Business

Customers kick as scarcity of new naira notes hits banks

Five days after the Deposit Money Banks (DMBs) began dispensing the newly-redesigned naira notes, depositors are lamenting the scarcity of fresh currency, as banks have continued to dish out the old notes slated to be binned by January 31, 2023.

Against this backdrop, bank customers are querying the rationale behind having more of the old notes constituting the bulk of cash dispensed by the banks and Automated Teller Machines (ATMs), when their lifespan is barely a month away.

Although the Central Bank of Nigeria (CBN) says the volume of the new notes would be far less than what currently obtains with the old notes, the Nigerian business community is appealing to the regulator to put more new notes into circulation.

While the banks are rationing the new notes, Daily Sun gathered that currency traffickers and influential individuals are allegedly colluding with banks to mop the little available new notes released to them by the CBN.

Timothy Akparawa, a businessman in Wuse Market, told Daily Sun that getting the new notes has become a huge challenge since they were released.

READ ALSO:

- Buhari govt insists it negotiated with Twitter Before lifting ban

- South Africa’s President Ramaphosa re-elected as ANC party leader

- Why Elon Musk may soon step down as Twitter CEO

“I have been to three of my banks to get the new notes but to no avail. The cashiers are still paying out the old notes. Same with the ATMs. This is a serious problem because we have about a month to stop using the old notes”, he lamented.

Also lamenting, Florence Agada, a Point of Sales operator, said her customers were uncomfortable accepting the old notes.

“Some of my customers don’t want to collect the old notes anymore. They said it will soon expire , but banks are not giving us new notes. They keep asking us to check the next day. It’s been one story after the other. No new notes. We also have issues around acceptance of the new notes in some remote areas”, she said.

Commenting on the development, the Chief Executive Officer, Centre for the Promotion of Private Enterprise (CPPE), Muda Yusuf, told Daily Sun that the CBN should be given the benefits of doubts to quickly fine-tune logistics challenges that may have been encountered in the initial rollout of the new notes.

“CBN should not underestimate the huge logistics required to ensure the new notes get to every nook and cranny of the country. Nigeria is a vast country and we must ensure the new notes get to all areas, especially remote places. A programme like this requires sound preparedness. By now, ATMs should not be dispensing old notes. It should not be”, he said.

Several institutions and groups have continued to complain about the currency withdrawal limit policy, with States Governors urging President Muhammadu Buhari to compel the CBN to rescind the move.

Business

PH refinery: 200 trucks will load petroleum products daily, says Presidency

PH refinery: 200 trucks will load petroleum products daily, says Presidency

No fewer than 200 trucks are set to load petroleum products at the government-owned Port Harcourt Refinery, the presidency has said.

A presidential spokesperson, Sunday Dare, made this known in a statement through his official X handle on Tuesday.

Newstrends had reported that the Nigerian National Petroleum Company on Tuesday announced that Port Harcourt Refinery has resumed operations and crude oil processing after years of inactivity.

READ ALSO:

- US-based Nigerians get 30-year sentence over $3.5m romance scam

- 4 Nigerians arrested in Libya for alleged drug trafficking, infection charges

- BREAKING: Port Harcourt refinery begins operation

Reacting, Dare said, “200 trucks are expected to load products daily from the refinery, Renewing the Hopes of Nigeria.”

He added that “the Port Harcourt refinery has two wings.

“The Old Refinery comes on stream today with an installed production capacity of 60, 000 barrels per day of crude oil.”

PH refinery: 200 trucks will load petroleum products daily, says Presidency

Business

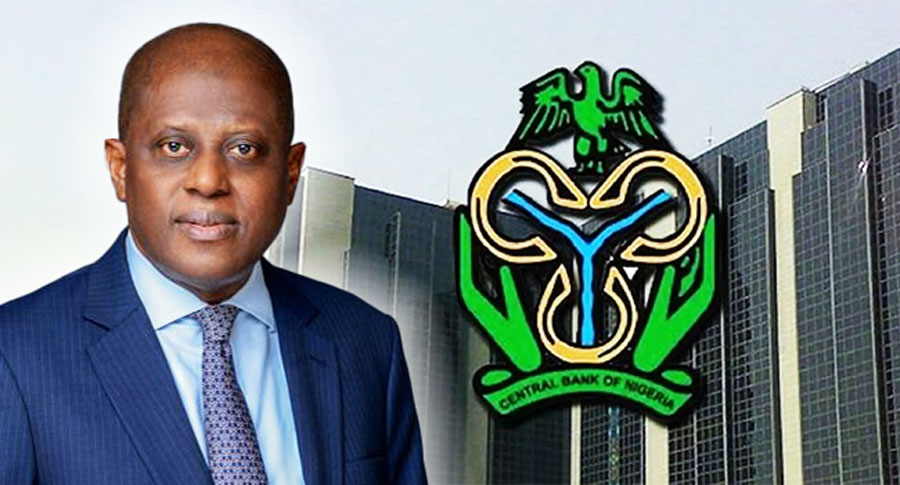

Breaking: CBN increases interest rate to 27.50%

Breaking: CBN increases interest rate to 27.50%

The Central Bank of Nigeria (CBN) has raised the lending interest to 27.50 per cent from 27.25 per cent.

This latest increase in the Monetary Policy Rate came after a meeting of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Monday and concluded Tuesday.

The Monetary Policy Rate measures the benchmark interest rate.

The CBN Governor, Yemi Cardoso, announced this in Abuja on Tuesday after the MPC meeting, last for the year, held at the apex bank’s headquarters.

He said the MPC voted unanimously to raise the MPR by 25 basis points from 27.25% to 27.50%; and retain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The CBN governor also said the MPC retained the Liquidity Ratio (LR) at 30% and Asymmetric Corridor at +500/-100 basis points around the MPR.

Business

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate dropped to 4.3% in Q2 – NBS

Nigeria’s unemployment rate stood at 4.3 per cent in the second quarter of 2024, the National Bureau of Statistics (NBS) has said in its latest report.

The report released on Monday said the unemployment rate decreased compared to the 5.3 per cent recorded in the Q1 of 2024.

The NBS defined the unemployment rate as the share of the labour force (the combination of unemployed and employed people) who are not employed but actively searching and are available for work.

“The unemployment rate for Q2 2024 was 4.3%, showing an increase of 0.1 percentage point compared to the same period last year,” the report stated.

“The unemployment rate among males was 3.4% and 5.1% among females.

“By place of residence, the unemployment rate was 5.2% in urban areas and 2.8% in rural areas. Youth unemployment rate was 6.5% in Q2 2024, showing a decrease from 8.4% in Q1 2024.”

Report also said the unemployment rate among persons with post-secondary education was 4.8 per cent; 8.5 per cent among those with upper secondary education, 5.8 per cent for those with lower secondary education, and 2.8 per cent among those with primary education in Q2 2024.

Employment rate – 76%

The report showed that the employment-to-population ratio, which measures the number of employed workers against the total working-age population, increased to 76.1 per cent in Q2 2024.

“In Q2 2024, 76.1% of Nigeria’s working-age population was employed, up from 73.1% in Q1 2024,” the report stated.

Self-employment – 85.6%

The report further showed that Nigeria’s labour market saw a notable shift as the proportion of self-employed individuals increased in Q2 2024.

It stated, “The proportion of persons in self-employment in Q2 2024 was 85.6%.”

-

metro21 hours ago

metro21 hours agoBREAKING: Port Harcourt refinery begins operation

-

Business3 days ago

Business3 days agoJust in: Dangote refinery reduces petrol price for marketers

-

metro2 days ago

metro2 days ago40-foot container falls on car in Lagos

-

Politics3 days ago

Politics3 days ago2027: Lagos Speaker, Obasa joins gov race, may battle Seyi Tinubu, others

-

Politics2 days ago

Politics2 days agoLagos 2027: Seyi Tinubu campaign team releases his life documentary

-

International2 days ago

International2 days agoTrump to sack 15,000 transgender officers from U.S. military: Report

-

Entertainment2 days ago

Entertainment2 days agoPolygamy best form of marriage for Africa – Okey Bakassi

-

Education14 hours ago

Education14 hours agoUS University opens 2025 scholarships for international students