Business

Scarcity: NNPC counters MRS, says marketer, three others imported adulterated fuel

The Nigerian National Petroleum Company Limited has countered MRS Oil Nigeria Plc as regards the recent importation of adulterated Premium Motor Spirit, popularly called petrol, into the country.

NNPC’s Group Managing Director, Mele Kyari, named MRS and three other dealers as the firms that imported the contaminated products into Nigeria. This was, however, in contrast to the position of MRS.

A speech shared to selected broadcast media quoted Kyari as saying, “On January 20, 2022, NNPC received a report from our quality inspector on the presence of emulsion particles in PMS cargoes shipped to Nigeria from Antwerp-Belgium.

“NNPC investigation revealed the presence of Methanol in Four (4) PMS cargoes imported by the following DSDP suppliers namely:

“Importer vessel name load port,

1. MRS MT Bow Pioneer LITASCO Terminal, Antwerp-Belgium; 2. Emadeb/Hyde/AY Maikifi/Brittania-U Consortium MT Tom Hilde; 3. Oando MT Elka Apollon; 4. Duke Oil MT Nord Gainer.”

He said cargoes quality certificates issued at load port (Antwerp-Belgium) by AmSpec Belgium indicated that the gasoline complied with Nigerian specification.

READ ALSO:

- Dakuku Peterside’s crocodile tears over destruction of waterfronts

- ‘Wike’s displacement of 100,000 Rivers people wicked, evil, inhuman’

- 70% of youths threatened by drugs, says Marwa

Kyari said NNPC quality inspectors including GMO, SGS, GeoChem and G&G conducted tests before discharge also showed that the gasoline met Nigerian specification.

“As a standard practice for all PMS import to Nigeria, the cargoes were equally certified by inspection agent appointed by the Nigeria Midstream and Downstream Petroleum Regulatory Authority has met Nigerian specification.

“It is important to note that the usual quality inspection protocol employed in both the load port in Belgium and our discharge ports in Nigeria do not include the test for per cent methanol content and therefore the additive was not detected by our quality inspectors.”

He noted that in order to prevent the distribution of the petrol, NNPC had ordered the quarantine of all un-evacuated volumes and the holding back of all the affected products in transit (both truck and marine).

“All defaulting suppliers have been put on notice for remedial actions and NNPC will work with the authority to take further necessary actions in line with subsisting regulations,” Kyari stated.

But MRS had on Wednesday denied any involvement in the imports of the adulterated products, as it explained that methanol was prohibited in petrol imported into Nigeria.

It said, “Due to current subsidy regime, NNPC is the sole supplier of all PMS in Nigeria. Consequently, NNPC through their trading arm Duke Oil, supplied a cargo of PMS purchased from international trader Litasco and delivered it with Motor Tanker Nord Gainer.

READ ALSO:

- No going back on strike if govt fails to honour agreements –ASUU

- OAU student dies after falling into ‘soakaway’

- Police confirm killing of 7 by cultists in Imo

- Terrorists kill DPO, soldier, one other; abduct housewife in Katsina

“This vessel discharged in Apapa between the January 24 and 30, 2022 and the following major marketers with receiving quantities were the recipients of the product:

OVH, 10,000 metric tonnes; MRS, 5,000MT; NIPCO, 5,958MT; ARDOVA, 6,000MT; Total, 10,000MT.”

The company stated that being one of the beneficiaries, MRS received the product in its depot and distributed the product to only eight of its stations in Lagos.

It explained that following delivery into tank, it was observed that the product appeared hazy and dark, adding that the management of MRS immediately directed that further sale(s) should be stopped and the

product isolated.

The firm further stated that the allegation against MRS that it imported contaminated products, was therefore mischievous, false and untrue.

“MRS is not an importer of this contaminated PMS into the country, nor does MRS sell substandard products,” it stated.

Punch

Aviation

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

The Air Peace CEO, Allen Onyema, has warned that Nigeria’s new tax laws threaten the survival of local airlines, arguing that the legislation reinstates taxes removed under the 2020 reforms. The taxes include customs duties on imported aircraft, aircraft parts, engines, and Value Added Tax (VAT) on tickets, which Onyema says will impose unsustainable financial burdens on airlines.

Speaking in an interview with Arise News on Sunday, Onyema stressed the high cost implications for airline operators.

“There is VAT on the importation of aircraft. For an aircraft worth $80 million, you are supposed to pay 7.5 percent. With bank loan interest rates at 30–35 percent, plus VAT on spare parts, it is unsustainable,” Onyema said. “If we implement that tax reform, Nigerian airlines will go down in three months.”

The Air Peace CEO also announced that the airline industry will no longer tolerate unruly passengers starting January 1, 2026. Onyema cited instances of disruptive behaviour by passengers on flights, including smuggling alcohol into the cabin, forcing upgrades to business class without payment, and threatening fellow travellers.

READ ALSO:

- Train Derailment in Southern Mexico Kills 13, Injures Nearly 100 in Oaxaca

- Tragedy in Lekki as Lexus SUV Crashes Into Children, One Feared Dead, Four Injured

- Presidency Intervenes in Akume, Alia Political Dispute in Benue

He referenced a recent incident on a flight diverted to Manchester, UK, due to bad weather, where passengers staged a viral video accusing Air Peace of misconduct, despite British authorities confirming that over 200 flights were diverted that day.

Onyema emphasised that airlines will now enforce stricter measures, including blacklisting unruly passengers, asserting that the behaviour is currently being “supported by the system unnecessarily.”

The statement comes amid growing concerns over rising domestic airfares. On December 10, the Senate summoned the Aviation Minister, Festus Keyamo, and industry stakeholders over soaring ticket prices. Subsequently, on December 11, the House of Representatives called on the federal government to reduce aviation taxes by 50 percent to ease costs for travellers.

Onyema’s comments highlight both the financial pressures on Nigerian airlines due to aviation taxes and the sector’s new stance on passenger discipline to safeguard safety and service standards.

VAT on Aircraft, Spare Parts Threatens Survival of Nigerian Airlines, says Allen Onyema

Auto

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Changan CS55 and Kia Seltos have clinched top honours at the 2025 Nigeria Auto Journalists Association (NAJA) International Auto Awards, winning Midsize SUV of the Year and Compact SUV of the Year, respectively.

The awards were announced at a recent well-attended ceremony held at the Oriental Hotel, Victoria Island, Lagos, which brought together key stakeholders across Nigeria’s automotive value chain to celebrate excellence, resilience and innovation in the industry.

Changan CS55’s latest recognition comes after its impressive performance at last year’s 17th edition of the awards, where it was crowned Nigeria’s New Car of the Year.

At the 2025 ceremony, the compact crossover SUV edged out strong contenders such as the Kia Sonet and Chery Tiggo to secure the coveted Midsize SUV title.

Changan vehicles are marketed and assembled in Nigeria by Mikano Motors, reinforcing the growing impact of local assembly in the country’s automotive sector.

In the Compact SUV category, the Kia Seltos emerged winner, beating notable competitors such as the Toyota Prado, Changan CS55 and Chery Tiggo.

READ ALSO:

- Ojuelegba Bridge Gridlock as Container Truck Overturns in Surulere, Lagos

- Troops Foil Kidnapping on Otukpo–Enugu Expressway, Rescue Passengers in Benue

- Davido Joins Accord Party, Aligns With Uncle, Osun Governor Ademola Adeleke

Industry analysts have described the Seltos as a compelling blend of practicality and style, praising its bold design, versatility and appeal to modern drivers.

Other corporate winners at the event are the Mikano Group, which was named Auto Company of the Year; Iron Products Industries (IPI) Limited, honoured as Truck Assembler/Body Builder of the Year; Lanre Shittu Motors (JAC), awarded Truck Plant of the Year; and Innoson Vehicle Manufacturing (IVM), which won Passenger Car Assembly Plant of the Year.

These recognitions highlighted the depth and growing strength of indigenous participation in Nigeria’s automotive industry.

Speaking at the ceremony, the Director-General of the National Automotive Design and Development Council (NADDC), Otunba Joseph Osanipin, commended NAJA for sustaining a credible platform promoting excellence and accountability within the sector.

In his welcome address, NAJA Chairman Mr Theodore Opara described the awards as a benchmark for performance in Nigeria’s evolving automotive ecosystem, noting that the industry continues to adapt amid policy reforms, technological advancements and changing consumer expectations.

The 2025 NAJA International Auto Awards once again underscored the critical role of leading brands in strengthening Nigeria’s transportation and industrial backbone, while celebrating outstanding achievements across the nation’s automotive landscape.

Changan CS55, Kia Seltos take top SUV honours at 2025 NAJA Auto Awards

Railway

Excited passengers hail FG as 50% yuletide train fare cut sparks nationwide rush

Excited passengers hail FG as 50% yuletide train fare cut sparks nationwide rush

Excitement swept through major railway stations across the country on Tuesday and Wednesday as thousands of passengers turned out to enjoy the Federal Government’s 50 percent yuletide train fare reduction, with many openly praising the initiative as a major relief amid rising transport costs.

From the Lagos–Ibadan and Abuja–Kaduna standard gauge corridors to key narrow gauge routes, passengers arrived early, smiling, cheering and expressing gratitude to the government for what they described as a “timely Christmas gift.”

Several train services departed with near-full capacity as Nigerians seized the opportunity to travel cheaply to reunite with family and loved ones for the Christmas and New Year celebrations.

The discounted festive rail service, approved by the Federal Government and implemented by the Nigerian Railway Corporation (NRC), runs from Tuesday, December 23, 2025, to Sunday, January 4, 2026, offering passengers a 50 percent reduction on fares nationwide.

Speaking at various stations, passengers said the fare cut had significantly eased the financial burden of holiday travel, especially for families and group travellers.

Many described the initiative as people-centred and compassionate, noting that it allowed them to travel safely and comfortably at a time when road transport costs have surged.

“I never imagined I would travel this cheap during Christmas,” a passenger at the Lagos terminus said. “This is a big relief. The government has really tried, and we are grateful.”

Confirming the successful commencement of the programme, the NRC Chief Public Relations Officer, Callistus Unyimadu, said the turnout across major routes showed strong public acceptance of the initiative, adding that early bookings reflected overwhelming passenger interest.

The Managing Director and Chief Executive Officer of the NRC, Dr Kayode Opeifa, assured passengers that the corporation was fully prepared to sustain safe, efficient and customer-friendly services throughout the festive period.

He said enhanced security, safety and customer service measures had been put in place across stations and onboard trains to manage the increased traffic resulting from the fare reduction.

The NRC noted that both standard gauge and narrow gauge services are fully operational, advising passengers on standard gauge routes to continue using NRC-approved online booking platforms, while narrow gauge passengers can purchase tickets directly at designated railway stations.

The 50 percent yuletide train fare cut is part of the Renewed Hope Agenda of President Bola Ahmed Tinubu, aimed at reducing transportation costs, promoting inclusive mobility and encouraging rail transport as a safer and more reliable option during peak travel seasons.

As the festive rush continues, the NRC urged passengers to cooperate with railway officials and comply with travel guidelines to ensure smooth and hitch-free journeys throughout the discount period.

If you want, I can make it more emotional, more political, or more populist depending on the platform (Vanguard, Punch-style, or government-leaning tone).

-

metro2 days ago

metro2 days agoIbadan Explosion: Fayose Releases Documents, Claims Makinde Got ₦50bn from FG

-

metro1 day ago

metro1 day agoNiger Delta Crackdown: Army Seizes ₦150m Stolen Oil, Arrests 19 Suspects

-

metro2 days ago

metro2 days agoPlateau Kidnappers Demand ₦1.5m Each as 28 Muslim Travellers Remain in Captivity

-

Sports2 days ago

Sports2 days agoCristiano Ronaldo Wins Best Middle East Player at 2025 Globe Soccer Awards in Dubai

-

Sports2 days ago

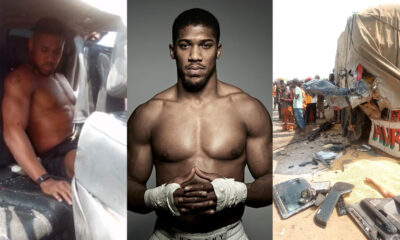

Sports2 days agoAnthony Joshua injured as two die in fatal Lagos-Ibadan Expressway crash (plus photos)

-

Opinion3 days ago

Opinion3 days agoHow a Misleading Channels TV Headline Reignited Nigeria’s Religious Tensions

-

metro3 days ago

metro3 days agoNigerian Army Kills 438 Boko Haram, ISWAP Terrorists in Seven Months

-

metro16 hours ago

metro16 hours agoOgun Man Arrested After ₦4,000 Debt Dispute Claims Stepbrother’s Life