight operations to Nigeria in October 2022 over its inability to repatriate its $85 million revenue trapped in Nigeria.

Business

Dollar crashes against Naira at official market

Dollar crashes against Naira at official market

The Naira on Wednesday appreciated at the official market, trading at N1,459.02 to the dollar.

Data from the official trading platform of the FMDQ Exchange, revealed that the Naira gained N61.38.

This represents a 4.04 per cent gain when compared to the previous trading date on Tuesday, when the local currency exchanged at N1,520.40 to a dollar.

READ ALSO:

- Reps invite Ribadu over faulty presidential air fleet

- What autopsy revealed on cause of Mohbad’s death – Pathologist

- UK varsities considering NECO results for admission – Registrar

Also, the total daily turnover increased to 289.14 million dollars on Wednesday up from 128.76 million dollars recorded on Tuesday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,593 and N1,401 against the US dollar.

Dollar crashes against Naira at official market

Business

Nigeria’s inflation rises further to 33.69%, highest in 28 years

Nigeria’s inflation rises further to 33.69%, highest in 28 years

Nigeria’s inflation rose to its highest in 28 years as it hit 33.69 per cent in April 2024, up from 33.20 per cent in March.

A report by the National Bureau of Statistics revealed this on Wednesday. It showed the food and non-alcoholic beverages category continued to be the biggest contributor to inflation.

Food inflation, which accounts for the bulk of the inflation basket, reached 40.53 per cent in annual terms, against 40.01 per cent in March.

The galloping inflation is attributed largely to President Bola Tinubu administration’s removal of petrol subsidy and naira devaluation due to foreign exchange rates unification.

Reuters in a report recalled that the Central Bank of Nigeria had raised interest rates twice this year, including its largest hike in around 17 years, as it struggles to contain the price pressures.

CBN Governor Olayemi Cardoso has indicated that rates will stay high to bring down inflation.

The bank holds another rate-setting meeting next week.

Price pressures have left millions of Nigerians grappling with the worst cost of living crisis in decades as they struggle to meet their basic needs.

To ease the pressure on government workers, Tinubu recently introduced a wage award of N35,000 and direct cash transfer to the vulnerable.

-

Business1 day ago

Business1 day agoDollar crashes against Naira at official market

-

News14 hours ago

News14 hours agoUpdated: Reps condemn assault on Nasarawa female doctor by patient family

-

metro1 day ago

metro1 day agoThree police officers sentenced to life imprisonment in Anambra

-

News22 hours ago

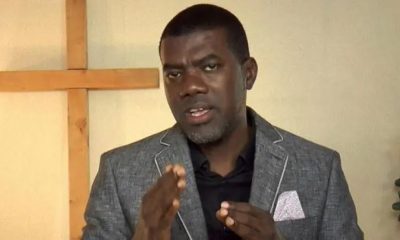

News22 hours agoWike, Fubara are ego-driven, crude – Reno Omokri

-

Aviation17 hours ago

Aviation17 hours agoUpdated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

-

metro3 days ago

metro3 days agoEdo community attacked, houses razed, 8 cars burnt

-

metro2 days ago

metro2 days agoNigerian who killed wife in UK bags life jail

-

Auto2 days ago

Auto2 days ago150 OEMs, others set for Lagos motor fair, Africa autoparts expo