Business

UBA posts N2tn record earnings, proposes N2.30/share dividend

UBA posts N2tn record earnings, proposes N2.30/share dividend

UBA Nigeria Plc has announced a profit after tax of N607.696 billion in 2023, representing a 257 per cent increase over N170.27 billion in 2022.

It also revealed its gross earnings as N2.08 trillion in 2023, about 143 per cent increase over N835 billion made a year earlier.

This is the bank’s highest gross earnings and ranks as one of the highest in the banking sector for 2023.

The bank gave the figures in its audited financial results for the full year ended December 31, 2023 filed at Nigerian Exchange Limited (NGx).

The banks’ total assets also rose by 90.22 percent, doubling the N10 trillion mark, to close at N20.65 trillion in December 2023; up from N10.86 trillion in 2022.

UBA Group Shareholders’ Funds also rose from N922 billion as of December 2022.

During the 2023 financial year, UBA Group cost-to-income ratio dropped from 59.2 per cent, in 2022, to 37.2 per cent pointing at the Group’s improving efficiency.

In fulfilment of the promise made by the UBA Group Chairman, Tony Elumelu, to shareholders at the last Annual General Meeting, the bank proposed a final dividend of N2.30 kobo for every ordinary share of 50 kobo, for the financial year ended December 31, 2023.

The final dividend is subject to the ratification of the shareholders during its upcoming annual general meeting (AGM).

UBA also recorded a 61.3 per cent growth in loans to customers, moving up to N5.5 trillion in 2023, whilst customer deposits rose by 90.31 per cent to N14.9 trillion, compared to N7.8 trillion recorded in the corresponding period of 2022.

This is considered a reflection of increased customer confidence, enhanced customer experience, successes from the ongoing business transformation programme and the deepening of its retail banking franchise.

UBA’s Group Managing Director/Chief Executive Officer, Oliver Alawuba, said, “I am very pleased with the unprecedented results achieved by our Group in FY2023.

“The group is well positioned for further business expansion in FY2024 having closed FY2023 with Capital Adequacy Ratio of 32.6.”

Business

PH refinery: 200 trucks will load petroleum products daily, says Presidency

PH refinery: 200 trucks will load petroleum products daily, says Presidency

No fewer than 200 trucks are set to load petroleum products at the government-owned Port Harcourt Refinery, the presidency has said.

A presidential spokesperson, Sunday Dare, made this known in a statement through his official X handle on Tuesday.

Newstrends had reported that the Nigerian National Petroleum Company on Tuesday announced that Port Harcourt Refinery has resumed operations and crude oil processing after years of inactivity.

READ ALSO:

- US-based Nigerians get 30-year sentence over $3.5m romance scam

- 4 Nigerians arrested in Libya for alleged drug trafficking, infection charges

- BREAKING: Port Harcourt refinery begins operation

Reacting, Dare said, “200 trucks are expected to load products daily from the refinery, Renewing the Hopes of Nigeria.”

He added that “the Port Harcourt refinery has two wings.

“The Old Refinery comes on stream today with an installed production capacity of 60, 000 barrels per day of crude oil.”

PH refinery: 200 trucks will load petroleum products daily, says Presidency

Business

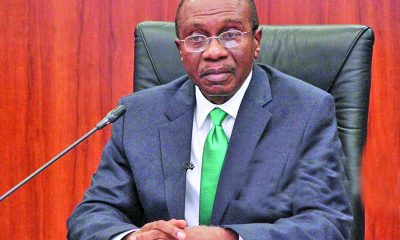

Breaking: CBN increases interest rate to 27.50%

Breaking: CBN increases interest rate to 27.50%

The Central Bank of Nigeria (CBN) has raised the lending interest to 27.50 per cent from 27.25 per cent.

This latest increase in the Monetary Policy Rate came after a meeting of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Monday and concluded Tuesday.

The Monetary Policy Rate measures the benchmark interest rate.

The CBN Governor, Yemi Cardoso, announced this in Abuja on Tuesday after the MPC meeting, last for the year, held at the apex bank’s headquarters.

He said the MPC voted unanimously to raise the MPR by 25 basis points from 27.25% to 27.50%; and retain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The CBN governor also said the MPC retained the Liquidity Ratio (LR) at 30% and Asymmetric Corridor at +500/-100 basis points around the MPR.

Business

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate stood at 4.3 per cent in the second quarter of 2024, the National Bureau of Statistics (NBS) has said in its latest report.

The report released on Monday said the unemployment rate decreased compared to the 5.3 per cent recorded in the Q1 of 2024.

The NBS defined the unemployment rate as the share of the labour force (the combination of unemployed and employed people) who are not employed but actively searching and are available for work.

“The unemployment rate for Q2 2024 was 4.3%, showing an increase of 0.1 percentage point compared to the same period last year,” the report stated.

“The unemployment rate among males was 3.4% and 5.1% among females.

“By place of residence, the unemployment rate was 5.2% in urban areas and 2.8% in rural areas. Youth unemployment rate was 6.5% in Q2 2024, showing a decrease from 8.4% in Q1 2024.”

Report also said the unemployment rate among persons with post-secondary education was 4.8 per cent; 8.5 per cent among those with upper secondary education, 5.8 per cent for those with lower secondary education, and 2.8 per cent among those with primary education in Q2 2024.

Employment rate – 76%

The report showed that the employment-to-population ratio, which measures the number of employed workers against the total working-age population, increased to 76.1 per cent in Q2 2024.

“In Q2 2024, 76.1% of Nigeria’s working-age population was employed, up from 73.1% in Q1 2024,” the report stated.

Self-employment – 85.6%

The report further showed that Nigeria’s labour market saw a notable shift as the proportion of self-employed individuals increased in Q2 2024.

It stated, “The proportion of persons in self-employment in Q2 2024 was 85.6%.”

-

metro12 hours ago

metro12 hours agoBREAKING: Port Harcourt refinery begins operation

-

Business2 days ago

Business2 days agoJust in: Dangote refinery reduces petrol price for marketers

-

metro1 day ago

metro1 day ago40-foot container falls on car in Lagos

-

Politics2 days ago

Politics2 days ago2027: Lagos Speaker, Obasa joins gov race, may battle Seyi Tinubu, others

-

Politics1 day ago

Politics1 day agoLagos 2027: Seyi Tinubu campaign team releases his life documentary

-

International1 day ago

International1 day agoTrump to sack 15,000 transgender officers from U.S. military: Report

-

Entertainment1 day ago

Entertainment1 day agoPolygamy best form of marriage for Africa – Okey Bakassi

-

metro1 day ago

metro1 day agoPolicewoman dismissed in Edo threatens to kill children, commit suicide