Business

Investors lose N1.5trn in stocks over new monetary policy

Investors lose N1.5trn in stocks over new monetary policy

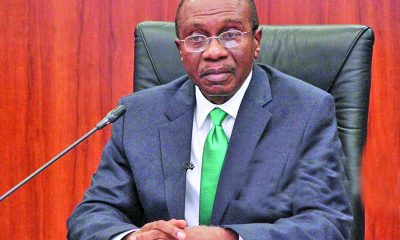

Investors in the Nigerian stock market lost about N1.5 trillion of their investment in the stock market following the massive adjustments in the Central Bank of Nigeria, CBN’s Monetary Policy Rate, MPR, at the Monetary Policy Committee, MPC, meeting yesterday.

Recall that the meeting raised the MPR by unprecedented 400 basis points to an equally unprecedented MPR height of 22.75 percent from 18.75 percent.

The NGX market capitalisation, which represents the total value of investment on the Nigerian Exchange Limited, NGX, dropped to N54.317 trillion at the close of trading on Wednesday from N55.810 trillion recorded on Monday.

On Tuesday, when the Governor of the CBN, Yemi Cardoso, announced the new MPR, the stock market went down with investors’ losing N773 billion and on Wednesday it dropped further by N720 billion.

READ ALSO:

- President Tinubu launches expatriate employment levy

- Accidental Discharge: Police warn hunters against carelessness

- Liverpool beat Southampton to seal FA Cup quarters

In the same vein, another major stock market gauge, NGX All Share Index, ASI, declined for the two consecutive days by 2.7 percent to close at 99,266.02 points from 101,995.53 points it closed on Monday.

Trading analysis showed that the NGX ASI declined on Tuesday and Wednesday by 1.4 % and 1.3% respectively.

Market activities showed trade turnover settled lower relative to the previous session, with the value of transactions down by 4.8 percent. A total of 396.23million shares valued at N5.83billion were exchanged in 10,549 deals.

Analysts attributed the bearish trend to selloffs in highly priced stocks and profit taking in blue chip companies that weighed on the benchmark NGX All Share index which closed lower, as the market reacted immediately to the 4% increase in MPR.

Reacting to this development, analysts at Investdata stated: “This position did not come as a surprise to many, however, since Olayemi Cardoso, the new CBN Governor, had signaled this since November 2023, coupled with the failure to hold a policy meeting for so long a time, with inflation rate climbing to almost 28-year high at 29.9%. It is also the highest since Nigeria returned to democracy in May 1999, while the Naira depreciation is hitting almost 70% against dollar in the New Year 2024.”

Investors lose N1.5trn in stocks over new monetary policy

Aviation

FAAN begins sale of e-tags at airports

FAAN begins sale of e-tags at airports

The Federal Airport Authority of Nigeria (FAAN) on Friday commenced the sale of electronic tags (e-tags) at airports.

The initiative, it said in a statement, was in line with the presidential directive that mandating the use of e-tags for accessing the nation’s federal airports.

“Following the presidential directive that all citizens are mandated to pay for e-tags at all the 24 federal airports across the country, we wish to inform the general public that the e-tags are available for sale from Friday, 17th May, 2024 at the following locations,” FAAN said.

“Lagos: Murtala Muhammed International Airport Lagos, Terminal 1, 5th Floor) Office of HOD Commercial. Contact: 08033713796 or 08023546030.

“Abuja: Nnamdi Azikiwe International Airport, HOD Commercial Office (General Aviation Terminal) Contact: 08034633527 or 08137561615.”

FAAN however said there would be an option to pay in cash at the access gates for motorists without e-tags.

On May 14, Minister of Aviation and Aerospace Development, Festus Keyamo, announced that everyone, including the President and Vice President, would pay tolls at the airports.

Keyamo said the government was losing over 82 per cent of the revenue it should have earned from the access fee.

Business

Your pension funds safe, won’t be accessed illegally, FG tells workers

Your pension funds safe, won’t be accessed illegally, FG tells workers

Minister of Finance and Coordinating Minister of the Economy, Mr. Wale Edun, says the Federal Government has no plans of illegally accessing the N20 trillion pension funds for infrastructure development.

He said noone should entertain any fear over the safety of the contributions of workers that make up the pension funds.

Edun had earlier said the spoken on a move to use the pension funds as part of the government’s efforts to bridge Nigeria’s estimated 20 million housing deficit, and provide massive housing and mortgage loans at 12 per cent interest rates, with 25-year repayment plans.

The minister’s comments had elicited serious reactions from notable groups and Nigerians, including the organised labour and a former Vice President, Alhaji Atiku Abubakar, who advised the government to suspend the move.

Atiku said the move was potentially disastrous for retired Nigerians dependent on their pensions.

But in a statement personally issued on Thursday, Edun said the stories making the rounds that the government planned to illegally access the savings and pension contributions of workers were false.

He stated that the pension industry was guided by rules, adding that the government would be strictly guided by extant rules in accessing the pension funds of workers.

The minister stressed that government would not go outside the stipulated limitations on what the funds could be invested in.

The statement read in partu, “It has come to my notice that there are stories making the rounds that the Federal Government plans to illegally access the hard-earned savings and pension contributions of workers. Nothing could be farther from the truth.

“The pension industry, like most the financial industries, is highly regulated. There are rules. There are limitations about what pension money can be invested in and what it cannot be invested in.

“The Federal Government has no intention whatsoever to go beyond those limitations and go outside those bounds, which are there to safeguard the pensions of workers.

“What was announced to the Federal Executive Council was that there was an ongoing initiative drawing in all the major stakeholders in the long-term saving industry, those that handle funds that are available over a long period to see how, within the regulations and the laws, these funds could be used maximally to drive investment in key growth areas, including infrastructure, housing, and, of course, to find a way to provide Nigerians with affordable mortgages.

“Within this context, there is no attempt, nor is it being considered, to offer unsafe investments for pension funds or even insurance funds or any investment funds.

“No attempt whatsoever to increase the risk. No attempt whatsoever to lower the returns that would otherwise be earned.”

Aviation

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Emirates Airlines on Thursday announced that its flight operations to Nigeria would resume on October 1, 2024.

It said this in a statement, “The service will be operated using a Boeing 777-300ER. EK783 will depart Dubai at 0945hrs, arriving in Lagos at 1520hrs. The return flight EK784 will leave Lagos at 1730hrs and arrives in Dubai at 0510hrs the next day.

“Tickets can be booked now on Emirates.com or via travel agents.”

It quoted Emirates’ Deputy President and Chief Commercial Officer, Adnan Kazim, as saying the Lagos-Dubai service has traditionally been popular in Nigeria.

“We thank the Nigerian government for their partnership and support in re-establishing this route and we look forward to welcoming passengers back onboard,” Kazim said.

Minister of Aviation and Aerospace Development, Festus Keyamo, on Wednesday said the Emirates Airlines had given a definite date to resume flight operations to Nigeria and would make the announcement in a matter of days.

Emirates Airlines suspended flight operations to Nigeria in October 2022 over its inability to repatriate its $85 million revenue trapped in Nigeria.

-

Business2 days ago

Business2 days agoDollar crashes against Naira at official market

-

News20 hours ago

News20 hours agoUsing pre-registered SIM card may land you in jail, NCC warns

-

metro2 days ago

metro2 days agoThree police officers sentenced to life imprisonment in Anambra

-

News2 days ago

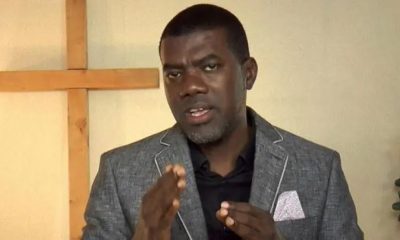

News2 days agoWike, Fubara are ego-driven, crude – Reno Omokri

-

News1 day ago

News1 day agoUpdated: Reps condemn assault on Nasarawa female doctor by patient family

-

Aviation2 days ago

Aviation2 days agoUpdated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

-

International1 day ago

International1 day agoUK says it’s developing radio frequency to blast out drones

-

metro3 days ago

metro3 days agoNigerian who killed wife in UK bags life jail