Business

Kill subsidy, cut CBN loans, raise ‘sin’ taxes… 7 things World Bank wants Buhari to do in 2022

The World Bank on Tuesday released its November 2021 Nigeria Development Update, which showed — among other things — that eight million Nigerians fell into poverty in less than two years as a result of inflation shocks.

The report also revealed that Nigeria no longer benefits from high oil prices, with record low revenues, and exorbitant fuel subsidies, which makes Nigeria the only country in the world granting universal price petrol subsidies.

Also, the report reiterated that Nigeria has the worst revenue-to-GDP ratio among 115 countries monitored by the World Bank. Worse than Haiti.

To address the grim picture of Nigeria’s economy going into the future, the World Bank has recommended a number of policy decisions for the Muhammadu Buhari administration and the Central Bank of Nigeria (CBN) starting from the year 2022.

The Cable brings you a summary of the policy recommendations from the 112-paged Nigeria Development Update.

RAISE TAXES ON SINFUL GOODS

The World Bank recommended that the government raises taxes on what it referred to as “sinful goods,” including cigarette, alcohol, sugary drinks.

The bank said FG has “accelerated efforts to diversify its revenue stream; however, risks to the implementation of these reforms remain high”.

“These reforms include improving tax administration, especially for VAT, while also undertaking some significant policy reforms, such as implementing a levy on electronic money transfers, and additional excise taxes on alcohol and tobacco

“While these reform efforts are expected to generate additional revenues of over ₦ 3 trillion a year, they may be challenging to politically implement in the run up to the national elections, planned for 2023.”

Despite the perceived difficulties, the bank advised that FG increase these taxes in order to generate adequate revenue.

READ ALSO:

- Dozens still missing 2 days after Abuja-Kaduna Road attack

- #EndSARS protester who testified before Lagos panel ‘stabbed by hoodlums’

- Married man abandons girlfriend in Lagos hotel room, rapes receptionist

KILL FUEL SUBSIDIES

Fuel subsidy removal has been a recurrent recommendation in World Bank/IMF policy briefs for Nigeria for more than a decade, but little has been done about this.

In this report, the World Bank has asked the government to remove subsidies, again. The bank argues that the poorest Nigerians do not benefit much from the subsidy regime.

“Nigeria is the only country in the world with a universal price subsidy that applies exclusively to PMS. Universal price subsidies for liquid fuels are almost always regressive, as the rich consume far more fuel than the poor,” the report read.

“PMS subsidies are especially regressive because PMS is used primarily in light- and medium-duty motor vehicles, which are rarely owned by the poor. Since raising PMS prices tends to have minimal adverse effects on poor households, governments worldwide have typically prioritized eliminating PMS subsidies over those that apply to other fuels.

“However, Nigeria has done the opposite—eliminating all subsidies for liquid fuels other than PMS. Moreover, the Nigerian PMS subsidy is exceptionally generous, and in October 2021 the PMS pump price was the seventh-lowest among 168 economies surveyed at just ₦495 per liter”

The bank said the poorest 40 percent of Nigerians consume less than 3 percent of the total PMS consumption in Nigeria.

CUT LOANS FROM CBN

The World Bank said in its projections for Nigeria, that if current debt accumulation levels are maintained, the country’s debt-to-GDP ratio will hit 40 percent by 2025.

The bank, therefore, advised that the Buhari-admin cut back on its request for overdrafts from the CBN through the Ways and Means financing system. The bank asked FG to keep overdrafts to levels stipulated by law.

“Faced with a widening budget deficit, policymakers have increasingly turned to costly CBN overdrafts (also known as Ways and Means financing), which are not properly integrated into the fiscal accounts.

“While Nigeria’s debt burden remains manageable for the time being, maintaining sustainable debt dynamics will require curbing the use of CBN financing for the deficit and addressing fiscal pressures to break the cycle of low growth and rising public debt.”

FIX FOREX POLICY

“The current mix of monetary, fiscal, foreign exchange (FX), and trade policies also plays a prominent role as a driver of inflation,” the World Bank said. The bank recommended that fixing inflation will need some solution from forex management.

“Trade and FX restrictions, including the closure of land borders starting in August 2019, have increased prices for food and consumer goods, and imports of over 40 goods, including many staple foods, are currently ineligible for FX through formal windows.

“Nigeria’s exchange-rate management has resulted in the rise of parallel rates, which are closely linked to food-price dynamics.”

To address inflation, the bank recommended enhancement of the “flexibility and predictability of exchange rate management”. It also asked that all land borders be fully open for trade.

BUILD THE DIGITAL ECOSYSTEM

“One leading barrier is Nigeria’s underdeveloped fixed broadband infrastructure, which is partly attributable to burdensome Federal and State regulations,” the World Bank diagnosed.

“This weak infrastructure base creates a ripple effect across the economy, contributing to low levels of financial inclusion, and persistent geographic and gender gaps in access to and use of digital technologies.

“Conflicts, particularly in the north, exacerbate these challenges, due to heightened security risks. By investing in its digital infrastructure and strong foundational ID systems, Nigeria can promote economic development, security, governance, and efficient delivery of services, thereby accelerating progress toward an inclusive digital economy.”

The bank advised Nigeria to build digital public platforms, digital financial services, digital entrepreneurship, digital skills, and digital infrastructure.

PROTECT THE POOR

When subsidies are removed, the World Bank forsees some inflation, which would affect the poor and vulnerable. The bank is therefore calling on the government to fix this by protecting the poor.

“Implement a large-scale (covering 25% to 50% of the population) and time-bound targeted cash-transfer program to mitigate impacts of high inflation and the PMS subsidy removal,” the bank said.

It also called on government to “redirect savings from PMS subsidy to finance primary health, basic education, and rural connectivity projects”.

The bank said that the government in 2022 has planned to spend ~N3,000 per person per year on health while fuel subsidies could cost N13,000 per person per year in the same year”.

It called on the government to rearrange its priorities to shield the poor from bearing the burden of the subsidy removal.

SPEED UP PORT CLEARANCE

The World Bank advised that the government “reduce delays in border and port clearance by simplifying and harmonizing

documents, streamlining, automating procedures, and introducing risk-based customs interventions.”

This would entail spending up the processes of import at the popular Apapa Port, which is the busiest in the country, and one of the least efficient on the continent.

The Cable

Auto

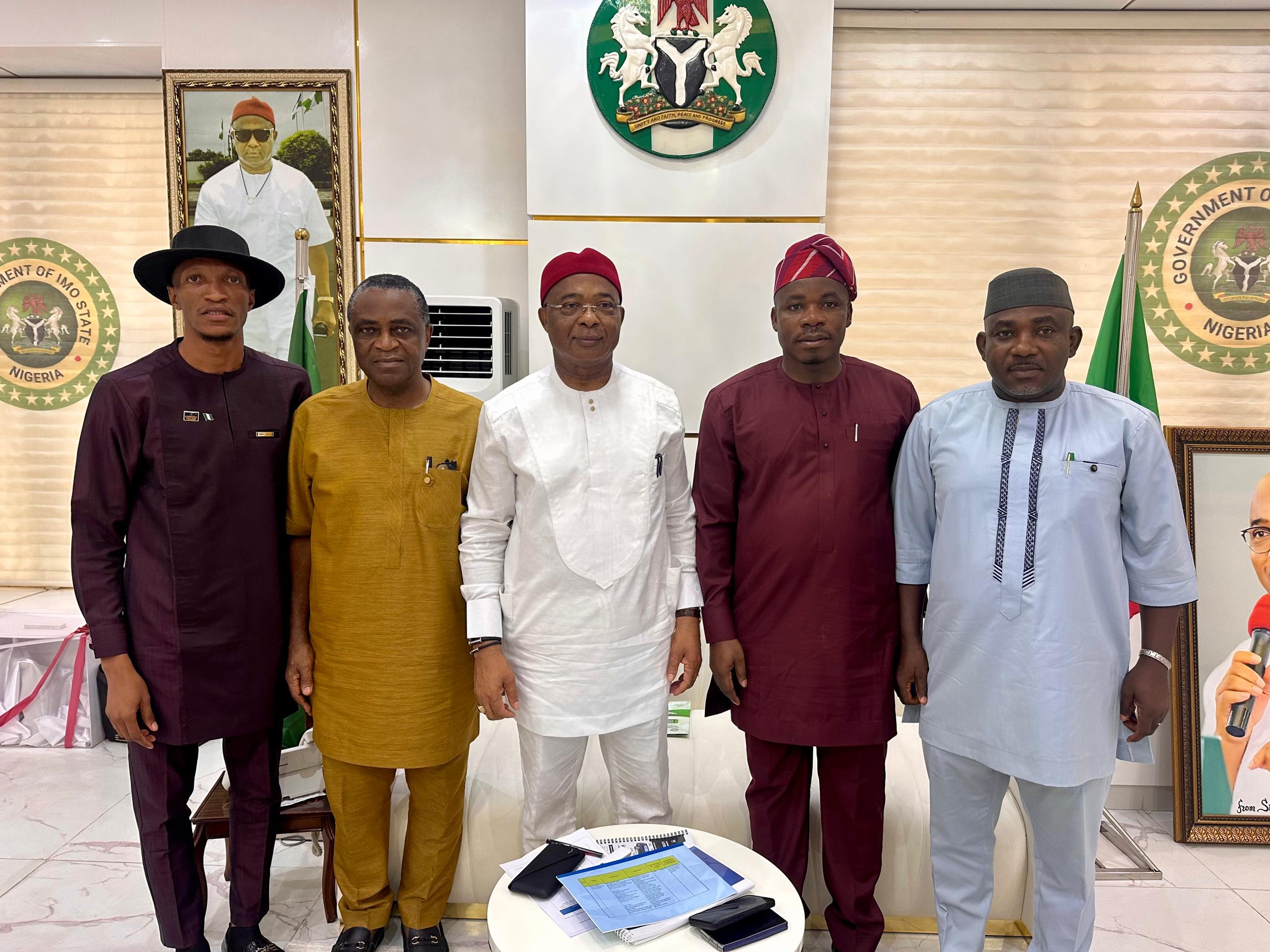

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

NADDC DG hails Kojo Motors for establishing CNG conversion centre in Owerri

Kojo Motors has partnered the National Automotive Design and Development Council (NADDC) in setting up the vehicle Compressed Natural Gas conversion centre in Owerri, lmo State.

Director-General of the NADDC, Joseph Osanipin, during an empowerment and awareness summit on Wednesday, March 19, 2025, commended the auto firm for the monumental project.

“Today, we are gathered here for Compressed Natural Gas (CNG) Empowerment and Awareness Summit 2025 with the theme ‘Building a youth-based nation through cleaner energy’,” he said.

Osanipin said that the the purpose of the summit was to create awareness and sensitize the public to safety, standards and regulation in the use of the CNG as a better alternative source of energy for mobility.

NADDC, he said, was equipping technicians with the knowledge, skills and competencies required to safely and efficiently convert vehicles to run on CNG.

“The Council is a parastatal of the Federal Government under the Federal Ministry of Industry, Trade and Investment,” he added.

“It has the regulatory oversight on the Nigerian Automotive Industry to initiate, recommend, supervise and regulate policies and programmes for locally manufactured vehicles and components in Nigeria.

The NADDC boss noted that the Council had worked tirelessly to ensure the survival and growth of this sector with a view to enhancing its contribution to the national economy.

As part of the CNG conversion programme, 60 technicians will be receiving hands-on training in converting vehicles to run on CNG which would run for five days from the March 17 to 21,2025.

Osanipin emphasized the importance of using certified conversion kits and specialized workshops to ensure safety during the process.

“The cylinders used in CNG vehicles are fortified, making them safer than traditional vehicle fuel tanks,” he said.

Also speaking during the event, Professor Anoka Njan, representative of the Minister of Industry Trade and Investment, praised the NADDC and Kojo Motors efforts, stating that the ministry fully supported the initiative as part of broader efforts to alleviate challenges in the auto industry and empower the youth.

Imo State Commissioner for Youth Development, Dr. Emeka Mandela Ukaegbu, who spoke at the summit on behalf of Governor Hope Uzodinma, emphasised the immense potential of the CNG in easing Nigeria’s transportation challenges and improving the economy.

“CNG offers a safer, cleaner, and cheaper alternative to the hardships many face in the country,” Dr. Madela said.

The administration is partnering with NADDC and automotive industry bodies to establish conversion workshops and CNG refilling stations across Imo State, ensuring that the state plays a key role in this important shift toward greener energy solutions.

The event marks a significant step in NADDC’s ongoing efforts to transform Nigeria’s automotive industry, making it more sustainable while creating new opportunities for skilled technicians and local communities.

Chinedu Oguegbu, Managing Director of OMAA, which is the vehicle brand promoting the petrol-powered to CNG conversion project, highlighted the economic benefits of running vehicles on CNG instead of petrol.

He listed the economic advantages to include savings up to 60 percent in the cost of fuel relative to dirtier options like diesel and petrol.

According to him, there is up to 90 percent reduction in knocks and carbon emission, and it is found to be healthier, cleaner and more environmentally friendly.

Besides savings in foreign exchange (FX) with abundance of gas locally, there is also massive resources in-country over 203 tcf of proven reserves that requires no refining and relatively lower investment for processing.

Nigeria has an estimated 15-20 million vehicles in operation that can be converted to dual-fuel or bi-fuel.

The OMAA boss reiterated the crucial need to provide an alternative to existing fuel system with the abundance of CNG as an option.

Delivering his goodwill message, Chino Ogwumike, the National Sales Manager at Kojo Motors, thanked the DG of NADDC for partnering with Kojo in this laudable project in Owerri, the heartland of the South-East of Nigeria and the government of Imo State for accepting to provide the land for building the CNG hub in the state capital.

Ogwumike stated that the flourishing automotive dealership with branches spread across the country under the visionary leadership of the founder and Executive Chairman, Ikenna Oguegbu, is strongly committed to contributing its quota towards the progress and development of Nigeria’s automotive sector and the economy.

Business

Binance delists five cryptocurrencies

Binance delists five cryptocurrencies

Binance, the world’s largest cryptocurrency exchange, has announced the delisting of five digital assets after a routine review of their adherence to industry standards.

According to a statement released by Binance, the affected cryptocurrencies include Aergo (AERGO), AirSwap (AST), BurgerCities (BURGER), COMBO (COMBO), and Linear Finance (LINA).

The decision was based on several key factors, including trading volume, security, liquidity, the commitment of project teams, and compliance with regulatory requirements.

READ ALSO:

- Akpabio told me I’d make good movements with my waist – Natasha

- Supreme Court declares Wike’s ally Anyanwu as PDP National Secretary

- Why we want Natasha out of Senate – Kogi Central constituents

The company said this step, aimed at maintaining a robust and transparent trading environment, shows Binance’s commitment to ensuring that all listed assets align with the platform’s evolving criteria.

“These projects no longer meet the platform’s listing requirements,” Binance noted in its internal review. As a result, these tokens will be removed from all spot trading pairs starting March 28, 2025, at 3:00 a.m. UTC.

The exchange has advised users holding these assets to take appropriate steps to manage their portfolios ahead of the delisting deadline.

Key delisting details and user guidelines

Binance provided additional clarity on how the delisting process will impact its users:

- Binance Futures: Positions for AERGO, LINA, and COMBO will be automatically closed and settled by March 27, 2025, at 9:00 a.m. UTC.

- Binance Simple Earn & Investment Products: The affected tokens will no longer be available across these services after March 27, 2025.

- Binance Convert & Trading Bots: Support for the delisted tokens will cease by March 28, 2025.

Binance also mentioned that in some instances, delisted tokens might be converted into stablecoins on behalf of users after delivery. However, the exchange clarified that this would only apply if explicitly announced.

Looking ahead, Binance revealed plans to launch a Vote to Delist feature, enabling the public to suggest assets for delisting in the future. However, the tokens mentioned in this announcement will not be eligible for the feature.

Binance delists five cryptocurrencies

Business

Air Peace slashes Nigeria-London fare by N600,000

Air Peace slashes Nigeria-London fare by N600,000

Air Peace has announced a ₦600,000 reduction in its Nigeria-London airfare for all travelers flying from Nigeria.

In a statement released on Wednesday in Lagos, the airline’s Head of Corporate Communications, Dr. Ejike Ndiulo, stated that the discount is part of Air Peace’s latest promo offer.

Passengers departing from any Nigerian city to London can enjoy significant savings, along with an exclusive one-free extra luggage allowance.

READ ALSO:

- Tinubu’s state of emergency prevented Fubara from impeachment – AGF

- FG blames Fubara for bombing of oil pipeline

- Over 90% Nigerian land not registered, says Housing minister

According to Ndiulo, the airline rewarded five lucky winners of a raffle draw at the Silverbird Man of the Year Awards held on Sunday in Lagos.

He said that three winners won return economy tickets to any of Air Peace’s domestic destinations, while two won economy return tickets to London.

He said that the Chairman/Chief Executive Officer of Air Peace, Dr Allen Onyema, emphasised the airline’s commitment to driving Nigeria’s socio-economic development through its corporate social responsibility initiatives.

Air Peace slashes Nigeria-London fare by N600,000

-

International2 days ago

International2 days agoUK announces new passport application fees starting April 2025

-

Auto3 days ago

Auto3 days agoLanre Shittu Motors offers support for EV bus design competition in universities

-

metro3 days ago

metro3 days agoIbas: 18 things to know about Rivers administrator

-

metro3 days ago

metro3 days agoSoldiers take over Rivers Government House after state of emergency declaration

-

metro3 days ago

metro3 days agoPipeline explosion hits Bayelsa amid Rivers state emergency declaration

-

metro2 days ago

metro2 days agoCourt lifts order stopping Senate probe on Natasha Akpoti

-

metro8 hours ago

metro8 hours ago‘We’re not hiring,’ NNPC denies viral recruitment adverts

-

metro2 days ago

metro2 days agoTanker explodes on Abuja bridge, many feared dead, 30 vehicles burnt