News

Electricity customers lodge 204,506 complaints

The number of complaints received by electricity distribution companies in the country from consumers rose to 204,506 in the first three months of this year, according to the Nigerian Electricity Regulatory Commission.

NERC data showed that the complaints received by the 11 Discos in Q1 2020 increased by 15.02 per cent from the 177,807 received during the fourth quarter of 2019.

“In total, the Discos attended to 188,749 complaints, representing an increase of 1.84 percentage point from the preceding quarter,” it said.

The report showed that Ibadan and Port Harcourt Discos had the lowest customers’ complaints resolution rates based on the proportion of complaints not addressed in the first quarter of 2020.

NERC said, “Similar to the preceding quarter, Enugu and Yola Discos received the highest and lowest number of customer complaints respectively during the first quarter of 2020.

“It is noteworthy that Yola has continued to record the least customer’s complaints since the second quarter of 2019.”

According to the report, the Discos’ customer complaints centred on service interruption, poor voltage, load shedding, metering, estimated billing, disconnection, and delayed connection.

It said during the period under review, majority of the Discos received complaints on each of those key issues, adding that only Kaduna Disco had no record of customers’ complaint on load shedding.

“The number of complaints on metering and billing decreased significantly but still dominates the customer complaints during the quarter under review,” the commission said.

It said metering and billing accounted for 42.96 per cent (87,854) of the total complaints received during the first quarter of 2020 as against 50.49 per cent (89,782) recorded in the preceding quarter.

“This implies that, on average, 965 customers complained about metering and billing per day in the first quarter of 2020,” NERC said.

It said the observed decrease in the rate of customer complaint related to billing and metering could be attributed to the impact of the order on capping of estimated bill, which capped the monthly volume of energy an unmetered customer could be billed to the average vending of the prepaid customers in the neighbourhood.

“Another issue of serious concern to customers is service interruption and disconnection which respectively account for 18.40 per cent (i.e., 37,631) and 12.06 per cent (i.e., 24,666) of the total customer complaints during the quarter,” the commission added.

According to the report, to ensure improved customer service delivery, NERC continued to monitor and audit customers’ complaint handling and resolution process by Discos.

“Also, the commission continuously monitors the operation and efficacy of its Forum Offices which were set up to redress on consumers’ complaints not adequately resolved to the customers’ satisfaction by the responsible Discos,” it said.

-The Punch

News

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

Police to Arrest TikToker Mirabel After She Recants False Rape Claim

The Ogun State Police Command has confirmed plans to arrest and prosecute TikTok user Mirabel after she admitted that her viral rape allegation was false, authorities and investigative reports indicate.

Mirabel, a social media influencer, first sparked national attention after posting videos alleging she had been sexually assaulted in her home in Ogijo, Ogun State. The posts quickly went viral, drawing widespread outrage, calls for justice, and prompting the police to launch an immediate investigation.

An audio recording of a phone conversation, shared online by social media personality VeryDarkMan (VDM), reportedly captures Mirabel acknowledging that parts of her story were fabricated. In the recording, she apologises and admits creating a threatening TikTok account to support her narrative, claiming she had been taking drugs at the time and “was not thinking clearly” when posting the videos.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

A police source said senior officers, including the Divisional Police Officer, were at the hospital where Mirabel was receiving medical care. Once she is discharged, she will be taken into custody and formally charged under provisions of Nigeria’s Criminal Code relating to false reporting of sexual offenses. “The essence is to serve as a deterrent to others,” the source added.

The Ogun State Police had earlier ensured that Mirabel received medical treatment and support, following procedures to protect her health while the investigation continued. The Lagos State Domestic and Sexual Violence Agency (DSVA) confirmed that the incident fell outside its jurisdiction and forwarded all relevant information to the Ogun authorities.

This development has sparked public debate about the responsible use of social media, the impact of false allegations, and the importance of evidence-based reporting. Legal experts warn that fabricating sexual assault claims can carry serious criminal penalties and may undermine the credibility of genuine victims.

Authorities continue to urge the public to avoid spreading unverified claims and to cooperate with law enforcement in ongoing investigations. Updates on the case will be issued by the Ogun State Police Command as formal legal proceedings begin.

News

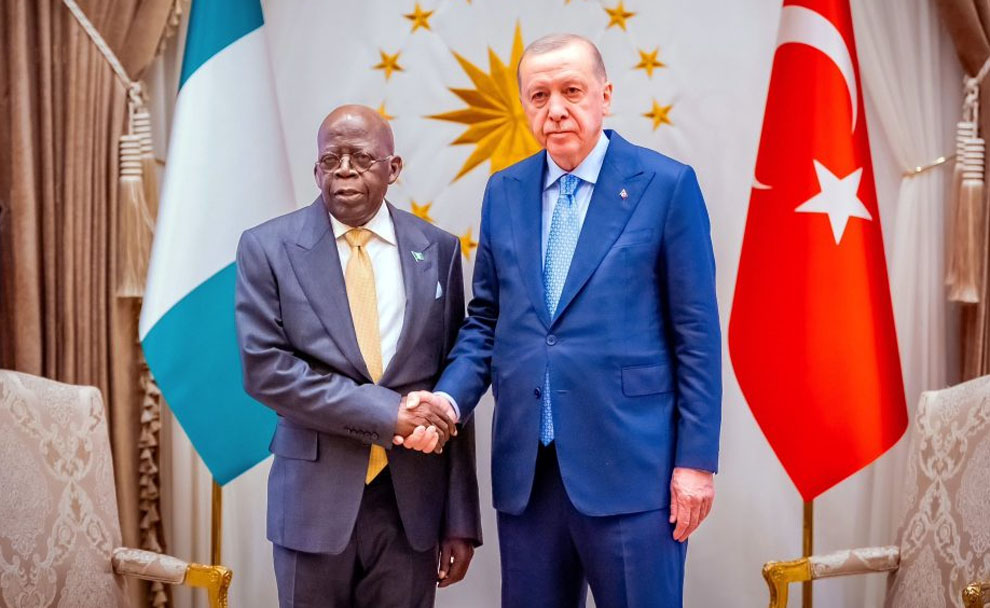

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

President Bola Tinubu has commenced a strategic expansion of Nigeria’s defence diplomacy, engaging the European Union (EU) and Turkey to strengthen the nation’s security architecture while reducing overreliance on the United States. The initiative comes as Nigeria faces multiple security threats, including Boko Haram insurgency in the north-east, farmer-herder clashes in the north-central region, separatist violence in the south-east, and escalating banditry in the north-west.

The move coincided with a visit to Brussels by National Security Adviser Mallam Nuhu Ribadu, who led discussions at the first EU-Nigeria Peace, Security, and Defence Dialogue. Both sides agreed to deepen collaboration on regional stability, counter-terrorism, and violent extremism, while enhancing intelligence sharing, maritime security, and cybersecurity cooperation. An EU diplomat in Abuja emphasized that the bloc would provide non-lethal military support, while respecting Nigeria’s sovereignty, describing the EU as “more consistent, more reliable, and more coherent than the United States” in delivering security assistance.

READ ALSO:

- Again, Early Morning Blaze Destroys Dozens of Shops in Kano Market

- Suspected Terrorists Warn Kebbi Residents: Pay ₦100 Million or Face Attack

- ICPC Searches El-Rufai’s Abuja Home Amid Multi-Agency Corruption Investigation

During his state visit to Turkey in January 2026, President Tinubu also held defence discussions with Turkish officials. Turkish companies pledged to supply military equipment, advanced systems, and tactical hardware, while exploring joint local production arrangements with Nigeria. Türkiye is currently regarded as a global leader in armed drones, which could bolster Nigeria’s counter-terrorism operations and reconnaissance capabilities.

Despite these new partnerships, Nigeria continues security cooperation with the United States, including deployments by United States Africa Command (AFRICOM) to support training, intelligence sharing, and operational planning. Recent U.S. personnel arrivals in Bauchi State aim to enhance counter-terrorism capacity without taking direct combat roles, operating under Nigerian command structures.

Analysts say Nigeria’s diversified defence diplomacy seeks to reduce dependency on a single partner, while providing access to a wider range of technology transfer, training opportunities, procurement options, and operational expertise. The strategy also reflects a broader trend of African nations balancing traditional defence alliances with emerging strategic partners to better address evolving security threats.

With regional instability and domestic insurgency on the rise, Nigeria’s engagement with Turkey, the EU, and other partners is expected to strengthen the Nigerian Armed Forces, enhance counter-terrorism operations, and secure national and regional stability.

Tinubu Reduces Reliance on U.S, Strengthens Defence Partnerships With Turkey, EU

News

Tinubu, German Chancellor Merz Pledge Stronger Nigeria-Germany Ties

Tinubu, German Chancellor Merz Pledge Stronger Nigeria-Germany Ties

President Bola Tinubu and German Chancellor Friedrich Merz have agreed to deepen bilateral relations between Nigeria and Germany, with a focus on security cooperation, power infrastructure, and railway development.

The commitment emerged during a telephone discussion on Wednesday, in which both leaders reaffirmed their dedication to expanding collaboration across critical sectors.

A major topic was Nigeria’s Presidential Power Initiative. President Tinubu highlighted the need for further support, particularly in power transmission infrastructure, to ensure reliable electricity supply nationwide. Chancellor Merz expressed Germany’s readiness to assist, noting that Siemens could provide technical support and Deutsche Bank could finance components of the initiative.

READ ALSO:

- Tinubu, el-Rufai and the cobra

- American Woman, 64, Alleges Embassy Mocked 27-Year-Old Fiancé Before Visa Denial

- Epstein, Ex-Israeli PM Named in Alleged Profiteering From Boko Haram Crisis

Security concerns in the Sahel region also featured prominently in the call. President Tinubu stressed the urgent need for enhanced intelligence and reconnaissance capabilities, including the provision of used helicopters to strengthen regional security. “The Sahel corridor is bad and needs our support. Intelligence support and reconnaissance are needed,” he said.

Beyond security and infrastructure, both leaders emphasized the potential for collaboration in creative arts and skills development. Chancellor Merz highlighted the value of cultural exchange and proposed establishing a Great Museum of African Arts to promote African heritage internationally.

Nigeria-Germany diplomatic relations have spanned more than 65 years, with longstanding economic and political ties. Chancellor Merz also welcomed Nigeria’s incoming ambassador to Berlin, signaling intentions to further consolidate bilateral engagements.

The 10-minute telephone call, which began at 2:01 p.m. and ended at 2:10 p.m., was confirmed in a statement by President Tinubu’s Special Adviser on Information and Strategy, Bayo Onanuga, on February 18, 2026.

Tinubu, German Chancellor Merz Pledge Stronger Nigeria-Germany Ties

-

News3 days ago

News3 days agoSaudi Arabia Confirms Sighting of Ramadan Crescent, Fasting Begins Wednesday

-

metro3 days ago

metro3 days agoLagos Woman Shares Ordeal After Alleged Rape, Sparks Nationwide Outcry

-

News3 days ago

News3 days agoRamadan Begins in Nigeria as Sultan Confirms Crescent Sighting

-

International23 hours ago

International23 hours agoCanada Opens New Express Entry Draw for Nigerian Workers, Others

-

metro3 days ago

metro3 days agoSeven Killed in Horrific Crash at Ota Toll Gate

-

News2 days ago

News2 days agoKorope Drivers Shut Down Lekki–Epe Expressway Over Lagos Ban (Video)

-

Health2 days ago

Health2 days agoRamadan Health Tips: Six Ways to Stay Hydrated While Fasting

-

metro22 hours ago

metro22 hours agoOsun Awards 55.6km Iwo–Osogbo–Ibadan Road Project to Three Contractors

You must be logged in to post a comment Login