Business

Zenith, Access, GTB, 8 others earn N72.7bn from account maintenance

Zenith, Access, GTB, 8 others earn N72.7bn from account maintenance

A total of eleven banks listed on the floor of the Nigerian Exchange generated N72.7bn from account maintenance charges in the half year of 2023.

Data obtained from the half-year financial statements of these listed commercial banks on the Nigerian stock market showed this figure.

Zenith Bank, Access, GTB are clearly the top three banks that raked in the largest amount from the account maintenance fee in the first half of the year, according to a report by Nairametrics on Sunday.

The three banks are followed by United Bank for Africa, First bank and First City Monument Bank.

The remaining five banks on the list are Stanbic IBTC, Sterling Bank, Fidelity Bank, Wema Bank and Unity Bank.

Zenith Bank generated a sum of N21.02bn from account maintenance, representing 28.91 per cent of the total income of the 11 banks.

Access Holdings recorded N13.36bn, a 10.97 per cent year-on-year increase in its account maintenance income.

GTCO generated N10.48bn, which is 11.08 per cent year-on-year increase over N9.44bn recorded in the half-year 2022.

UBA generated N9.64bn from account maintenance income between January and June 2023, representing a 46.11 per cent increase compared to N6.59bn recorded in the corresponding period of 2022.

First Bank of Nigeria’s account maintenance income was put at N5.19bn. This is a decline of 43.5 per cent from N9.17bn generated in half-year 2022.

FCMB came sixth on the list with N3.85bn in revenue from account maintenance, which is 16.3 per cent higher than N3.32bn recorded in 2022.

The other five banks are Stanbic IBTC –N2.64bn; Sterling Bank – N2.39bn; Fidelity Bank – N1.76bn; Wema Bank – N1.63bn and Unity Bank – N745m.

The amount generated from account maintenance charges in the half-year of 2023 represents a 7.44 per cent increase compared to N67.69bn recorded in the corresponding period of 2022.

The fees are charged on current accounts only regarding debit transactions to third parties and debit transfers/lodgements to the customer’s account in another bank.

Banks’ earnings from account maintenance charges may be seen as low compared to other revenue streams.

A directive by the Central Bank of Nigeria, on bank charges to commercial banks allows them to charge their customers a “negotiable” N1 per mille.

This means banks can charge N1 per N1,000 debit transactions on current accounts. Banks’ account maintenance charges come in the form of COT ( as Commission on Turnover) which is a charge levied on customer withdrawals by their banks.

Business

PH refinery to blend 1.4-million litre petrol daily – NNPC

PH refinery to blend 1.4-million litre petrol daily – NNPC

Rehabilitated old Port Harcourt refinery is currently operating at 70 per cent of its installed capacity, the Nigerian National Petroleum Company Limited has said.

The Port Harcourt Refining Company (PHRC) operates two refineries: the old refinery with a capacity of 60,000 barrels per stream day (bpsd) and a new refinery with an installed capacity of 150,000 bpsd.

The NNPCL in a statement on Tuesday, said it planned to increase the operation to 90 per cent of the refinery’s capacity.

“The Board and Management of the Nigerian National Petroleum Company Limited (NNPC Ltd) express heartfelt appreciation to Nigerians for their support and excitement over the safe and successful restart of the 60,000 barrels-per-day Old Port Harcourt Refinery,” the statement reads.

“This achievement marks a significant step forward after years of operational challenges and underperformance.

“We are, however, aware of unfounded claims by certain individuals suggesting that the refinery is not producing products. For clarity, the Old Port Harcourt Refinery is currently operating at 70% of its installed capacity, with plans to ramp up to 90%.”

According to NNPC, the refinery has commenced production of daily outputs of straight-run petrol (naphtha), which is blended into 1.4 million litres of petrol.

The national oil company said the refinery has also started producing 900,000 litres of kerosene per day and 1.5 million litres per day of diesel.

The NNPC said 2.1 million litres daily volume of low-pour fuel oil (LPFO) would also be produced at the refinery, adding that additional volumes of liquefied petroleum gas (LPG) will be refined at the plant.

“It is worth noting that the refinery incorporates crack C5, a blending component from our sister company, Indorama Petrochemicals (formerly Eleme Petrochemicals), to produce gasoline that meets required specifications,” NNPC said.

“Blending is a standard practice in refineries globally, as no single unit can produce gasoline that fully complies with any country’s standards without such processes.”

Additionally, the NNPC said it has made substantial progress on the new Port Harcourt refinery, “which will begin operations soon without prior announcements”.

“We urge Nigerians to focus on the remarkable achievements being realized under the able and progressive leadership of President Bola Tinubu and to support efforts aimed at delivering more dividends to the nation,” the energy firm said.

According to the statement, malicious attacks on “clear progress” only undermine the “significant strides made by NNPC Ltd and the country”.

Business

PH refinery: 200 trucks will load petroleum products daily, says Presidency

PH refinery: 200 trucks will load petroleum products daily, says Presidency

No fewer than 200 trucks are set to load petroleum products at the government-owned Port Harcourt Refinery, the presidency has said.

A presidential spokesperson, Sunday Dare, made this known in a statement through his official X handle on Tuesday.

Newstrends had reported that the Nigerian National Petroleum Company on Tuesday announced that Port Harcourt Refinery has resumed operations and crude oil processing after years of inactivity.

READ ALSO:

- US-based Nigerians get 30-year sentence over $3.5m romance scam

- 4 Nigerians arrested in Libya for alleged drug trafficking, infection charges

- BREAKING: Port Harcourt refinery begins operation

Reacting, Dare said, “200 trucks are expected to load products daily from the refinery, Renewing the Hopes of Nigeria.”

He added that “the Port Harcourt refinery has two wings.

“The Old Refinery comes on stream today with an installed production capacity of 60, 000 barrels per day of crude oil.”

PH refinery: 200 trucks will load petroleum products daily, says Presidency

Business

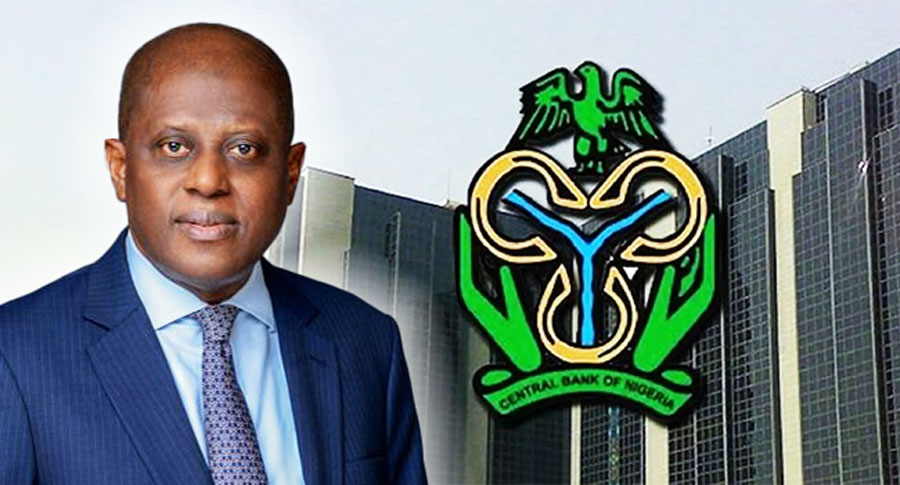

Breaking: CBN increases interest rate to 27.50%

Breaking: CBN increases interest rate to 27.50%

The Central Bank of Nigeria (CBN) has raised the lending interest to 27.50 per cent from 27.25 per cent.

This latest increase in the Monetary Policy Rate came after a meeting of the Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN) on Monday and concluded Tuesday.

The Monetary Policy Rate measures the benchmark interest rate.

The CBN Governor, Yemi Cardoso, announced this in Abuja on Tuesday after the MPC meeting, last for the year, held at the apex bank’s headquarters.

He said the MPC voted unanimously to raise the MPR by 25 basis points from 27.25% to 27.50%; and retain the Cash Reserve Ratio (CRR) at 50% for Deposit Money Banks and 16% for Merchant Banks.

The CBN governor also said the MPC retained the Liquidity Ratio (LR) at 30% and Asymmetric Corridor at +500/-100 basis points around the MPR.

-

metro22 hours ago

metro22 hours agoBREAKING: Port Harcourt refinery begins operation

-

Business3 days ago

Business3 days agoJust in: Dangote refinery reduces petrol price for marketers

-

metro2 days ago

metro2 days ago40-foot container falls on car in Lagos

-

Politics3 days ago

Politics3 days ago2027: Lagos Speaker, Obasa joins gov race, may battle Seyi Tinubu, others

-

Politics2 days ago

Politics2 days agoLagos 2027: Seyi Tinubu campaign team releases his life documentary

-

International2 days ago

International2 days agoTrump to sack 15,000 transgender officers from U.S. military: Report

-

Entertainment2 days ago

Entertainment2 days agoPolygamy best form of marriage for Africa – Okey Bakassi

-

Education15 hours ago

Education15 hours agoUS University opens 2025 scholarships for international students