Business

UBA declares N316.4bn half-year profit, N2 dividend

UBA declares N316.4bn half-year profit, N2 dividend

Africa’s Global Bank, United Bank for Africa (UBA) Plc has released its audited financial results for the half year ended June 30, 2024, with an impressive performance across key financial indicators.

Specifically, the bank recorded a pre-tax profit of N401.5 billion and N316 billion after-tax profit in the year under consideration.

The bank said in a statement on Monday that this was achieved despite the tough macroeconomic climate in Nigeria and the geopolitical environment challenges where it operates.

According to UBA’s Head of Media and External Relations, Ramon Nasir, the audited financials released to the Nigerian Exchange Limited (NGX) on Monday showed that the bank recorded double-digit growth in its gross earnings and operating incomes. showed that the bank recorded double-digit growth in its operating incomes.

He said interest income rose by 134.3 per cent, reaching N1 trillion compared to N428.2 billion recorded in June last year while total assets grew by 37.2 percent, increasing from N20.6 trillion in December 2023 to N28.3 trillion.

He said customer deposits increased by 33.7 per cent during the same period, reaching N23.2 trillion, up from N17.3 trillion recorded at the end of 2023.

“The results filed showed that profit before tax (PBT) which stood at N403 billion in June 2023, closed the half year at N402 billion, while profit after tax (PAT) dropped slightly from N378 billion to N316 billion in the year under consideration,” he said.

He added, “However, the banks’ shareholders funds increased by 47 percent from N2.03 trillion in December 2023, to N2.99 trillion.”

Nasir also said UBA’s board of directors declared an interim dividend of N2 per share for each ordinary share of N0.50 kobo, marking a 300 percent increase compared to the N0.50 kobo declared during the same period in 2023.

He said this was in line with the bank’s culture of paying both interim and final cash dividends.

Commenting on the results, UBA’s Group Managing Director/CEO, Oliver Alawuba, stressed the bank’s commitment to consistently deliver value to its shareholders.

He said, “UBA Group has continued to deliver strong double-digit growth in high quality and sustainable banking revenue streams, driven by a focused growth in balance sheet, transaction and digital banking businesses across geographies in line with our strategic goals.

“The Group’s performance has been buoyed by consistent strong growth in all core and sustainable banking income lines. Our intermediation business showed strong growth with net interest income expanding by 143% YoY to N675 billion.

“As the Group intensifies its customer acquisition drive, we are making significant investments in technology, data analytics, product research and innovation to enhance our value proposition and customer experience.”

The UBA’s Executive Director on Finance and Risk, Ugo Nwaghodoh, expressed delight at the milestones achieved by the bank in driving operational efficiency.

“Our cost optimisation provides scope for further moderation, as we explore options towards a drastic reduction of our foreign currency denominated cost components, robotizing and automation of processes and application of artificial intelligence to our operations,” Nwaghodoh said.

He said the group would focus on effectively managing the heightened credit, operational, cyber and information security risks, as it continues to conduct its business within the tenets of UBA’s moderate risk appetite in alignment with the company’s sustainability goals.

The executive director said the group was on track to strengthen its share capital to support its medium to long-term goals while complying with recent regulatory requirements in Nigeria and other regions where it operates.

Business

Air Peace slashes Nigeria-London fare by N600,000

Air Peace slashes Nigeria-London fare by N600,000

Air Peace has announced a ₦600,000 reduction in its Nigeria-London airfare for all travelers flying from Nigeria.

In a statement released on Wednesday in Lagos, the airline’s Head of Corporate Communications, Dr. Ejike Ndiulo, stated that the discount is part of Air Peace’s latest promo offer.

Passengers departing from any Nigerian city to London can enjoy significant savings, along with an exclusive one-free extra luggage allowance.

READ ALSO:

- Tinubu’s state of emergency prevented Fubara from impeachment – AGF

- FG blames Fubara for bombing of oil pipeline

- Over 90% Nigerian land not registered, says Housing minister

According to Ndiulo, the airline rewarded five lucky winners of a raffle draw at the Silverbird Man of the Year Awards held on Sunday in Lagos.

He said that three winners won return economy tickets to any of Air Peace’s domestic destinations, while two won economy return tickets to London.

He said that the Chairman/Chief Executive Officer of Air Peace, Dr Allen Onyema, emphasised the airline’s commitment to driving Nigeria’s socio-economic development through its corporate social responsibility initiatives.

Air Peace slashes Nigeria-London fare by N600,000

Business

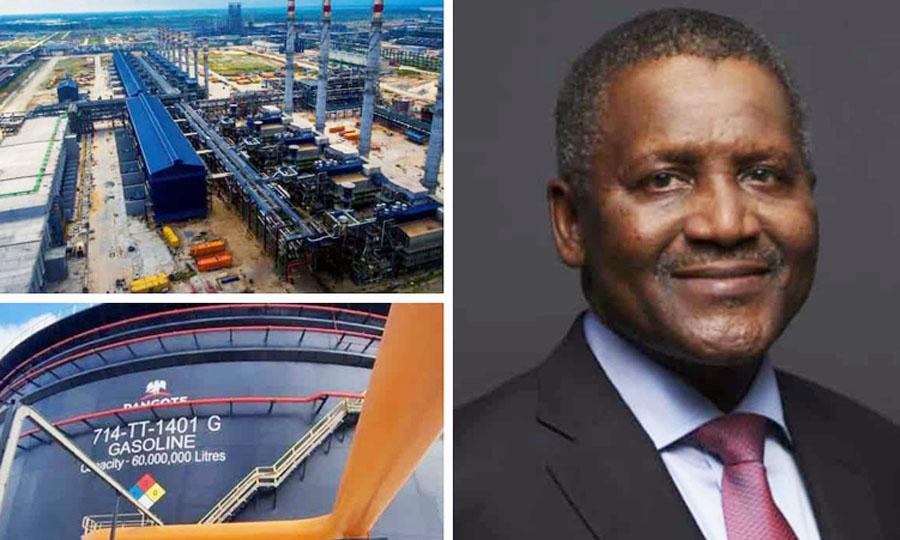

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Petroleum products marketers have predicted a potential shake-up in the downstream sector as Dangote Refinery halts the sale of petrol in naira.

The marketers, while expressing shock over the development, said there are genuine concerns over supply chain disruptions and impending price hikes.

Stakeholders fear the ripple effects may deepen economic pressures on businesses and consumers nationwide.

Dangote Refinery, in a statement, said the move was necessary to avoid a mismatch between its sales proceeds and our crude oil purchase obligations, which are currently denominated in US dollars.

“To date, our sales of petroleum products in Naira have exceeded the value of naira-denominated crude we have received. As a result, we must temporarily adjust our sales currency to align with our crude procurement currency.

“Our attention has also been drawn to reports on the internet claiming that we are stopping loading due to an incident of ticketing fraud. This is malicious falsehood. Our systems are robust and we have had no fraud issues.

READ ALSO:

- NLC, TUC urge Tinubu to reverse emergency rule in Rivers

- Rivers administrator to get withheld allocation, says FG

- Tanker explodes on Abuja bridge, many feared dead, 30 vehicles burnt

“We remain committed to serving the Nigerian market efficiently and sustainably. As soon as we receive an allocation of naira-denominated crude cargoes from NNPC, we will promptly resume petroleum product sales in naira. We appreciate your understanding and cooperation during this period”, the company explained.

Commenting on the development, the National President of the Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN), Mr. Billy Gillis-Harry, expressed rude shock at the development, saying the decision by Dangote will impact petroleum products availability, energy security and pricing.

He said the coming onboard of the Dangote Refinery has been able to stabilise the supply chain while guaranteeing access to product.

However, he warned the suspension of petroleum products into the sldomestic market by Dangote should not be an excuse for importers of products to profiteer by putting the country in a disadvantage condition.

He argued that PETROAN has been at the forefront of canvassing for multiple sources of products for the market, saying the entry of Dangote refinery into the downstream market was received with so much joy.

Gillis-Harry further lamented that the business decision of Dangote to sell his products in dollars has automatically shut out the local market from the business equation because domestic pricing and sales of petroleum products is in naira. On October 1, 2024, the federal government officially announced the commencement of crude oil sale to Dangote Refinery and other local refineries in the local currency.

The move was to reduce the pressure on the foreign reserves and ensure the stability of the local currency.

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Business

CBN projects continued drop in inflation for six months

CBN projects continued drop in inflation for six months

The Central Bank of Nigeria has projected a gradual drop in inflation rate over the next six months.

It stated this in its newly released report on inflation expectations for February 2025.

The report said businesses and household respondents expected the level of inflation to gradually reduce over the next six months.

The respondents also anticipated lower spending as their expenditure gradually dropped over the next six months.

A further analysis by income distribution indicated that more households earning above N200,000 per month perceived inflation to be moderating, driven by factors such as energy costs, exchange rate, transportation costs, interest rate and insecurity influenced their perception of the inflation rate in the month under review.

The CBN, however said 65.1 per cent of respondents wanted a reduction in interest rate by the financial institution.

The National Bureau of Statistics (NBS) in its Consumer Price Index (CPI) report for March said the inflation rate for February dropped to 23.18% year-on-year in February 2025, reflecting a second consecutive monthly decline from the 24.48% recorded in January.

This figure marks a significant 8.52 percentage point decrease from the 31.70% seen in February 2024, following the adoption of a new CPI rebasing methodology.

-

Auto2 days ago

Auto2 days agoLanre Shittu Motors offers support for EV bus design competition in universities

-

International1 day ago

International1 day agoUK announces new passport application fees starting April 2025

-

metro2 days ago

metro2 days agoIbas: 18 things to know about Rivers administrator

-

News3 days ago

News3 days agoBreaking: Tinubu declares state of emergency in Rivers State

-

metro2 days ago

metro2 days agoSoldiers take over Rivers Government House after state of emergency declaration

-

News3 days ago

News3 days agoTinubu holds emergency meeting with service chiefs

-

metro2 days ago

metro2 days agoPipeline explosion hits Bayelsa amid Rivers state emergency declaration

-

metro1 day ago

metro1 day agoCourt lifts order stopping Senate probe on Natasha Akpoti