News

Eleven of the world’s 20 fastest growing economies in 2024 are in Africa – AfDB

Eleven of the world’s 20 fastest growing economies in 2024 are in Africa – AfDB

The African Development Bank Group announced in its latest Macroeconomic Performance and Outlook (MEO) report that Africa will host eleven of the world’s 20 fastest-growing economies in 2024.

The continent’s real gross domestic product (GDP) growth is forecasted to average 3.8% in 2024 and 4.2% in 2025, surpassing the projected global averages of 2.9% and 3.2%, respectively.

Africa is poised to maintain its position as the second-fastest-growing region after Asia.

The 11 fastest growing economies and their projected growth rate for 2024 are;

- Niger – 11.2%

- Senegal – 8.2%

- Libya – 7.9%

- Rwanda – 7.2%

- Cote d’Ivoire – 6.8%

- Ethiopia – 6.7%

- Benin – 6.4%

- Djibouti – 6.2%

- Tanzania – 6.1%

- Togo – 6% and

- Uganda – 6%.

Speaking on the report, the President of the African Development Bank, Dr. Akinwunmi Adesina called for more financing in the face of the positive outlook noting that 15 African countries already posted growth rate above 5%.

READ ALSO:

- Mom runs over 7-year-old son with car after forcing him to walk from school as punishment

- Barcelona grabs win with Lewandowski’s penalty

- Cristiano Ronaldo surpasses Lionel Messi in non-penalty goals tally

He stated, “Despite the challenging global and regional economic environment, 15 African countries have posted output expansions of more than 5%,”

Regional outlook

Across the five regions in Africa, the bank projected East Africa to experience the fastest economic growth in 2024 at 5.1% followed by West Africa at 4.0%.

On the other hand, North and Central Africa are expected to grow at 3.9% and 3.5% respectively while Southern Africa will see the weakest growth at 2.2% in 2024.

More Insights

- While the report cast a bright light at Africa, the continent still grapples with several risks such as inflation, currency depreciation, elevated debt levels, and political risks with the rise of coups across the Sahel.

- Inflation continues to pose a threat to Africa’s population owing to monetary policy tightening across Europe and the United States, geopolitical tensions in Europe and the Middle east leading to stress in supply chains of energy and agricultural products.

- By the end of 2022, around 19 African countries posted double-digit inflation rates leading to reduction in consumer spending thereby plunging vulnerable populations deep into poverty. The figure remained unchanged in 2023. The continent averaged around 17.3% inflation in 2023.

- In the previous year, many African countries experienced severe currency depreciation with commodity exporters the most vulnerable. This was primarily due to hawkish inflation targeting monetary policies in the United States.

- Political risks due to internal conflicts and coups also threaten the economic growth across the continent. Last year, the continent saw coups in Niger and Gabon. However, since 2020 putschist have struck 9 times with varying degree of success mainly across the Sahel region.

Eleven of the world’s 20 fastest growing economies in 2024 are in Africa – AfDB

News

Nigerian woman declared dead appears in UK court to reclaim her £350,000 home

Nigerian woman declared dead appears in UK court to reclaim her £350,000 home

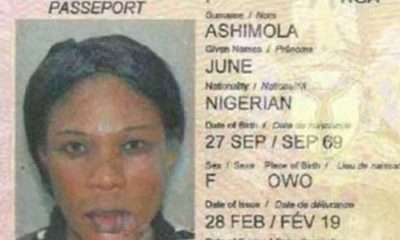

A 55-year-old Nigerian woman, June Ashimola, who was falsely declared dead, has appeared via video link from Nigeria before the UK High Court to prevent a convicted fraudster from seizing her £350,000 home in Woolwich, southeast London.

Ashimola was wrongly declared dead in February 2019, sparking a long legal battle over her estate.

However, she has now presented herself before Deputy Master John Linwood, asserting that she is alive and a victim of fraud.

According to DailyMail on Wednesday, the court heard that following her wrongful declaration of death, power of attorney over her estate, which consisted primarily of a house, was granted to Ms. Ruth Samuel, acting on behalf of Bakare Lasisi, who falsely claimed to have married Ashimola in 1993.

However, the judge ruled that the supposed marriage was a fabrication and that Lasisi did not exist.

According to court records, Ashimola left the UK for Nigeria in 2018 and had not returned since.

By October 2022, power of attorney had been awarded to Samuel on behalf of the fictitious Lasisi, who laid claim to Ashimola’s estate.

The judge ultimately found that Tony Ashikodi, a convicted fraudster who served three years in prison in 1996 for obtaining property by deception, had orchestrated the elaborate scheme to seize her home.

READ ALSO:

- Ex-Twitter CEO Jack Dorsey locked out of X account

- Obasanjo lambasts Tinubu on high cost of VP new residence, Lagos-Calabar highway

- ‘Akpabio can’t be forced to honour IPU invitation over Natasha’s accusations’

“This is an unusual probate claim in that the deceased says she is very much alive,” Deputy Master Linwood remarked, describing the case as a web of fraud, forgery, impersonation, and intimidation.

“The root of this claim is a long running battle or campaign waged by a Mr Tony Ashikodi for control and/or ownership of the property.

‘Ms Ashimola left the UK for Nigeria in about October 2018 and has not returned since. This claim involves wide-ranging allegations of fraud, forgery, impersonation and intimidation,” Linwood added.

Despite visa challenges preventing her from appearing in person, Ashimola’s identity was verified through passport photographs, leading the judge to dismiss the claims against her estate.

After reviewing the evidence, Deputy Master Linwood ruled, “’I find Ms Ashimola is alive and that the death certificate was forged and/or fraudulently obtained or produced or concocted.

“Her alleged death was part of Mr Tony Ashikodi’s attempts to wrest control of the property from her.

“The person who appeared before me and identified herself as Ms Ashimola was physically like her photographs in each passport.

READ ALSO:

- Natasha: Senate writes IPU on her suspension

- Nigerian man gets life jail in Italy for rape, murder

- Heavens won’t fall if Gov Fubara is impeached, says Wike

“I find that Ms Ashimola was not married to Mr Lasisi and that the marriage certificate is a concocted or fraudulent document for these reasons.

“I do not accept Mr Lasisi exists or if he does is aware of his identity being used. I do not accept that emails supposedly from him were actually from him.”

He further accused Ashikodi of attempting to mislead the court and found that both Ashikodi and Samuel were either directly involved in producing the fraudulent documents or knowingly relied on them.

He added, “I find that the probate power of attorney submitted supposedly by Mr Lasisi and Ms Samuel was a fraudulently produced or concocted document.

“The death certificate was not proven to the necessary standard in that only a copy was produced. The provenance was unknown. There was no evidence before me that it was a genuine document evidencing a real event.

“I find it was forged and/or fraudulently produced or concocted. The persons who relied upon it namely Mr Tony Ashikodi and Ms Samuel were either directly involved in its production or else knew it was false.’”

As a result, the power of attorney was revoked, safeguarding Ashimola’s rightful ownership of her £350,000 property.

The court also heard that legal costs incurred by both parties have exceeded £150,000, an amount that may surpass the property’s equity value.

Nigerian woman declared dead appears in UK court to reclaim her £350,000 home

News

Natasha: Senate writes IPU on her suspension

Natasha: Senate writes IPU on her suspension

The complaint filed by Senator Natasha Akpoti-Uduaghan at the United Nations Inter-Parliamentary Conference in New York has continued to generate reactions from various quarters.

The Kogi Central lawmaker had taken her case to the Inter-Parliamentary Union (IPU), alleging injustice and harassment, including her recent suspension from the Nigerian Senate.

Following her presentation, the IPU assured her that it would take necessary steps to address her grievances but emphasized the need to also hear the other side before making any official pronouncement.

The Nigerian Senate has however replied to Senator Natasha’s complaint to the IPU through a letter written by the Senate Leader, Senator Opeyemi Bamidele.

The letter was read by the Chairperson of the House of Representatives committee on Women Affairs and Social Development, Honorable Kafilat Ogbara, who is attending the event in an official capacity representing Nigeria.

The Senate letter read in part, “Senator Natasha-Akpoti-Uduaghan was suspended for gross misconduct and unruly behaviour and not as a result of allegation of sexual harassment or assault.

READ ALSO:

- Nigerian man gets life jail in Italy for rape, murder

- Heavens won’t fall if Gov Fubara is impeached, says Wike

- Abuja sex workers lose case seeking to legalise prostitution

“The authority of the Senate of the Federal Republic of Nigeria firmly refutes the deliberate misinformation and false narrative being circulated by certain media organisations regarding the sixth months suspension of Senator Natsaha-Akpoti-Uduaghan.

“Let it be unequivocally stated that Uduaghan was suspended solely for her persistent act of misconduct and disregard for the Senate Standing Orders.”

Honourable Ogbara, however, called for a thorough investigation into the allegation by Senator Natasha against the Senator President, Godswill Akpabio.

She maintained that procedures and necessary actions under the Senate rules were observed before Senator Natasha’s suspension.

Last week, the Senate suspended the lawmaker in a move that has continued to generate debates across the country.

She had initially submitted a petition to the Senate accusing Akpabio of sexual harassment. But the lawmakers threw it out before suspending her even after submitting another petition.

Senator Natasha vowed to continue the fight against “injustice”. But in the wake of the suspension, Akpabio denied the accusations and maintained he has never assaulted women.

Her altercation with the Senate president started on February 20, 2025, after her seat was changed during plenary.

That is not the first time both individuals had issues. In July 2024, Akpabio had while trying to correct her for misconduct told her to follow the rules and that the Senate is not a nightclub where anybody can talk anyhow. The Akwa Ibom lawmaker, however, later apologised to her for the remark.

Natasha: Senate writes IPU on her suspension

News

Tinubu set to appoint new ambassadors after 18 months

Tinubu set to appoint new ambassadors after 18 months

President Bola Tinubu is finally taking steps to fill Nigeria’s diplomatic leadership positions after operating without ambassadors for a year and a half.

According to a credible source in the Presidential Villa, the government has completed the screening of potential candidates to head Nigeria’s over 100 diplomatic missions worldwide. A senior official in the Ministry of Foreign Affairs also confirmed that the appointments are expected “very soon.”

This move follows Tinubu’s decision in September 2023 to recall all Nigerian ambassadors shortly after taking office.

“The issue is being resolved,” the source said, indicating that the long diplomatic vacuum may be coming to an end very soon.

“Nigeria’s security services have conducted background checks on potential appointees and have shared their findings with relevant agencies in the presidency and legislature”, according to an intelligence official.

The foreign affairs ministry has previously blamed financial constraints for the delay in naming new diplomats.

Nigeria, Africa’s most populous nation has budgeted N302.4 billion this year to operate its foreign missions.

READ ALSO:

- Bode George reacts to Jandor’s anti-party accusation, says he’ll regret ever walking Lagos streets

- High expectations as petrol price may drop to N800/litre

- PANDEF seeks Tinubu intervention in Rivers crisis

A former Nigerian ambassador who served in Africa and the United States noted that since taking office in May 2023, President Tinubu has focused primarily on addressing Nigeria’s struggling economy, with foreign policy taking a second priority.

The former ambassador, who requested anonymity, said government officials had informed him that several foreign leaders had raised concerns about Nigeria’s lack of ambassadors during discussions with President Tinubu. According to this source, the president has assured these leaders that appointments will be made soon.

Another official who asked to remain anonymous as he was not authorised to speak to the press confirmed that the appointment was imminent.

“Ambassadorial appointments require approval from the National Assembly. So, the list will be submitted to the Senate President, who will then announce it. But it has not been submitted yet. Yes, I can confirm that but it will be submitted shortly.

In April 2024, the government appointed 12 consuls-general and five chargés d’affaires to represent Nigeria in 14 countries, but these interim measures fell short of filling the leadership vacuum in key missions.

Consuls-general and chargés d’affaires can perform routine administrative duties and oversee the operations of an embassy. They, however, lack the diplomatic weight to engage at the highest levels, such as with heads of state or critical international negotiations.

This newspaper learnt that a founder of a tier-one bank, a former Deputy Governor of Lagos State and the Speaker of a House of Assembly in the North were considered for the ambassadorial roles.

Tinubu set to appoint new ambassadors after 18 months

-

metro2 days ago

metro2 days agoJUST IN: Fubara locked out of Rivers Assembly complex (Video)

-

Railway2 days ago

Railway2 days agoWe’ll stamp out railway vandalism, says Opeifa, after recovering stolen 91 sleepers, 25 rails

-

metro2 days ago

metro2 days agoBREAKING: House of Reps orders shutdown of porn websites nationwide

-

metro2 days ago

metro2 days agoOmokri to el-Rufai: No party defector has ever become Nigeria’s president

-

metro3 days ago

metro3 days agoAPC council chairmanship aspirant hacked to death in Lagos

-

Entertainment2 days ago

Entertainment2 days agoI’ve videos of multiple men sleeping with my wife – Ijoba Lande

-

News16 hours ago

News16 hours agoNigerian woman declared dead appears in UK court to reclaim her £350,000 home

-

Entertainment16 hours ago

Entertainment16 hours agoCourt bans viewing of controversial film, ‘Gang of Lagos’