Business

Breaking: CBN jacks up interest rate to 15.5%

The Central Bank of Nigeria (CBN) has raised the monetary policy rate (MPR), which measures interest rate, from 14 per cent to 15.5 per cent to tame rising inflation.

The interest rate was raised from 13 per cent to 14 per cent in July this year.

The monetary policy rate is the baseline interest rate in an economy, every other interest rate used within an economy is built on.

Governor of the CBN, Godwin Emefiele, addressing journalists on Tuesday after the committee’s meeting in Abuja, said 10 members of the committee voted for the rate hike.

In August, Nigeria’s inflation rate rose to a nearly two-decade high at 20.52 per cent.

Business

Air Peace slashes Nigeria-London fare by N600,000

Air Peace slashes Nigeria-London fare by N600,000

Air Peace has announced a ₦600,000 reduction in its Nigeria-London airfare for all travelers flying from Nigeria.

In a statement released on Wednesday in Lagos, the airline’s Head of Corporate Communications, Dr. Ejike Ndiulo, stated that the discount is part of Air Peace’s latest promo offer.

Passengers departing from any Nigerian city to London can enjoy significant savings, along with an exclusive one-free extra luggage allowance.

READ ALSO:

- Tinubu’s state of emergency prevented Fubara from impeachment – AGF

- FG blames Fubara for bombing of oil pipeline

- Over 90% Nigerian land not registered, says Housing minister

According to Ndiulo, the airline rewarded five lucky winners of a raffle draw at the Silverbird Man of the Year Awards held on Sunday in Lagos.

He said that three winners won return economy tickets to any of Air Peace’s domestic destinations, while two won economy return tickets to London.

He said that the Chairman/Chief Executive Officer of Air Peace, Dr Allen Onyema, emphasised the airline’s commitment to driving Nigeria’s socio-economic development through its corporate social responsibility initiatives.

Air Peace slashes Nigeria-London fare by N600,000

Business

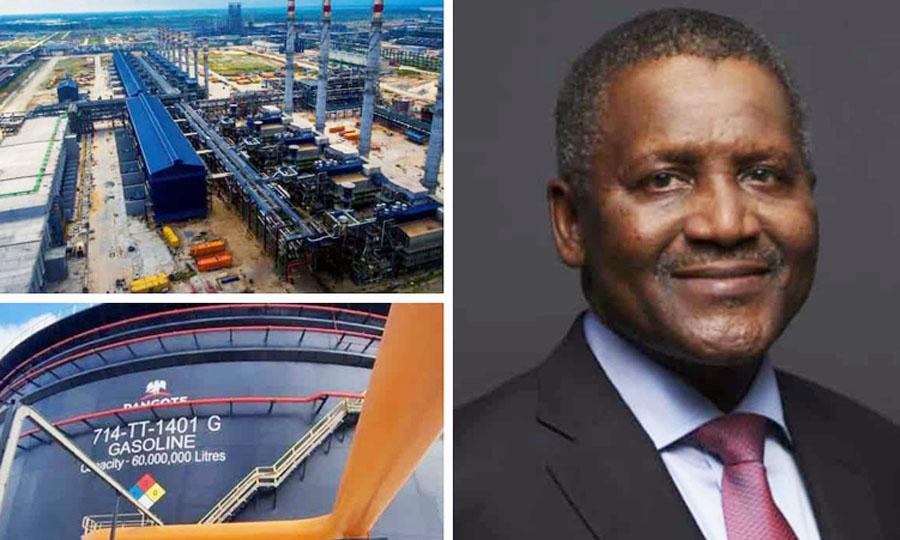

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Petroleum products marketers have predicted a potential shake-up in the downstream sector as Dangote Refinery halts the sale of petrol in naira.

The marketers, while expressing shock over the development, said there are genuine concerns over supply chain disruptions and impending price hikes.

Stakeholders fear the ripple effects may deepen economic pressures on businesses and consumers nationwide.

Dangote Refinery, in a statement, said the move was necessary to avoid a mismatch between its sales proceeds and our crude oil purchase obligations, which are currently denominated in US dollars.

“To date, our sales of petroleum products in Naira have exceeded the value of naira-denominated crude we have received. As a result, we must temporarily adjust our sales currency to align with our crude procurement currency.

“Our attention has also been drawn to reports on the internet claiming that we are stopping loading due to an incident of ticketing fraud. This is malicious falsehood. Our systems are robust and we have had no fraud issues.

READ ALSO:

- NLC, TUC urge Tinubu to reverse emergency rule in Rivers

- Rivers administrator to get withheld allocation, says FG

- Tanker explodes on Abuja bridge, many feared dead, 30 vehicles burnt

“We remain committed to serving the Nigerian market efficiently and sustainably. As soon as we receive an allocation of naira-denominated crude cargoes from NNPC, we will promptly resume petroleum product sales in naira. We appreciate your understanding and cooperation during this period”, the company explained.

Commenting on the development, the National President of the Petroleum Products Retail Outlets Owners Association of Nigeria (PETROAN), Mr. Billy Gillis-Harry, expressed rude shock at the development, saying the decision by Dangote will impact petroleum products availability, energy security and pricing.

He said the coming onboard of the Dangote Refinery has been able to stabilise the supply chain while guaranteeing access to product.

However, he warned the suspension of petroleum products into the sldomestic market by Dangote should not be an excuse for importers of products to profiteer by putting the country in a disadvantage condition.

He argued that PETROAN has been at the forefront of canvassing for multiple sources of products for the market, saying the entry of Dangote refinery into the downstream market was received with so much joy.

Gillis-Harry further lamented that the business decision of Dangote to sell his products in dollars has automatically shut out the local market from the business equation because domestic pricing and sales of petroleum products is in naira. On October 1, 2024, the federal government officially announced the commencement of crude oil sale to Dangote Refinery and other local refineries in the local currency.

The move was to reduce the pressure on the foreign reserves and ensure the stability of the local currency.

Fresh fuel price hike likely as Dangote refinery suspends petrol sale in naira

Business

CBN projects continued drop in inflation for six months

CBN projects continued drop in inflation for six months

The Central Bank of Nigeria has projected a gradual drop in inflation rate over the next six months.

It stated this in its newly released report on inflation expectations for February 2025.

The report said businesses and household respondents expected the level of inflation to gradually reduce over the next six months.

The respondents also anticipated lower spending as their expenditure gradually dropped over the next six months.

A further analysis by income distribution indicated that more households earning above N200,000 per month perceived inflation to be moderating, driven by factors such as energy costs, exchange rate, transportation costs, interest rate and insecurity influenced their perception of the inflation rate in the month under review.

The CBN, however said 65.1 per cent of respondents wanted a reduction in interest rate by the financial institution.

The National Bureau of Statistics (NBS) in its Consumer Price Index (CPI) report for March said the inflation rate for February dropped to 23.18% year-on-year in February 2025, reflecting a second consecutive monthly decline from the 24.48% recorded in January.

This figure marks a significant 8.52 percentage point decrease from the 31.70% seen in February 2024, following the adoption of a new CPI rebasing methodology.

-

metro3 days ago

metro3 days agoCorper who criticised Tinubu govt under pressure to apologise, says Sowore

-

Auto2 days ago

Auto2 days agoLanre Shittu Motors offers support for EV bus design competition in universities

-

International24 hours ago

International24 hours agoUK announces new passport application fees starting April 2025

-

metro3 days ago

metro3 days agoBreaking: Trans-Niger Pipeline in Rivers explodes in fire after militants threat

-

metro3 days ago

metro3 days agoHusband bound, gagged by wife, children in Ogun community rescued (video)

-

metro2 days ago

metro2 days agoIbas: 18 things to know about Rivers administrator

-

News3 days ago

News3 days agoBreaking: Tinubu declares state of emergency in Rivers State

-

metro2 days ago

metro2 days agoSoldiers take over Rivers Government House after state of emergency declaration