Business

Tinubu economic reform policies may lead to social unrest – Analysts warn

Tinubu economic reform policies may lead to social unrest – Analysts warn

The international rating agency, Moody’s, has warned that the economic reforms of President Bola Tinubu may lead to social unrest that would potentially derail the expected progress.

Moody’s in its latest report titled “Inside Africa, 2023” gave the warning.

The analysts at Proshare Nigeria noted that while President Bola Tinubu’s pro-market policies had continued to receive favourable reviews from international agencies and companies, the realities in Nigerian wallets gave a different tale.

It said the policies carried high political risks, rising inflation and consequent public outcry.

According to the credit rating agency, the removal of the petrol subsidy will raise oil prices and reduce the purchasing power of citizens against a backdrop of crushing inequalities.

It therefore called for a delicate balance between the two.

It also noted that the administration’s foreign exchange (FX) unification policy would reduce market distortion but it had weakened the naira and could lead to higher imported inflation.

It stated that the ultimate priorities of the government should be improving the welfare and prosperity of Nigerians, rather than pandering to foreign economic preferences.

They noted, however, for Nigeria to relieve the stress of its citizens it must attract direct foreign investors and investment (DFI) and therefore, provide a compelling reason for fresh investment funding.

The analysts believe that President Tinubu’s ambitious reform agenda holds the potential for significant long-term economic gains, particularly with a more efficient allocation of resources and improved foreign investment.

However, the short-term pains of higher cost of living, lower purchasing power, and looming social unrest present substantial risks.

It warned that while the government intended to curb the corruption and inefficiencies associated with the subsidy regime, the oil subsidy reform could worsen social inequalities and poverty in the short term, as the palliatives would only marginally offset the large spike in costs borne by Nigerians.

Aviation

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Updated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

Emirates Airlines on Thursday announced that its flight operations to Nigeria would resume on October 1, 2024.

It said this in a statement, “The service will be operated using a Boeing 777-300ER. EK783 will depart Dubai at 0945hrs, arriving in Lagos at 1520hrs. The return flight EK784 will leave Lagos at 1730hrs and arrives in Dubai at 0510hrs the next day.

“Tickets can be booked now on Emirates.com or via travel agents.”

It quoted Emirates’ Deputy President and Chief Commercial Officer, Adnan Kazim, as saying the Lagos-Dubai service has traditionally been popular in Nigeria.

“We thank the Nigerian government for their partnership and support in re-establishing this route and we look forward to welcoming passengers back onboard,” Kazim said.

Minister of Aviation and Aerospace Development, Festus Keyamo, on Wednesday said the Emirates Airlines had given a definite date to resume flight operations to Nigeria and would make the announcement in a matter of days.

Emirates Airlines suspended flight operations to Nigeria in October 2022 over its inability to repatriate its $85 million revenue trapped in Nigeria.

Business

Dollar crashes against Naira at official market

Dollar crashes against Naira at official market

The Naira on Wednesday appreciated at the official market, trading at N1,459.02 to the dollar.

Data from the official trading platform of the FMDQ Exchange, revealed that the Naira gained N61.38.

This represents a 4.04 per cent gain when compared to the previous trading date on Tuesday, when the local currency exchanged at N1,520.40 to a dollar.

READ ALSO:

- Reps invite Ribadu over faulty presidential air fleet

- What autopsy revealed on cause of Mohbad’s death – Pathologist

- UK varsities considering NECO results for admission – Registrar

Also, the total daily turnover increased to 289.14 million dollars on Wednesday up from 128.76 million dollars recorded on Tuesday.

Meanwhile, at the Investor’s and Exporter’s (I&E) window, the Naira traded between N1,593 and N1,401 against the US dollar.

Dollar crashes against Naira at official market

Business

Nigeria’s inflation rises further to 33.69%, highest in 28 years

Nigeria’s inflation rises further to 33.69%, highest in 28 years

Nigeria’s inflation rose to its highest in 28 years as it hit 33.69 per cent in April 2024, up from 33.20 per cent in March.

A report by the National Bureau of Statistics revealed this on Wednesday. It showed the food and non-alcoholic beverages category continued to be the biggest contributor to inflation.

Food inflation, which accounts for the bulk of the inflation basket, reached 40.53 per cent in annual terms, against 40.01 per cent in March.

The galloping inflation is attributed largely to President Bola Tinubu administration’s removal of petrol subsidy and naira devaluation due to foreign exchange rates unification.

Reuters in a report recalled that the Central Bank of Nigeria had raised interest rates twice this year, including its largest hike in around 17 years, as it struggles to contain the price pressures.

CBN Governor Olayemi Cardoso has indicated that rates will stay high to bring down inflation.

The bank holds another rate-setting meeting next week.

Price pressures have left millions of Nigerians grappling with the worst cost of living crisis in decades as they struggle to meet their basic needs.

To ease the pressure on government workers, Tinubu recently introduced a wage award of N35,000 and direct cash transfer to the vulnerable.

-

Business23 hours ago

Business23 hours agoDollar crashes against Naira at official market

-

News13 hours ago

News13 hours agoUpdated: Reps condemn assault on Nasarawa female doctor by patient family

-

metro24 hours ago

metro24 hours agoThree police officers sentenced to life imprisonment in Anambra

-

News21 hours ago

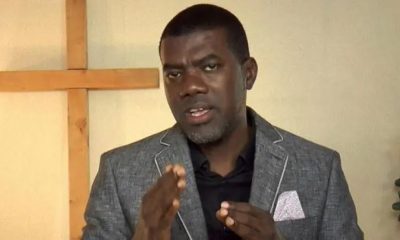

News21 hours agoWike, Fubara are ego-driven, crude – Reno Omokri

-

Aviation16 hours ago

Aviation16 hours agoUpdated: We’ll resume Lagos-Dubai flights on October 1, says Emirates

-

Auto2 days ago

Auto2 days ago150 OEMs, others set for Lagos motor fair, Africa autoparts expo

-

metro2 days ago

metro2 days agoNigerian who killed wife in UK bags life jail

-

metro3 days ago

metro3 days agoEdo community attacked, houses razed, 8 cars burnt